‘Avoidable errors’ wiped a year’s worth of Gary Gensler’s texts... oops

A Securities and Exchange Commission investigation into missing text messages from former chair Gary Gensler’s phone between October 2022 and September 2023 has concluded that “avoidable errors” led to their loss.

The SEC Office of Inspector General (OIG) investigated how nearly a year’s worth of text messages from Gary Gensler were permanently lost between October 2022 and September 2023, during the height of the agency’s crypto enforcement action campaign.

In a report released on Wednesday, the OIG revealed that the SEC’s IT department “implemented a poorly understood and automated policy that caused an enterprise wipe of Gensler’s government-issued mobile device,” which deleted stored text messages and operating system logs.

The loss was worsened by poor change management, lack of proper backups, ignored system alerts and unaddressed vendor software flaws.

The IT department failed to collect or maintain necessary log data, which is why the commission could not determine why Gensler’s smartphone stopped communicating with the SEC’s mobile device management system.

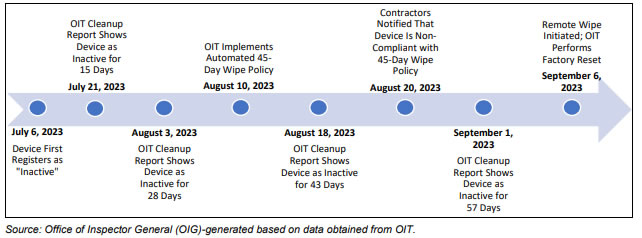

Timeline of events leading to the loss of Gensler’s text messages. Source: SEC

Timeline of events leading to the loss of Gensler’s text messages. Source: SEC

Key communications about crypto enforcement actions were lost

The OIG found that some of Gensler’s deleted texts involved SEC enforcement actions against crypto companies and their founders, meaning that key communications about how and when the SEC pursued cases may never be fully known, even to courts, Congress or the public.

Investigators reviewed about 1,500 messages recovered from colleagues and other records. They determined that the majority were federal records, with around 38% of the recovered text conversations “mission related” concerning matters directly involving SEC senior staff at the time, such as:

“A May 2023 conversation involving Gensler, his staff, and the Director of the Division of Enforcement about when the SEC would be filing an action against certain crypto asset trading platforms and their founder.”

SEC crackdown on recordkeeping

Around the same time that Gensler’s messages were disappearing into a black hole, the SEC cracked down on the use of messaging apps. Several global investment banking and financial institutions were charged with violating record-keeping and books-and-records laws under the 1934 Securities and Exchange Act.

“Finance, ultimately, depends on trust. By failing to honor their recordkeeping and books-and-records obligations, the market participants we have charged today have failed to maintain that trust,” said Gensler at the time.

Undermining transparency in crypto decisions

The SEC has since disabled text messaging on most devices, notified the National Archives and Records Administration of lost records, introduced Capstone-specific records training for senior officials, and started improving backup practices for senior officials’ devices.

“The loss of Gensler’s text messages may impact the SEC’s response to certain Freedom of Information Act requests,” it stated.

Gensler, who stepped down in January, was infamous in the crypto community for his bait-and-switch offer to “come in and get registered,” which pre-empted multiple SEC actions against companies that claimed they tried to do exactly that. Enforcement actions against crypto companies reached a 10-year high in 2023.

“Think about everything that happened in crypto during this time. Basically, FTX collapse through the Grayscale spot BTC ETF lawsuit,” observed NovaDius Wealth Management President Nate Geraci, who added“makes you think.”

“So Gary Gensler’s text messages from his tenure as SEC chairman are forever lost in a mysterious ‘boating accident’ ???,” quipped Custodia Bank founder Caitlin Long.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Borrowing short to repay long: The Bank of England and the Bank of Japan lead the shift from long-term bonds to high-frequency "interest rate gambling"

If expectations are not met, the government will face risks of uncontrollable costs and fiscal sustainability due to frequent rollovers.

How do 8 top investment banks view 2026? Gemini has summarized the key points for you

2026 will not be a year suitable for passive investing; instead, it will belong to investors who are skilled at interpreting market signals.

Valuation Soars to 11 Billions: How Is Kalshi Defying Regulatory Pressure to Surge Ahead?

While Kalshi faces lawsuits and regulatory classification as gambling in multiple states, its trading volume is surging and its valuation has soared to 11 billion dollars, revealing the structural contradictions of prediction markets rapidly growing in the legal gray areas of the United States.

How will the Federal Reserve in 2026 impact the crypto industry?

Shifting from the technocratic caution of the Powell era, the policy framework is moving towards a more explicit goal of reducing borrowing costs and serving the president's economic agenda.