As economic fissures deepen, Bitcoin may become the next "pressure relief valve" for liquidity

Cryptocurrency is one of the few areas where value can be held and transferred without relying on banks or governments.

Original Title: The Two-Tier K-Shaped Economy

Original Author: arndxt, Crypto Analyst

Original Translation: AididiaoJP, Foresight News

The US economy has split into two worlds: on one side, financial markets are booming; on the other, the real economy is slipping into a slow decline.

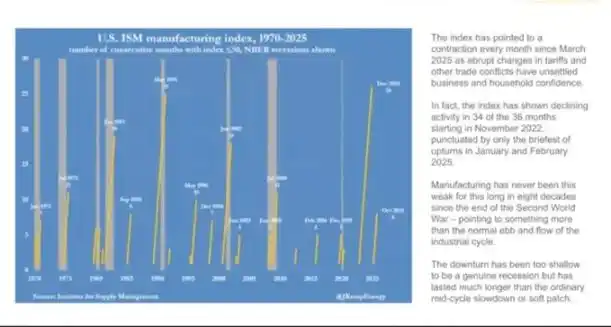

The Manufacturing PMI Index has contracted for over 18 consecutive months, the longest stretch since World War II, yet the stock market continues to rise as profits become increasingly concentrated among tech giants and financial companies. (Note: The full name of "Manufacturing PMI Index" is "Manufacturing Purchasing Managers' Index," which serves as a "barometer" for the health of the manufacturing sector.)

This is essentially "balance sheet inflation."

Liquidity keeps pushing up the prices of similar assets, while wage growth, credit creation, and small business vitality remain stagnant.

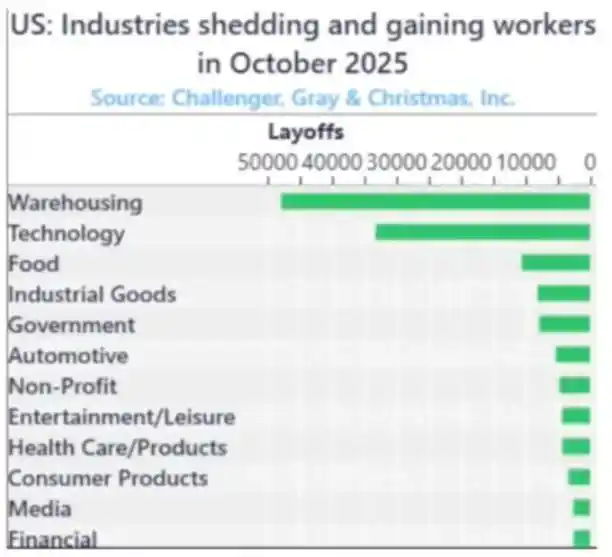

The result is an economic split, where during recoveries or economic cycles, different sectors move in completely opposite directions:

On one side: capital markets, asset holders, the tech industry, and large corporations surge rapidly (profits, stock prices, wealth).

On the other side: wage earners, small businesses, blue-collar industries → decline or stagnate.

Growth and hardship coexist.

Policy Failure

Monetary policy can no longer truly benefit the real economy.

The Federal Reserve's rate cuts have pushed up stock and bond prices, but have not brought new jobs or wage growth. Quantitative easing makes it easier for large corporations to borrow money, but does nothing to help small businesses develop.

Fiscal policy is also nearing its limit.

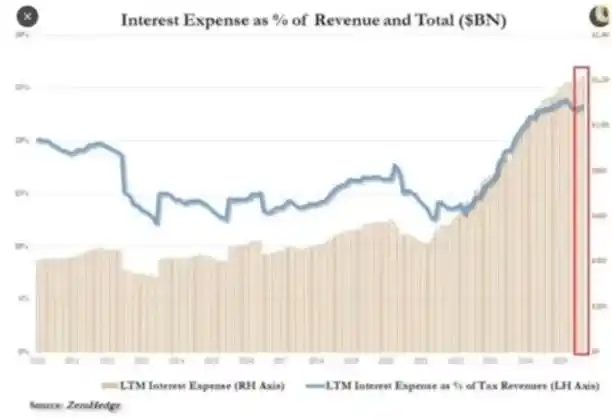

Now, nearly a quarter of government revenue is used solely to pay interest on national debt.

Policymakers are thus caught in a dilemma:

Tighten policy to fight inflation, and the market stagnates; loosen policy to promote growth, and prices rise again. The system is now self-reinforcing: any attempt to deleverage or shrink the balance sheet will impact the asset values it relies on for stability.

Market Structure: Efficient Harvesting

Passive capital flows and high-frequency data arbitrage have turned the public market into a closed-loop liquidity machine.

Positioning and volatility supply matter more than fundamentals. Retail investors have effectively become the counterparties to institutions. This explains why defensive sectors are abandoned, tech stock valuations soar, and the market structure rewards momentum chasing, not value.

We have created a market with extremely high price efficiency but extremely low capital efficiency.

The public market has become a self-reinforcing liquidity machine.

Funds flow automatically → through index funds, ETFs, and algorithmic trading → creating continuous buying pressure, regardless of fundamentals.

Price movements are driven by capital flows, not value.

High-frequency trading and systematic funds dominate daily trading; retail investors are actually on the other side of the trade. Stock price movements depend on positioning and volatility mechanisms.

Thus, tech stocks keep expanding while defensive sectors lag behind.

Social Backlash: The Political Cost of Liquidity

Wealth creation in this cycle is concentrated at the top.

The wealthiest 10% hold over 90% of financial assets; the higher the stock market climbs, the greater the wealth gap becomes. Policies that push up asset prices simultaneously erode the purchasing power of the majority.

With no real wage growth and unaffordable housing, voters will eventually seek change, either through wealth redistribution or political turmoil. Both options intensify fiscal pressure and drive up inflation.

For policymakers, the strategy is clear: keep liquidity abundant, push up markets, and claim economic recovery. Substitute superficial prosperity for substantive reform. The economy remains fragile, but at least the data can hold until the next election.

Cryptocurrency as a Pressure Valve

Cryptocurrency is one of the few areas where value can be held and transferred without relying on banks or governments.

The traditional market has become a closed system, with big capital capturing most of the profits through private placements before IPOs. For the younger generation, bitcoin is no longer just speculation, but an opportunity to participate. When the whole system seems manipulated, at least there is still a chance here.

Although many retail investors have been hurt by overvalued tokens and VC sell-offs, the core demand remains strong: people long for an open, fair, and self-controlled financial system.

Outlook

The US economy cycles through "conditioned reflexes": tightening → recession → policy panic → liquidity injection → inflation → repeat.

2026 may see the next round of easing, due to slowing growth and widening deficits. The stock market will have a brief celebration, but the real economy will not truly improve unless capital shifts from supporting assets to productive investment.

At present, we are witnessing the late-stage form of a financialized economy:

· Liquidity acts as GDP

· Markets become policy tools

· Bitcoin becomes a societal pressure valve

As long as the system keeps cycling debt into asset bubbles, we will not see a true recovery—only slow stagnation masked by rising nominal numbers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Spain Pins X for Illegal Crypto Promotion

Crypto Market Turns Cautious as Bitcoin Slips and Fear Index Hits Extreme Lows

XRP ETF Price Crash Explained

XRP Is Not Bitcoin Or Ethereum, Says Canary CEO As XRPC ETF Launches