Why Bitcoin Surpassing Google is Crypto’s Poetic Justice

2025/06/28 02:30

2025/06/28 02:30For the third time this year, Bitcoin’s market capitalization has exceeded Alphabet, Google’s parent company, signaling its recent strong performance. This upward trend is marked by Bitcoin reaching a new price threshold of $100,000 and the wider crypto industry securing key legislative successes in the United States.

Matthew Sigel, Head of Digital Assets Research at global investment firm VanEck, described Bitcoin’s outperformance of technology giants like Google as “poetic justice.” For him, it’s a sign that the investment world is finally waking up to Bitcoin’s perceived value proposition.

Bitcoin’s Ascendance Over Tech Giants

It’s been a great year for Bitcoin, and the wider crypto community is reveling in its success. It’s also keeping traditional tech on high alert.

This Friday, Bitcoin’s market capitalization reached $2.13 trillion, exceeding Alphabet’s by $30 billion. Though the difference is minimal, its significance is monumental, especially considering that this wasn’t the first time Bitcoin surpassed Alphabet.

So far this year, Bitcoin has achieved a similar feat twice before, once in April and again in May, taking Alphabet’s place as the fifth-largest global asset and closely trailing behind Amazon.

Largest companies by market capitalization. Source:

CompaniesMarketCap

Largest companies by market capitalization. Source:

CompaniesMarketCap

Meanwhile, crypto equities are also rejoicing in a rally of their own.

Crypto Equities Rally Amid Legislative Wins

The stocks of companies heavily involved in the blockchain sector have seen a recent surge in performance. Coinbase’s shares rose 53% year-to-date, reaching a high point of $379.

Coinbase stock price. Source:

Google Finance

Coinbase stock price. Source:

Google Finance

Other cryptocurrency-related stocks, including those of the Bitcoin treasury holding company Strategy, also rose as Bitcoin’s price climbed to $106,000. Mining firms like Riot and Mara additionally experienced gains.

This strong rally was also fueled by other notable events, such as the US Senate’s recent approval of the GENIUS Act. The passage marked an important legislative shift towards pro-crypto policies in an industry that previously faced a hostile environment.

According to Sigel, the increase in crypto stock values points to a clear and significant change in Bitcoin’s reputation, solidifying its status as a viable investment.

“Crypto equities are rallying because Wall Street finally gets it: the picks-and-shovels of the onchain economy are no longer science experiments. They’re tollbooths on a new financial superhighway,” he told BeInCrypto.

For him, these events signify Bitcoin’s growing prominence while simultaneously revealing the diminishing strength of its long-standing competitors.

A Poetic Justice for Bitcoin

The news of Bitcoin’s market capitalization reminded Sigel of a newsletter he wrote eight years ago when he worked as a portfolio strategist at another investment bank. It was titled “Google is Evil.”

The issue’s central theme strongly critiqued major tech companies’ immense market power and societal influence.

Sigel argued that giants like Google and Facebook functioned as harmful monopolies that negatively impacted society. He particularly condemned Google’s “rentier behavior,” asserting it used its dominant position to control cultural narratives and undermine democratic principles.

He ended the newsletter by disclosing that he had made his first Bitcoin purchase, albeit through a trust. He paid a $306 entry price.

Sigel’s first Bitcoin purchase. Source: Matthew Sigel.

Sigel’s first Bitcoin purchase. Source: Matthew Sigel.

Bitcoin’s underlying infrastructure and decentralized nature remain key benefits that Sigel defends to this day. For him, Bitcoin’s repeated surpassing of Google reflects that the technology is finally receiving the recognition it deserves.

“As for Bitcoin flipping Google, what poetic justice. One sells your data, the other sells you freedom. In a world drowning in surveillance and debt, investors are opting for scarcity and autonomy,” he said.

If Sigel’s Bitcoin bets prove as accurate as those he made in his 2017 newsletter, then Bitcoin holders stand to benefit significantly.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wintermute Market Outlook: Capital Inflows Stagnate, Market Enters Stock Game Phase

Global liquidity remains abundant, but funds have not temporarily chosen the crypto market.

Wall Street’s Calculation: What Does $500 Million Buy in Ripple?

Ripple's story has turned into a classic financial tale: about assets, valuation, and liquidity management.

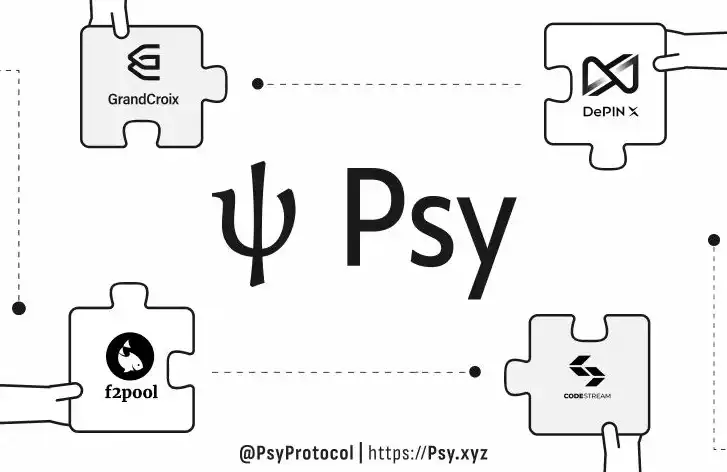

Leading mining pools and hash power ecosystems join Psy Protocol testnet to jointly build a new generation PoW smart contract platform

Leading mining pools and computing power ecosystems such as F2Pool and DePIN X Capital have joined a PoW platform designed for the agent economy, which is capable of processing over one million transactions per second.

Polkadot 2025 Q2 Treasury Report: $27.6 million spent, $106 million remaining!