Decoding SUI Price’s Sharp Liquidity Exodus This Week

SUI crypto price has been in free fall since Monday, marking its first major bearish pivot since it started rallying in late June.

While most top coins also experienced a retracement this week, Sui’s performance was more noteworthy considering the extent of its pullback.

For context, SUI lost over $3 billion from its market cap since Monday. This translated to ove 20% pullback from its $4.4 weekly top to its $3.36 press time price tag.

This latest pullback occurred after SUI price formed a bearish divergence. Moreover, its money flow indicator revealed that liquidity has been flowing out of the coin since mid-July.

However, the sharp decline suggested that other factors might have contributed to the bearish momentum.

SUI Price Takes a Hit Post Token Unlock

SUI’s sharp pullback followed the much anticipated token unlock event yesterday. Roughly 56.91 million new SUI coins added to the circulating supply on 1 August.

The token unlock event made SUI the highest number of tokens added to the circulating supply this month.

This token unlock event may have contributed heavily to the selloff this week, with investors exiting in anticipation of the downside.

The pullback also led to a retest of SUI’s previous descending resistance trend line. Some analysts predicted that the cryptocurrency may bounce back from the same trend line and possibly resume its previous bullish momentum.

SUI crypto already demonstrated support formation near the same descending trend line, suggesting that a bounce back in the coming days was plausible.

Moreover, its spot flow data revealed that the sell pressure was steadily declining. Furthermore, a glance at large order flow data revealed that whales were buying the dip.

OKX and Binance spot segments registered roughly $30 million worth of spot inflows into whale addresses.

The size of derivatives positions was even more impressive on the two exchanges, which registered over $152 million worth of buys.

While the data signaled a potential bullish comeback, the extent of the recovery would be determined by whether overall market sell pressure would prevail.

SUI price still managed to maintain a 30.15% gain in July from its opening to closing price despite the recent pullback.

Failure to secure a bounce back on the aforementioned descending resistance turned support may lead to more downside.

If this outcome occurs, then price could potentially push into the $3.37 to $3.12 price range, which aligns with the key Fibonacci retracement range.

Sui Network Performance Recap

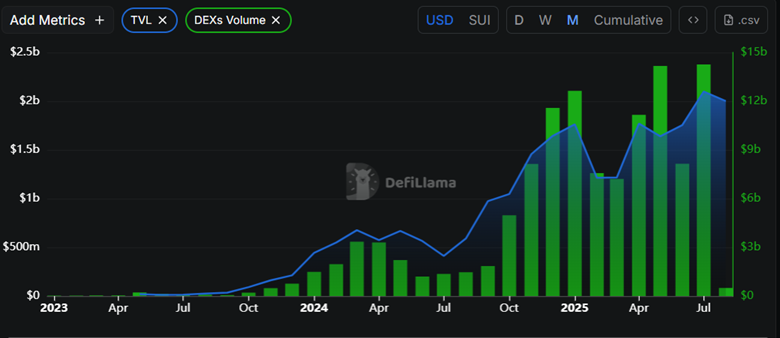

SUI network achieved noteworthy performance over the last few months, with 2025 shaping out to be even better than its performance in 2024.

The network’s monthly DEX volume surged as high as $14.26 billion in July, making it the highest monthly DEX volume in its history.

The peak DEX volume confirmed that the network continued to experience robust activity. SUI’s total value locked also clocked a new historic high at $2.29 billion on 28 July.

Network liquidity peaked at $1.24 billion in mid-July, after which it retraced and even briefly dipped below $1 billion. However, it has since recovered and hovered around $1.08 billion at press time.

Based on these findings, it was safe to say that SUI network activity in 2025 has been superior to its performance in the previous year.

The value of the newly added tokens was less than 2% of the overall market cap. As far as the SUI price performance is concerned, impact of the latest token unlock is likely to be temporary.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.

Alphabet’s TPUs Emerge as a Potential $900 Billion Chip Business

Ethereum Loses 25% of Validators After Fusaka: The Network Nears a Critical Failure