Trump Claims GENIUS Act Congressional Breakthrough

US President Donald Trump announced Tuesday night that congressional leaders have agreed to advance the landmark GENIUS Act following an Oval Office meeting, marking a significant turnaround after House Republicans failed to pass a key procedural vote earlier this week. “I am in the Oval Office with 11 of the 12 Congressmen/women necessary to pass … <a href="https://beincrypto.com/trump-genius-act-congressional-breakthrough-oval-office/">Continued</a>

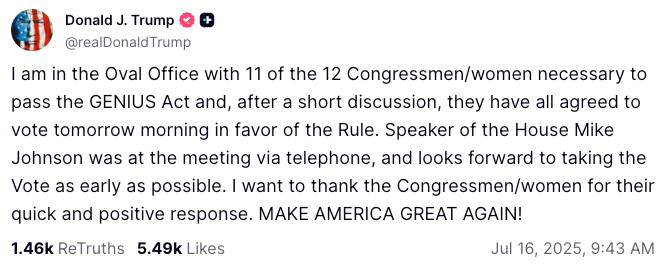

US President Donald Trump announced Tuesday night that congressional leaders have agreed to advance the landmark GENIUS Act following an Oval Office meeting, marking a significant turnaround after House Republicans failed to pass a key procedural vote earlier this week.

“I am in the Oval Office with 11 of the 12 Congressmen/women necessary to pass the GENIUS Act and, after a short discussion, they have all agreed to vote tomorrow morning in favor of the Rule,” Trump posted on Truth Social.

The president confirmed that House Speaker Mike Johnson participated via telephone and expressed enthusiasm for expediting the legislative process.

Strategic Reversal Following Congressional Setback

The announcement represents a dramatic reversal from earlier Tuesday’s setback, when House Republicans failed to secure a 196-222 procedural vote that would have advanced “Crypto Week” legislation. The failure stemmed from internal Republican divisions, with House Freedom Caucus members opposing the bundled package that included the GENIUS Act alongside the Clarity Act and defense appropriations.

The GENIUS Act establishes the first federal framework for dollar-pegged stablecoins, granting sweeping authority to the Department of Treasury and creating regulated pathways for private companies to issue digital dollars. The Senate passed the legislation with a 68-30 vote in June, with bipartisan support despite Democratic concerns over Trump’s cryptocurrency ventures.

Market Implications and Economic Projections

Treasury Secretary Scott Bessent has projected the U.S. stablecoin market could expand nearly eightfold to exceed $2 trillion within several years, underscoring the legislation’s potential economic impact. The bill aims to regulate the roughly $238 billion stablecoin market, creating a clearer framework for banks, companies and other entities to issue the digital currencies.

The renewed momentum follows sustained pressure from Trump, who has characterized stablecoin regulation as critical to maintaining American technological supremacy over China and Europe. Industry observers view the GENIUS Act as the crypto sector’s most achievable legislative priority, with established players seeking regulatory clarity to legitimize mainstream adoption.

“I want to thank the Congressmen/women for their quick and positive response,” Trump concluded, signaling confidence in Thursday’s procedural vote outcome.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETH traders ramp up positioning, setting a price target at $3.4K

BTC price pauses at $92K: Can Bitcoin avoid another crash?

Crypto bull market signal: ERC-20 stablecoin supply preserves $185B record

Five XRP charts suggest a short-term price rally to $2.80 is next