Bitcoin ( BTC ) saw fresh volatility at the March 27 Wall Street open as analysts said that short liquidations were now long overdue.

BTC price nears 2-week highs as volatility clears Bitcoin sell orders

Bitcoin's old 2021 all-time high proves to be a magnet as bulls' latest charge is cut off near two-week BTC price highs.

Bitcoin takes sell-side liquidity before fresh dip

Data from Cointelegraph markets Pro and TradingView tracked BTC price action as it hit its highest levels in nearly two weeks — $71,754 on Bitstamp.

A sudden correction then saw BTC/USD drop $1,300 in minutes, going on to total more than 4% as bulls fought to flip the key $69,000 zone to support.

The latest data covering flows for the United States spot Bitcoin exchange-traded funds (ETFs) remained encouraging.

After net inflows of more than $400 million the day prior, Wall Street trading began with a modest 1,300 BTC ($91 million) outflow from the Grayscale Bitcoin Trust (GBTC).

The figures, from crypto intelligence firm Arkham, were uploaded to X (formerly Twitter) by popular trader Daan Crypto Trades.

“We're indeed seeing some high volatility as well,” he added in a further post, noting that the local highs had filled a large wall of BTC sell orders.

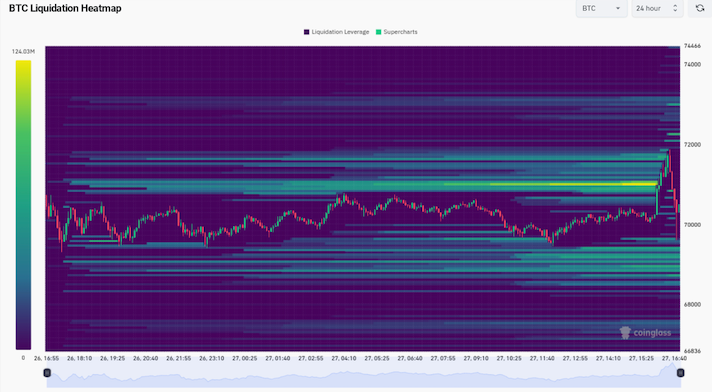

Liquidating short BTC positions was now a key topic of discussion for market observers. The latest data from on-chain monitoring resource CoinGlass showed bids thickening around $69,000 — a potential safety net should the market reverse.

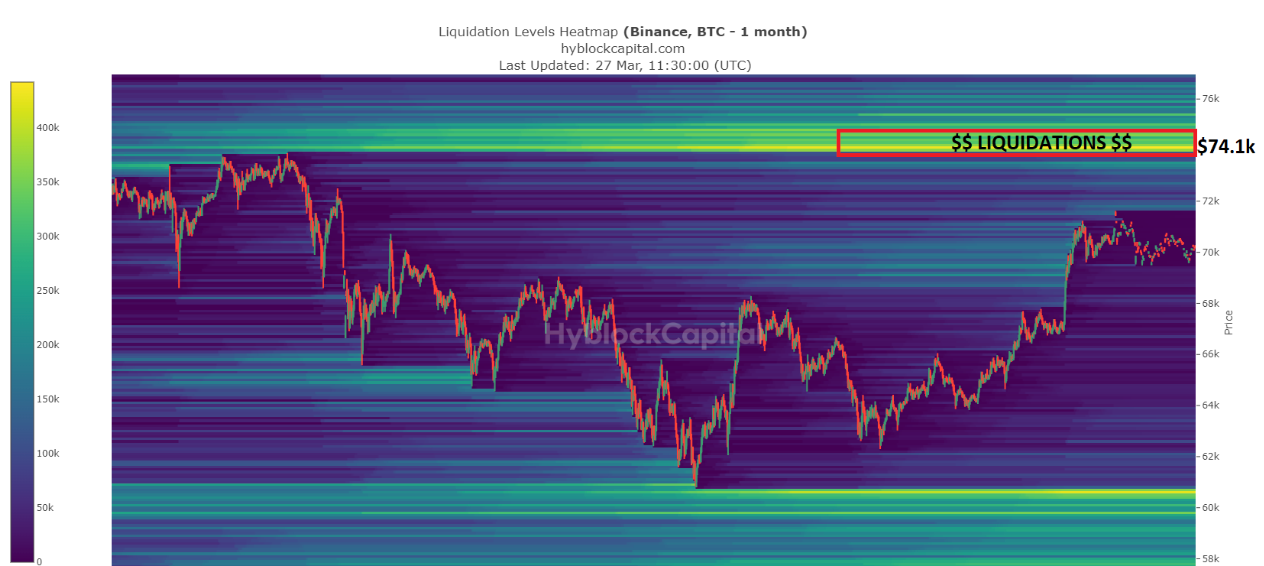

Further out, fellow trader CrypNuevo hoped for an attack on the final band of shorts around recent all-time highs at $74,000.

“Mid term: Liquidity at both sides but more likely to go for the upside liquidations at $74.1k because they're closer from current price,” he reasoned in part of an X post.

$69,000 remains key point on the BTC price map

With $68,500 coming back into play at the time of writing, popular trader Crypto Ed was among those calling for calm.

That price, he said in his latest YouTube video released on the day, would form a potentially suitable long entry and would not constitute a major corrective move.

“Not really sure if this next move is really a big one — $73,000 maybe,” he suggested about where BTC/USD could go thereafter.

A further correction could then set in before attacking the all-time highs.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Borrowing short to repay long: The Bank of England and the Bank of Japan lead the shift from long-term bonds to high-frequency "interest rate gambling"

If expectations are not met, the government will face risks of uncontrollable costs and fiscal sustainability due to frequent rollovers.

How do 8 top investment banks view 2026? Gemini has summarized the key points for you

2026 will not be a year suitable for passive investing; instead, it will belong to investors who are skilled at interpreting market signals.

Valuation Soars to 11 Billions: How Is Kalshi Defying Regulatory Pressure to Surge Ahead?

While Kalshi faces lawsuits and regulatory classification as gambling in multiple states, its trading volume is surging and its valuation has soared to 11 billion dollars, revealing the structural contradictions of prediction markets rapidly growing in the legal gray areas of the United States.

How will the Federal Reserve in 2026 impact the crypto industry?

Shifting from the technocratic caution of the Powell era, the policy framework is moving towards a more explicit goal of reducing borrowing costs and serving the president's economic agenda.