Polygon crypto price: Can Polygon’s tech push revive the token’s price?

Polygon’s native cryptocurrency, POL, is trading around $0.258 as of May 13, 2025 — still far from its all-time highs and struggling to gain strong upward momentum.

Despite broader market volatility, Polygon ( POL ) has been busy building. The network is rolling out major upgrades that it hopes will reshape its future, including a new token and infrastructure aimed at making Ethereum ( ETH ) faster and cheaper.

Polygon is best known as a “Layer 2” network for Ethereum. That means it helps scale Ethereum by moving activity off the main blockchain, while still using its security. But now, Polygon is moving beyond just one network.

Under its “Polygon 2.0” plan, it’s evolving into a whole ecosystem of connected chains, powered by a new technology called zkEVM—zero-knowledge Ethereum Virtual Machine. This tech promises more efficient, secure transactions.

As part of this shift, the project migrated from the MATIC token to a new one called POL. This new token will support more use cases, like securing multiple chains and participating in governance decisions.

Polygon recently launched the Agglayer Breakout Program to incubate and launch high-impact blockchain projects. Graduated projects allocated 5–15% of their token supply to POL stakers through airdrops.

These projects connected to Agglayer upon launch, enhancing network activity and value for the POL token.

So, where could the price go?

Analysts are divided. Short-term forecasts are cautious—CoinCodex sees POL reaching only about $0.27 by next month, while Coinpedia sees the price topping out at $0.47 by next year.

But long-term bulls like DigitalCoinPrice see a much brighter future, predicting POL could hit $3.91 by the end of 2025 if adoption takes off.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar Users Can Now Borrow USDC Using XLM as Collateral via Templar Protocol

Wintermute Market Outlook: Capital Inflows Stagnate, Market Enters Stock Game Phase

Global liquidity remains abundant, but funds have not temporarily chosen the crypto market.

Wall Street’s Calculation: What Does $500 Million Buy in Ripple?

Ripple's story has turned into a classic financial tale: about assets, valuation, and liquidity management.

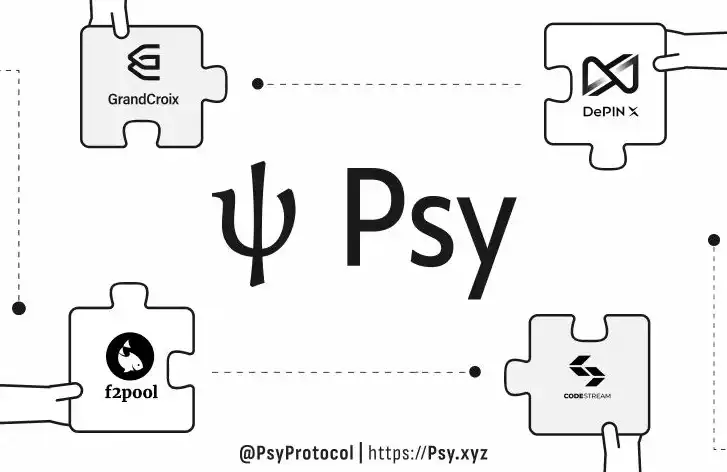

Leading mining pools and hash power ecosystems join Psy Protocol testnet to jointly build a new generation PoW smart contract platform

Leading mining pools and computing power ecosystems such as F2Pool and DePIN X Capital have joined a PoW platform designed for the agent economy, which is capable of processing over one million transactions per second.