Blockchain Group Acquires More Bitcoin, Hits 1,933 BTC in Holdings

The Blockchain Group (Euronext: ALTBG) has confirmed the acquisition of 29 additional Bitcoin (BTC) worth approximately €2.8 million, bringing its total holdings to 1,933 BTC.

The Blockchain Group (Euronext: ALTBG) has confirmed the acquisition of 29 additional Bitcoin (BTC) worth approximately €2.8 million, bringing its total holdings to 1,933 BTC.

The move was funded through a €3 million capital raise under its “ATM-type” program with TOBAM, completed on July 8 at an average share price of €4.056.

The latest BTC acquisition was executed by Banque Delubac & Cie and securely custodied via Taurus, a Swiss digital asset infrastructure provider. The purchase is part of The Blockchain Group’s ongoing strategy to increase Bitcoin per fully diluted share, reinforcing its position as Europe’s first Bitcoin Treasury Company.

As of July 14, the company’s Bitcoin holdings are valued at approximately €174.8 million, acquired at an average cost of €90,406 per coin. The group’s year-to-date performance indicators reveal a BTC Yield of 1,368.3%, with BTC Gain of 547.3 BTC and a BTC € Gain of €52.1 million. Quarter-to-date, BTC Yield stands at 7.1%.

🟠 The Blockchain Group confirms the acquisition of 29 BTC for ~€2.8 million, the holding of a total of 1,933 BTC, and a BTC Yield of 1,368.3% YTD⚡️

— The Blockchain Group (@_ALTBG) July 14, 2025

The capital increase also altered the company’s shareholder distribution. Notable participants include TOBAM Bitcoin Enhanced Fund and Adam Back. The fully diluted share count now stands at over 320 million.

The company uses proprietary metrics like BTC Yield and BTC Gain to measure the impact of capital allocation on per-share Bitcoin exposure. As of July 14, each fully diluted share represents 602 satoshis—up from just 41 sats in December 2024.

The Blockchain Group continues to blend equity strategy with digital asset accumulation, positioning itself as a pioneer in integrating Bitcoin into corporate treasury management in Europe. Notably, the organisation also secured approximately €3 million through a capital increase, reinforcing its long-term Bitcoin treasury strategy. The funds were raised under an “ATM-type” agreement with TOBAM, enabling the issuance of 739,000 new shares at an average price of €4.056 per share.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wintermute Market Outlook: Capital Inflows Stagnate, Market Enters Stock Game Phase

Global liquidity remains abundant, but funds have not temporarily chosen the crypto market.

Wall Street’s Calculation: What Does $500 Million Buy in Ripple?

Ripple's story has turned into a classic financial tale: about assets, valuation, and liquidity management.

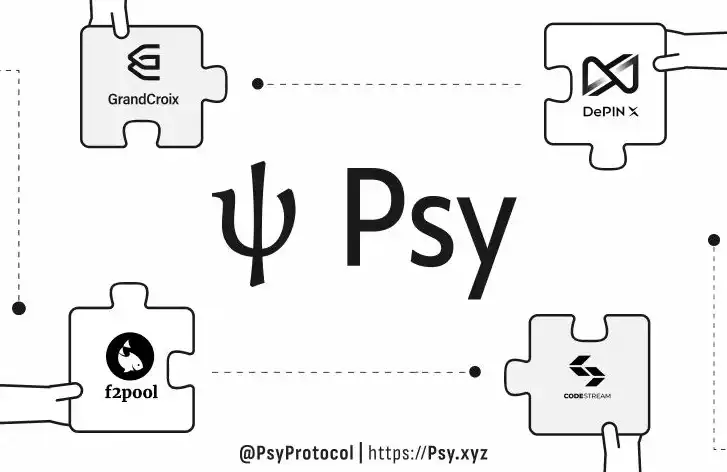

Leading mining pools and hash power ecosystems join Psy Protocol testnet to jointly build a new generation PoW smart contract platform

Leading mining pools and computing power ecosystems such as F2Pool and DePIN X Capital have joined a PoW platform designed for the agent economy, which is capable of processing over one million transactions per second.

Polkadot 2025 Q2 Treasury Report: $27.6 million spent, $106 million remaining!