Wintermute Market Outlook: Capital Inflows Stagnate, Market Enters Stock Game Phase

Global liquidity remains abundant, but funds have not temporarily chosen the crypto market.

Original Title: Liquidity, the lifeblood of crypto

Source: Wintermute

Translation: Azuma, Odaily

Key Conclusions

1. Liquidity dominates the cycles of the crypto market, and inflows from stablecoins, ETFs, and DATs (Digital Asset Treasuries) are slowing down.

2. Global liquidity remains abundant, but higher SOFR rates are keeping funds in short-term T-bills rather than flowing into the crypto market.

3. The crypto market is currently in a “self-sustaining” phase—funds are circulating internally until new external capital re-enters the market.

The Dominant Role of Liquidity

Liquidity often dominates every cycle rotation in the cryptocurrency market. In the long run, adoption may determine the narrative direction of the crypto industry, but what truly drives price changes is the direction of capital flows.

In recent months, the momentum of these capital inflows has clearly slowed. The capital inflow rate into the ecosystem through the three main channels—stablecoins, ETFs, and Digital Asset Treasuries (DATs)—has simultaneously weakened, shifting the crypto market from an expansion phase to one supported by existing capital.

While technological adoption is important, liquidity is the real key driving the cyclical rotation of the market. This is not just a matter of market depth, but of capital availability. When global money supply expands or real interest rates fall, excess liquidity inevitably seeks out risk assets, and crypto assets have historically (especially during the 2021 cycle) been among the biggest beneficiaries.

In previous cycles, liquidity mainly entered digital assets through the issuance of stablecoins, which is the core fiat on-ramp. As the market has matured, three major liquidity funnels have gradually formed, determining the paths for new capital to enter the crypto market:

· Digital Asset Treasuries (DATs): Tokenized funds and yield structures used to connect traditional assets with on-chain liquidity.

· Stablecoins: The on-chain form of fiat liquidity, serving as the foundational collateral for leverage and trading activities.

· ETFs: Entry channels providing BTC and ETH exposure for traditional financial institutions and passive capital.

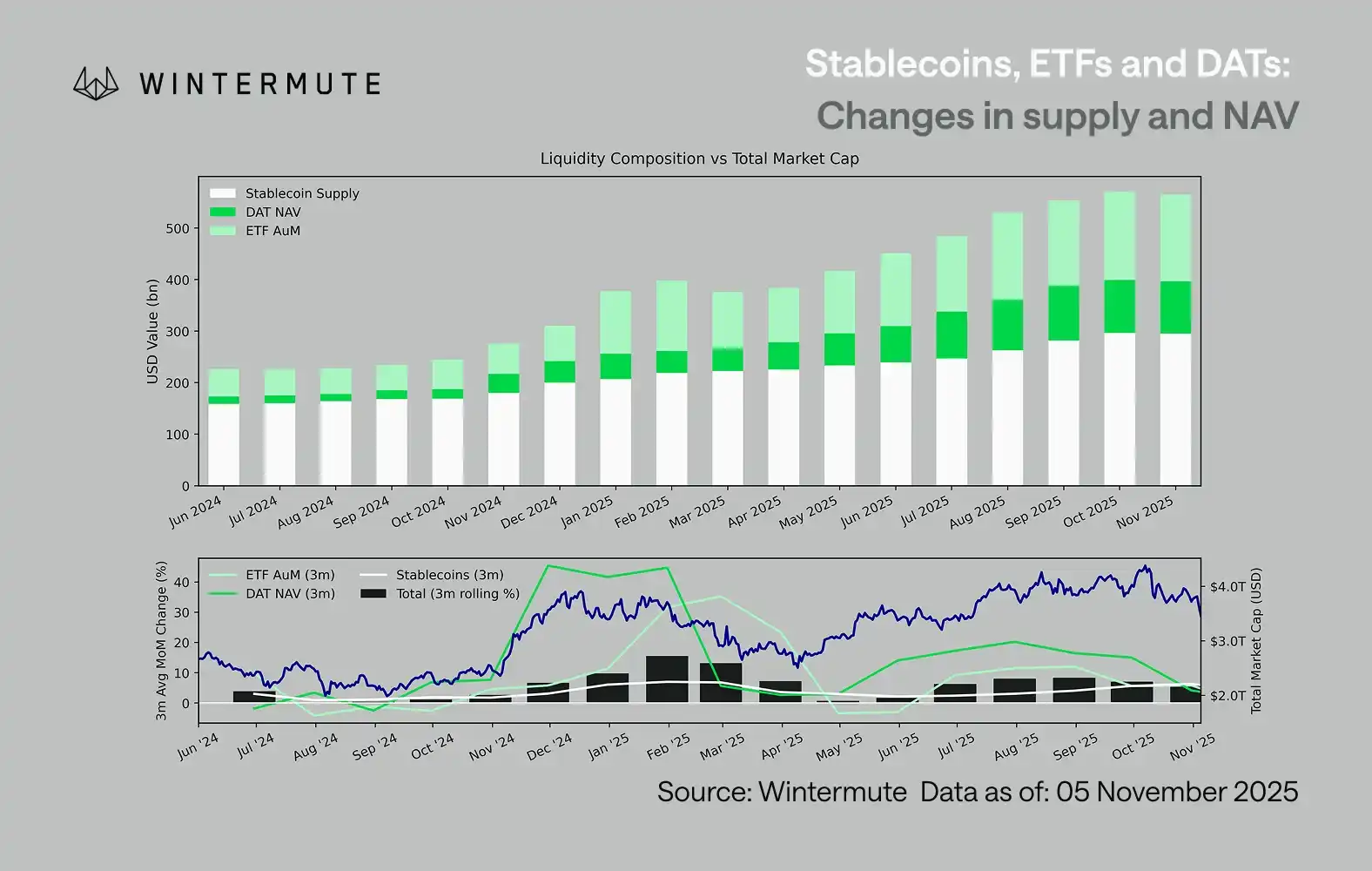

Combining the assets under management (AUM) of ETFs, the net asset value (NAV) of DATs, and the total issued stablecoins can serve as a reasonable indicator to measure the total capital inflow into digital assets.

The chart below shows the changes in these components over the past 18 months. The bottom chart shows that changes in this total are highly correlated with the overall market capitalization of digital assets—when capital inflows accelerate, prices rise accordingly.

Which Pathway's Inflows Have Slowed?

A key piece of information reflected in the chart is that inflows into DATs and ETFs have significantly weakened. These two pathways performed strongly in Q4 2024 and Q1 2025, and briefly rebounded in early summer, but momentum has gradually dissipated since then. Liquidity (M2) is no longer naturally flowing into the crypto ecosystem as it did at the beginning of the year. Since early 2024, the total size of DATs and ETFs has grown from about $4 billion to $27 billion, while stablecoin supply has doubled from about $14 billion to $29 billion. This shows structural growth, but also a clear “plateau period.”

It is important to observe the pace of slowdown in different pathways, as each reflects a different source of liquidity: Stablecoins reflect the native risk appetite of the crypto market; DATs represent institutional demand for yield assets; ETFs map the allocation trends of traditional financial capital; the simultaneous slowdown of all three indicates that new capital deployment is generally decelerating, not just rotating between products.

Stock Game Market

Liquidity has not disappeared; it is just circulating within the system rather than continuously expanding.

From a broader macro perspective, overall economic liquidity (M2) outside the crypto market has also not stagnated. Although higher SOFR rates temporarily constrain liquidity—making cash yields more attractive and keeping funds in the treasury market—the world is still in an easing cycle, and the US’s quantitative tightening (QT) has officially ended. The structural backdrop remains supportive, but currently, more liquidity is flowing into other forms of risk expression, such as the stock market.

Due to the reduction in external capital inflows, market dynamics have become closed. Funds are more often rotating between large-cap coins and altcoins, resulting in an internal game (PVP) scenario. This explains why rebound rallies are always short-lived, and why market breadth continues to narrow even when total assets under management remain stable. Currently, the surge in market volatility is mainly caused by a chain reaction of liquidations, rather than being driven by sustained trends.

Looking ahead, if any liquidity pathway sees a substantial recovery—whether it’s stablecoins being reissued, ETFs regaining popularity, or DATs increasing in scale—it will signal that macro liquidity is returning to the digital asset sector.

Until then, the crypto market will remain in a “self-sustaining” phase, with funds circulating internally rather than compounding growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New Bitcoin highs could take 2 to 6 months but data says it’s worth the wait: Analysis

Wintermute: Liquidity, the Lifeline of the Crypto Industry, Is in Crisis

Liquidity determines every cryptocurrency cycle.

Ray Dalio's latest post: This time is different, the Federal Reserve is fueling a bubble

Because the fiscal side of government policy is now highly stimulative, quantitative easing will effectively monetize government debt, rather than simply reinjecting liquidity into the private system.

Famous Bitcoin bull "Cathie Wood" lowers target price due to the "replacement" by stablecoins

Cathie Wood has lowered her 2030 bitcoin bull market target price by about $300,000, after previously predicting it could reach $1.5 million.