Bitcoin Faces Uncertainty Amid SOPR Flatness and Leverage Rise

- SOPR flatness and high leverage create market uncertainty in Bitcoin.

- Institutional actors, such as Metaplanet, show market confidence.

- Risk of major breakouts or liquidation cascades exists.

Bitcoin’s price action as of August 2025 is influenced by unprecedented leverage in futures markets and a critical SOPR level, creating high market uncertainty.

With institutional participation rising and leverage soaring, Bitcoin faces either significant growth or a potential crash, affecting altcoins and engaging market analysts globally.

Bitcoin is experiencing a period of uncertainty, with SOPR flatness and a rise in leverage in BTC futures markets causing instability. This market condition has left investors wary of potential outcomes, including major breakouts or market contractions.

Key market participants include institutional players such as Metaplanet, known for accumulating 775 BTC in August, reflecting their strategic confidence. Analysts highlight the surge in leverage, with BTC futures markets hitting new highs not seen in five years.

The current market scenario may lead to significant impacts on the cryptocurrency sector, potentially affecting prices and market behavior. The futures markets’ leverage peak introduces added volatility and risk for traders and industry participants.

With approximately $40 billion in open interest, market observers caution that long positions could amplify fragility. The potential for cascading liquidations calls for careful management of risk positions amid heightened market volatility.

Analysts warn of possible downturns across altcoins if Bitcoin corrections occur. Elevating leverage introduces risks similar to those of previous market events, raising concerns over potential market capitulations.

The market’s outcome depends on whether SOPR neutrality and leverage extremes resolve with a major breakout or crash. Historical patterns reveal both risks and opportunities, with market observers focusing on external catalysts like central bank policies or large-scale trading activity.

Analysts note that a significant change recently occurred:

“In August 2025, the estimated leverage ratio (ELR) for Bitcoin futures saw a 30-day change that reached the highest level in the past five years, exceeding the critical value of +0.4. This threshold has typically appeared during peak periods of high leverage and increasing market vulnerability.” — Axel Adler Jr., Analyst, CryptoQuant .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tornado Cash’s Roman Storm Faces 5 Years for a Crime DOJ Now Says It Won’t Prosecute

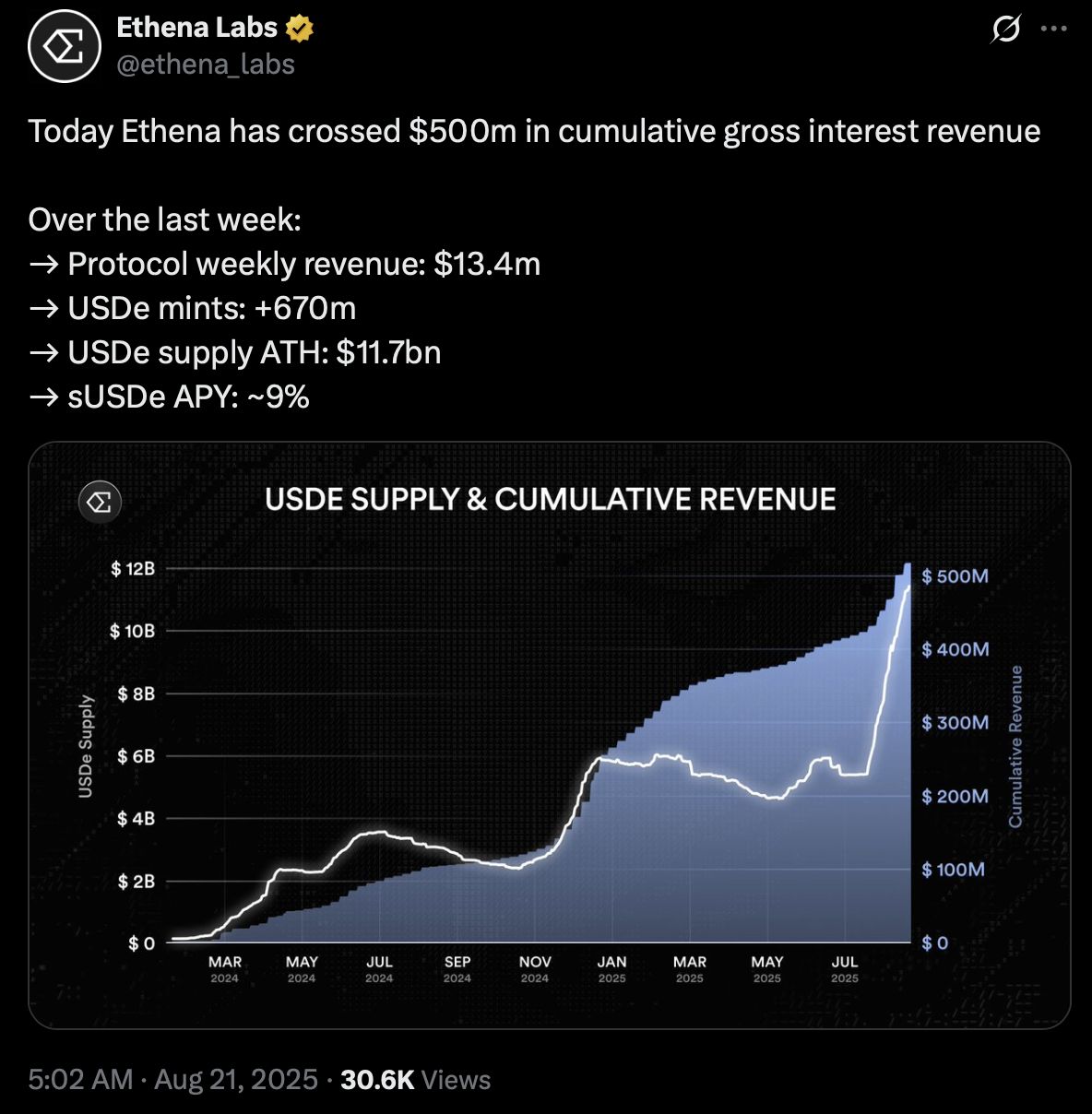

Ethena crosses $500M in cumulative revenue as synthetic stablecoins gain ground

Ancient Bitcoin Whale Sells, Invests Big in Ethereum

Crypto Option Market Diverges Before Jackson Hole Meeting