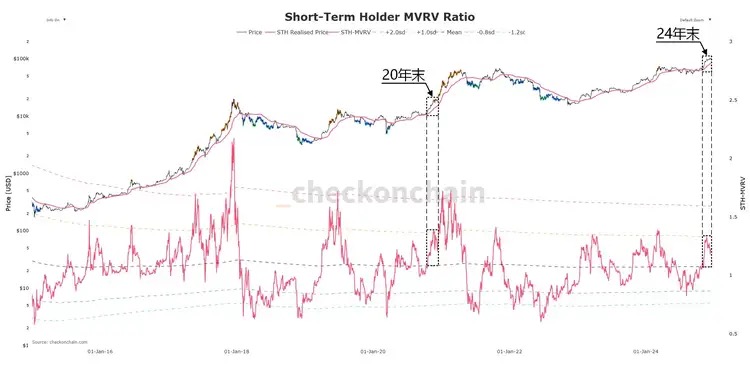

Short-term holders' MVRV indicator returns to key points: historical bull start signal reappears?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Long English Thread] Scroll Co-founder: The Inevitable Path of ZK

"Tether" in 2025: Capital Analysis

Mars Morning News | The first SUI ETF is approved for listing and trading; SEC meeting reveals regulatory differences on tokenization, with traditional finance and the crypto industry holding opposing views

The first SUI ETF is listed, an SEC meeting reveals regulatory disagreements, bitcoin price drops due to employment data, US debt surpasses 30 trillions, and the IMF warns of stablecoin risks. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

Moore Threads makes its debut with a surge of over 500%! The market value of the first domestic GPU stock once exceeded 300 billions yuan.

On its first day of trading, the "first domestic GPU stock" saw an intraday peak increase of 502.03%, with its total market value once exceeding 300 billions RMB. Market analysis shows that a single lot (500 shares) could earn up to 286,900 RMB at the highest point.