Ancient Bitcoin Whale Sells, Invests Big in Ethereum

- Large BTC holder sells 2,970 BTC, buying up Ethereum.

- Significant bullish move towards Ethereum with 185,000 ETH stake.

- Potential market shift as BTC outflows drive ETH inflows.

An ancient whale disposed of 2,970 BTC, adopting a long position on ETH with over 185,000 coins open as of August 21, 2025, monitored on-chain.

The whale’s significant asset shift highlights potential market influence, triggering increased Ethereum interest and impacting both BTC and ETH exchanges.

A prominent whale, inactive for years, has sold 2,970 BTC, equivalent to approximately $334 million, and taken a substantial long position in Ethereum. This move was confirmed through direct observation on blockchain networks by seasoned analysts.

The address, active since 2018, is now holding over 185,000 ETH. Analysts tracked significant movements, suggesting a strategic realignment from Bitcoin to Ethereum, potentially signaling a shift in market sentiment. Ali Martinez, Analyst, X, stated, “Whales are buying the dip and loading up on Ethereum. Their activity aligns perfectly with ETF buying and hints at a broader accumulation phase that could support the next leg up.”

This activity has directly influenced both Bitcoin and Ethereum markets. The BTC sale triggered notable outflows, while Ethereum witnessed a sharp increase in demand. Public ledger records verify sizable transactions aligning with this whale’s market maneuvers.

With Ethereum purchases totaling up to $790 million, this whale affects futures and spot markets substantially. Additionally, scrutiny on platforms like BitForex is heightened as these actions play out. Network analytics support this increased exchange activity.

The regulatory landscape remains unchanged, yet implications linger for trading and exchange platforms. These whale transactions might prompt closer regulatory oversight, especially considering past issues at BitForex . Institutional interest might propel Ethereum’s standing further.

Historical trends reveal Bitcoin-to-Ethereum reallocations often precede Ethereum rallies. These movements place pressure on Bitcoin’s short-term value, promoting Ethereum. Analysts view these trends in line with institutional confidence , potentially forecasting positive market outcomes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Samson Mow Suggests Bitcoin Rally May Resume If BTC Dominance Rises After Rebound From $112,000

Spot Ether ETFs Could Signal Renewed Demand as Holdings Reach 6.42M ETH, 5.31% of Supply

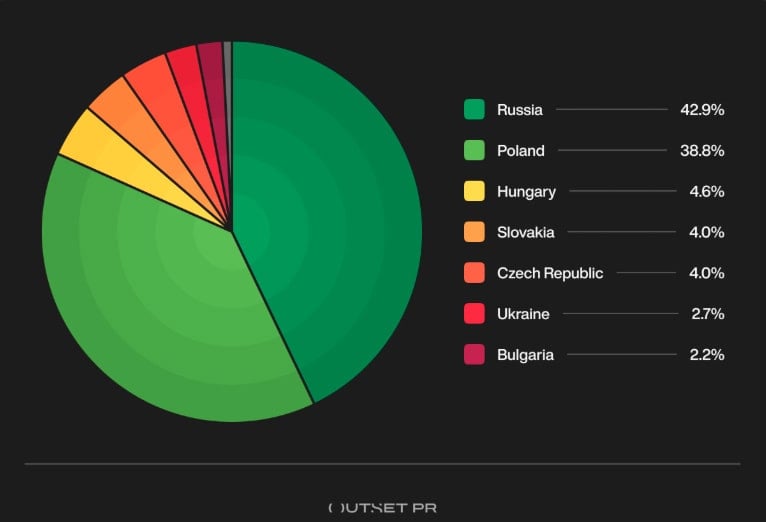

Cryptocurrencies outperform the S&P 500 in Q2, but Eastern European media continues to decline