Minimum Paid-Up Equity Requirement for Hong Kong Stablecoin Issuers Changed to HK$25 Million or 1/100th of the Par Value of the Stablecoin in Circulation

In the Consultation Conclusions on the Legislative Proposals for the Implementation of a Regulatory Regime for Stablecoin Issuers in Hong Kong, the HKMA and the FRC stated that a stablecoin issuer should hold sufficient financial resources to adequately address the relevant market risks, operational risks, technological risks, and other risks arising from the operation of its business, but taking into account the market's response to the change in the minimum paid-up equity requirement to the greater of HK$25 million or one percent of the liquidity in its stablecoins percent of the nominal value of its stablecoins in circulation, whichever is higher. However, the Monetary Authority retains the flexibility and power to impose additional capital requirements as and when necessary.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

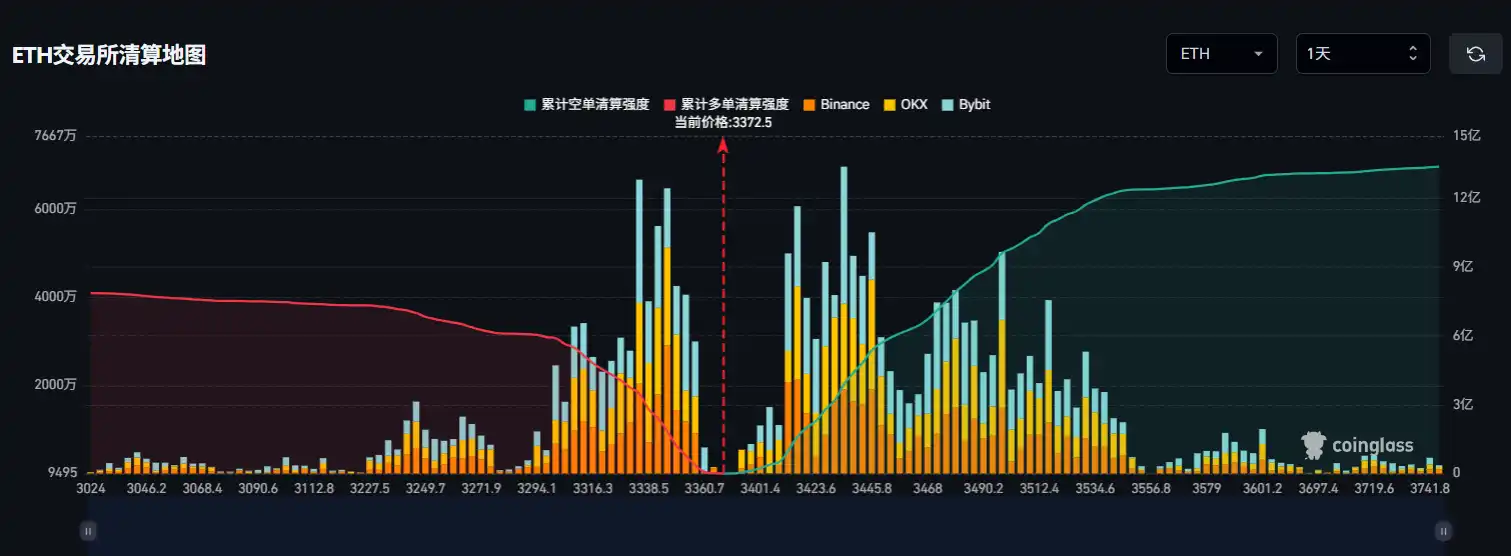

Data: Jeffrey Huang increases 25x ETH long position to $13.2 million, liquidation price at $3,321.4

CITIC Securities: The AI narrative has only affected the market slope, not the trend

Machi Big Brother increases 25x ETH long positions, current holdings exceed $13 million