Ether ( ETH ) traders are quietly rotating back into leverage, with fresh futures data signaling a major shift in market positioning as ETH approaches a critical technical zone.

Key takeaways:

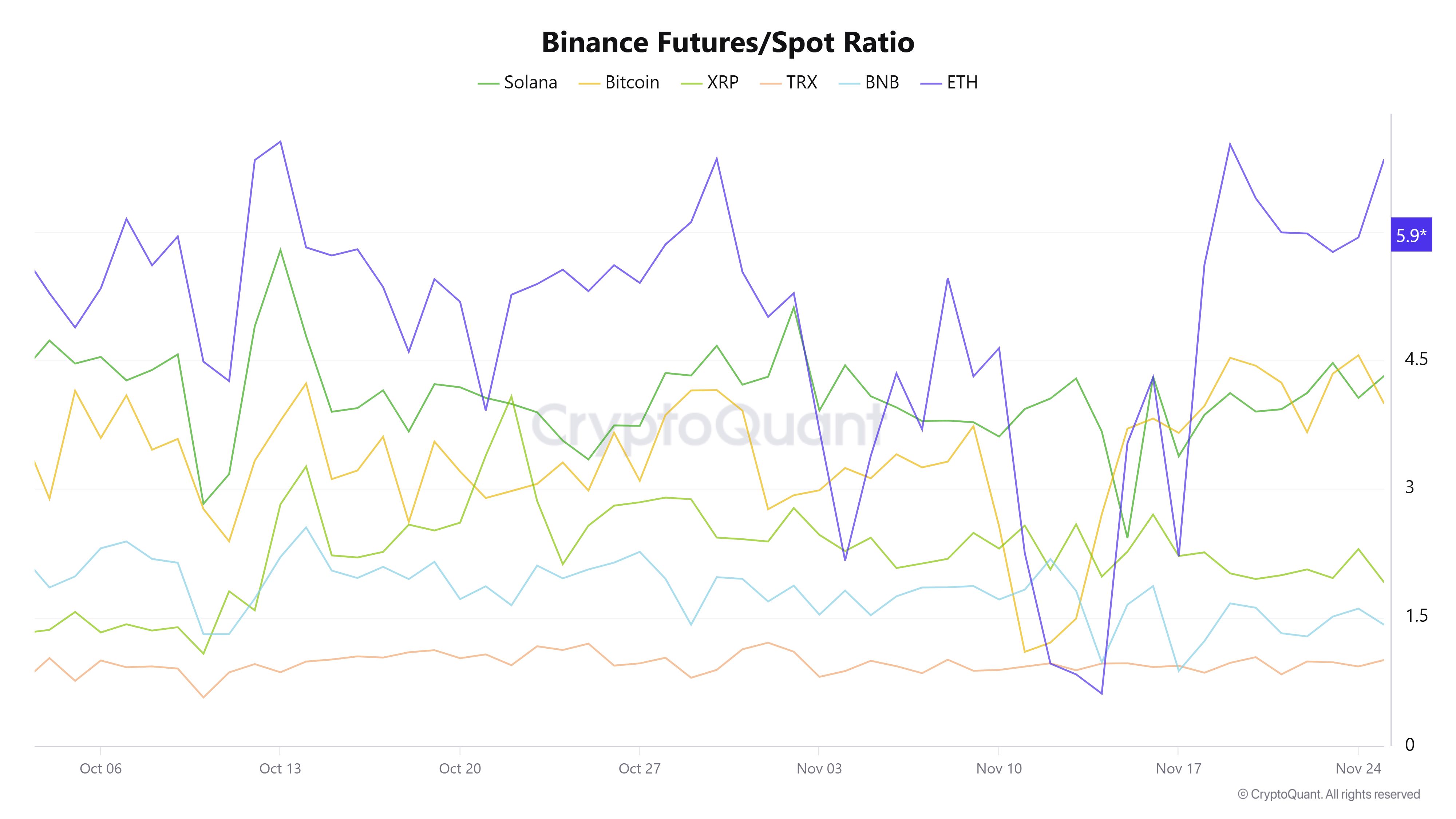

Ether leads all major crypto assets in the futures-to-spot ratio, with the current rating at 6.84.

Derivatives traders are reallocating risk into ETH while Bitcoin shows declining open interest.

Technical structure remains constructive, with bulls eyeing a potential run toward $3,390 if key levels flip.

ETH futures attract more attention from traders

Recent data from CryptoQuant indicated Ether’s futures-to-spot ratio on Binance had risen sharply from 5 to 6.84, its highest level in Q4. This acceleration marked a decisive rotation in market behavior, where traders increasingly prefer leveraged exposure over spot accumulation.

Binance Futures/Spot ratio for BTC, ETH, XRP. Source: CryptoQuant

Binance Futures/Spot ratio for BTC, ETH, XRP. Source: CryptoQuant

Compared to Bitcoin and Solana, sitting at 4 and 4.3, respectively, ETH has created a gap for itself as the market’s most aggressively positioned large-cap asset. This divergence pointed to rising expectations of ETH-specific volatility or catalysts ahead, with traders leaning heavily into derivatives to capture directional moves.

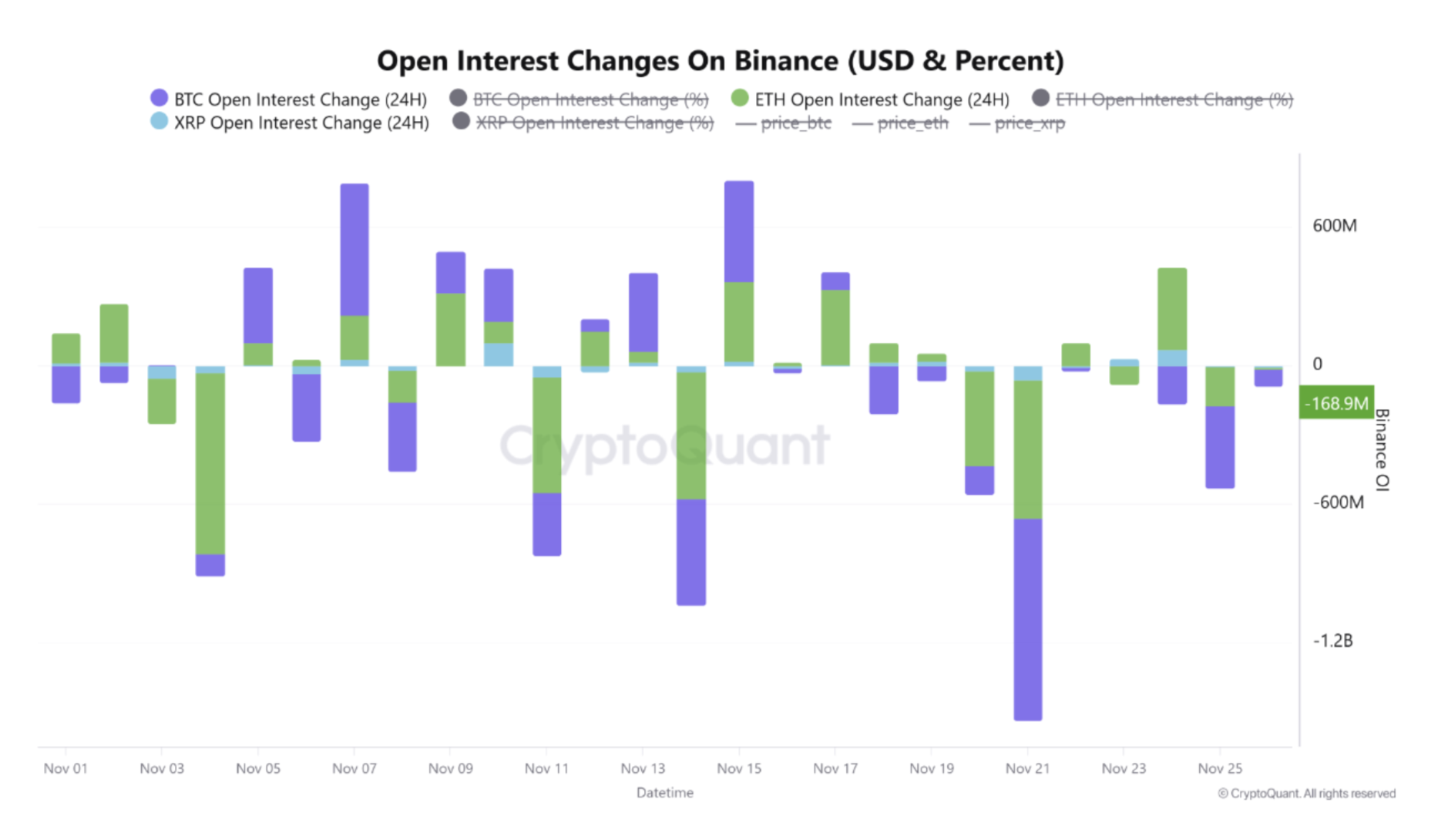

Further supporting this shift, onchain data from Binance highlighted a notable decline in Bitcoin open interest (OI) over the last two weeks, while Ether’s OI has remained relatively stable with only a mild 0.47% average pullback per day. The trend suggested that market participants are rotating risk capital out of BTC’s uptrend and into ETH’s higher-beta opportunity.

Open interest change on Binance for BTC, ETH. Source: CryptoQuant

Open interest change on Binance for BTC, ETH. Source: CryptoQuant

Related: Ethereum raises block gas limit to 60M as network capacity climbs ahead of Fusaka

ETH traders remain split on its next move

With ETH breaking the $3,000 level this week, analysts debated whether ETH can convert building derivatives pressure into a sustained breakout.

Crypto trader Scient argued ETH’s structure is already outperforming Bitcoin, pointing to a reinforced four-hour support base around $2,800. Bulls expected this zone to attract buyers again on any retest, setting up an initial push toward $3,050 and potentially the major liquidity cluster at $3,390, an area aligning with high-timeframe support/resistance, a fair value gap (FVG), and the yearly open.

Ether’s four-hour chart analysis by Scient. Source: X

Ether’s four-hour chart analysis by Scient. Source: X

However, Lab Trading’s analyst Ken believed the short-term is still bearish. ETH has consistently rejected the four-hour, 100-EMA level throughout November, and the trader warned that unless $3,000 flips into support, the market risks another downside extension.

Meanwhile, crypto analyst Kingpin Crypto said the “Thanksgiving lull” is a potential springboard. With price reacting off the 0.618 retracement of the 2025 rally and multiple higher-time frame supports below, some expect a December “Ethereum Santa rally” toward the $3,300s, especially as Bitcoin dominance continues to soften.

Related: Four reasons why Ethereum price remains bullish above $2,800