Spot Ether ETFs now hold 6.42 million ETH worth $27.66 billion, equal to 5.31% of the asset’s circulating supply.

Spot Ether ETFs hold 6.42 million ETH (~$27.66B) or 5.31% of circulating supply and registered $287.6M in net inflows on Thursday, led by BlackRock’s ETHA; the move reverses a multi-day outflow streak and signals renewed institutional demand for Ether exposure.

-

ETF reserves: 6.42M ETH = $27.66B (5.31% of supply)

-

$287.6M net inflows on Thursday after $924M of outflows since Aug. 15

-

BlackRock’s iShares Ethereum Trust (ETHA) led inflows with $233.5M; Fidelity’s FETH added $28.5M

Spot Ether ETFs hold 6.42M ETH ($27.66B) and logged $287.6M inflows Thursday. Read COINOTAG’s concise analysis and key takeaways on market impact now.

What do current Spot Ether ETF holdings tell investors?

Spot Ether ETFs collectively hold 6.42 million ETH, valued at about $27.66 billion, representing roughly 5.31% of Ether’s circulating supply. This concentration shows institutional products are a material buyer of ETH and can influence short- to medium-term price dynamics.

How did inflows and outflows evolve this week?

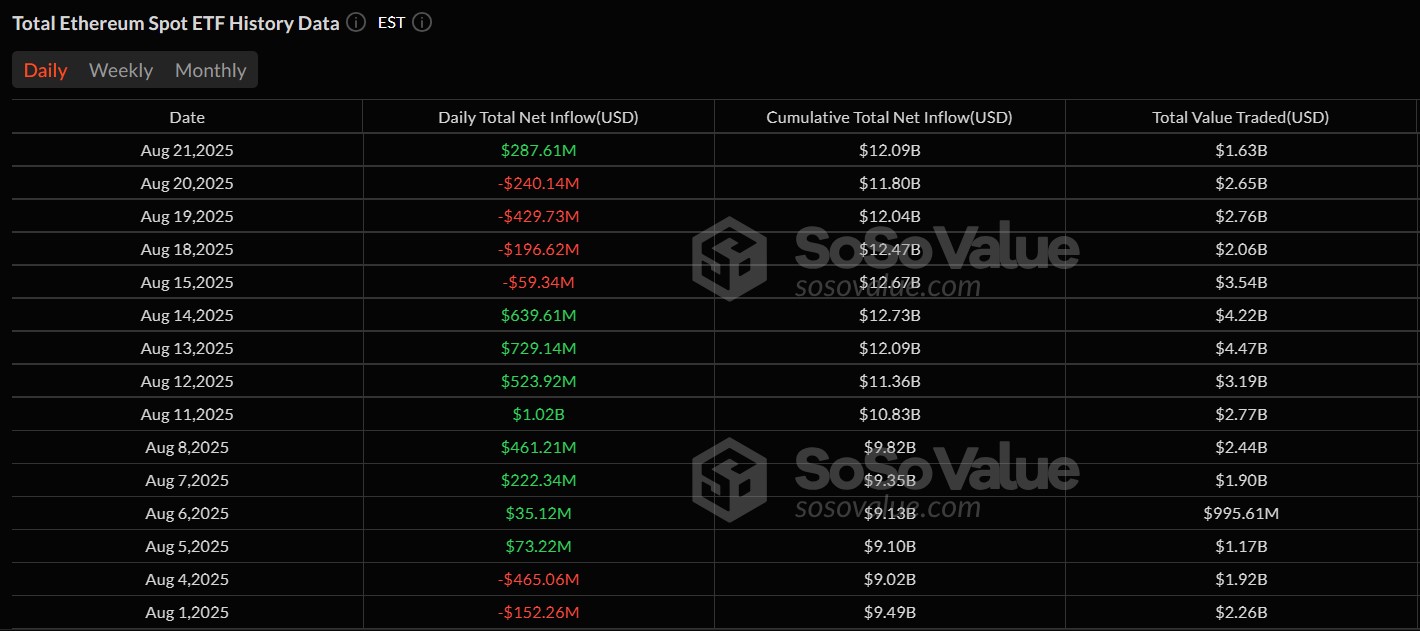

US spot Ether ETFs recorded $287.6 million in net inflows on Thursday, ending a four-day outflow streak. Data from ETF tracker SoSoValue indicates the funds shed over $924 million between Aug. 15 and Wednesday, with the largest single-day withdrawal of $429 million on Tuesday.

BlackRock’s iShares Ethereum Trust (ETHA) led Thursday’s inflows with $233.5 million, while the Fidelity Ethereum Fund (FETH) added $28.5 million. Other ETFs averaged about $6 million each for the day.

Spot Ether ETF inflow and outflow data in August. Source: SoSoValue

Why do ETF reserves and corporate treasuries matter?

ETF reserves concentrate buying power into tradable products, increasing visible demand for ETH. According to the reserve tracker Strategic ETH Reserve (SER), ETFs added a daily net inflow of 66,350 ETH, lifting their holdings to 5.31% of circulating supply.

Corporate treasuries and long-term institutional holdings total about 4.10 million ETH (roughly $17.66 billion), or 3.39% of supply. Large treasury purchases can reduce circulating supply and create additional network staking or custody questions.

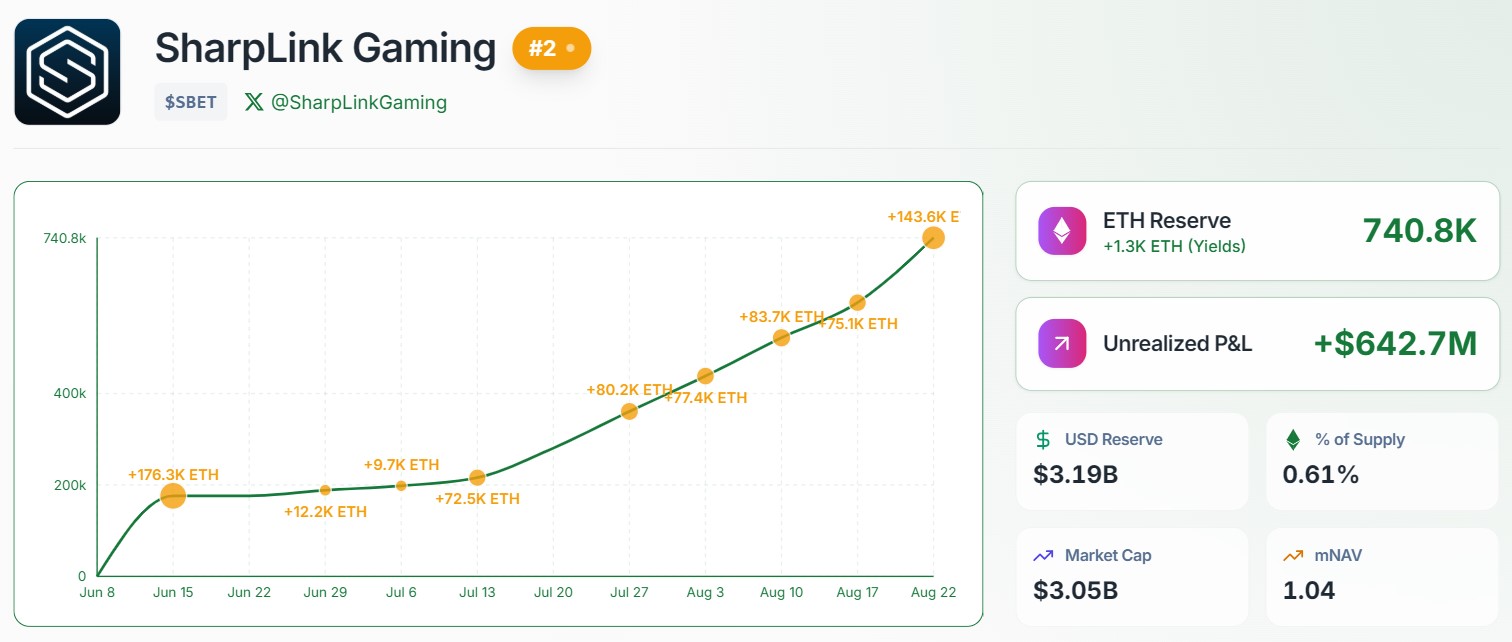

SharpLink Gaming is among corporate buyers, reportedly purchasing $667 million in Ether on Tuesday and raising its holdings to roughly 740,000 ETH (valued at about $3.2 billion). Bitmine Immersion Tech remains the largest corporate treasury holder with around 1.5 million ETH, per Strategic ETH Reserve data.

SharpLink gaming ETH treasury purchase data. Source: Strategic ETH Reserve

When do community debates surface around treasury accumulation?

Concentration of ETH in institutional treasuries has sparked debate on public forums. Some community members argue large purchases reduce circulating supply and help price discovery, while others raise decentralization concerns if staking or control becomes concentrated.

Discussion themes include price impact, staking participation, decentralization risks, and the broader effect on DeFi utilities where ETH serves as a base asset.

Frequently Asked Questions

How much ETH do spot Ether ETFs hold right now?

Spot Ether ETFs hold approximately 6.42 million ETH, valued at $27.66 billion, which is about 5.31% of Ether’s circulating supply according to Strategic ETH Reserve data.

Who led the recent ETF inflows?

BlackRock’s iShares Ethereum Trust (ETHA) led inflows with $233.5 million on Thursday, followed by Fidelity’s FETH with $28.5 million, per SoSoValue data.

Do corporate ETH purchases benefit the network?

Large corporate purchases can reduce liquid supply and may increase staking if entities choose to stake holdings. Opinions vary: proponents cite price support and network backing, critics cite potential centralization risks.

Key Takeaways

- ETF concentration: Spot Ether ETFs hold 6.42M ETH ($27.66B), ~5.31% of supply.

- Recent flows: $287.6M inflows on Thursday reversed prior multi-day withdrawals.

- Institutional treasuries: Corporate holdings total ~4.10M ETH ($17.66B), shifting supply dynamics.

Conclusion

Spot Ether ETFs and corporate treasuries now represent a meaningful portion of Ether’s available supply, and the recent inflow reversal suggests renewed institutional interest. Monitor ETF flows, major treasury purchases, and on-chain reserve trackers for near-term market signals. COINOTAG will continue to report updates and analysis.

Published: 2025-08-22 | Updated: 2025-08-22