CITIC Securities: The AI narrative has only affected the market slope, not the trend

According to a report by Jinse Finance, CITIC Securities stated in its research report that since October, market volatility has increased, but the success rate of market timing has not been high. The underlying reason is that the structure of incremental funds is changing, with steady absolute return-oriented funds continuously entering the market, thereby reducing the effectiveness of traditional aggressive timing strategies. Currently, the truly important variables remain the stability of the overseas business environment for enterprises and AI, which involve China-US relations and the progress of AI infrastructure construction. At present, not only the TMT sector, but also the rise of nonferrous metals, chemicals, and new energy sectors are directly or indirectly influenced by the AI narrative. The combined proportion of these sectors in institutional holdings has already exceeded 60%. In this situation, the idea behind portfolio adjustment is not to deliberately avoid the AI narrative, but to select stocks with a bottoming and upward trend in ROE as much as possible. The AI narrative only affects the slope of the market trend, not the trend itself.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Spain Arrests Leader of €260 Million Cryptocurrency Ponzi Scheme

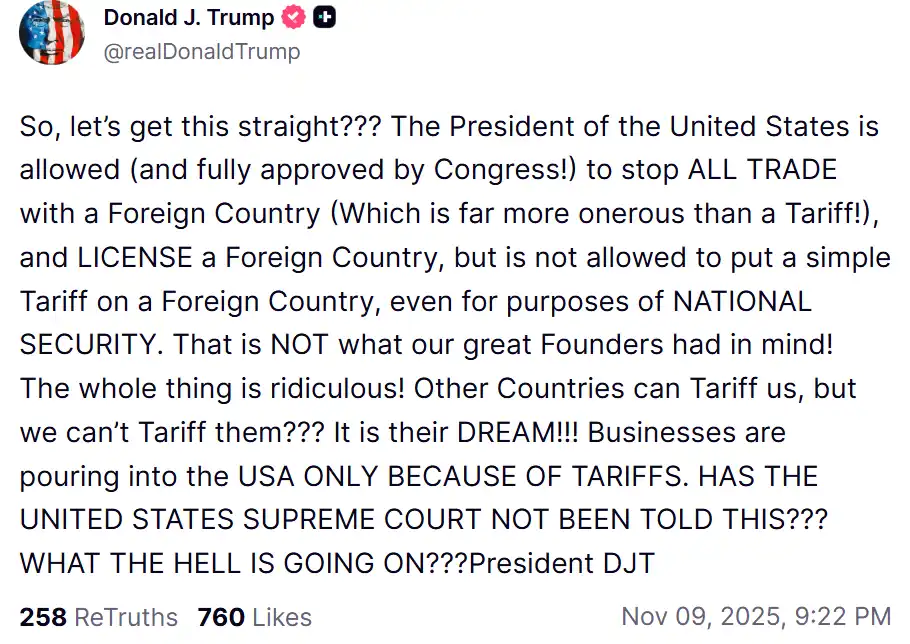

Trump reiterates that the president has the authority to decide whether to impose tariffs