Bloomberg Crypto: Bitcoin call options with strike prices of $80,000 and $100,000 increase significantly

According to Bloomberg Crypto, predictions of Bitcoin against $100,000 appear to be becoming more realistic in the options market due to a significant increase in Bitcoin call options with strike prices of $80,000 and $100,000. The latest positioning shift raises the possibility of a more sustained rally. On the other hand, options and futures markets have seen lower volatility and leverage, suggesting that Bitcoin’s rise to $70,000 was primarily driven by spot market demand, where retail investors typically purchase tokens rather than leveraging derivatives to increase leverage.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

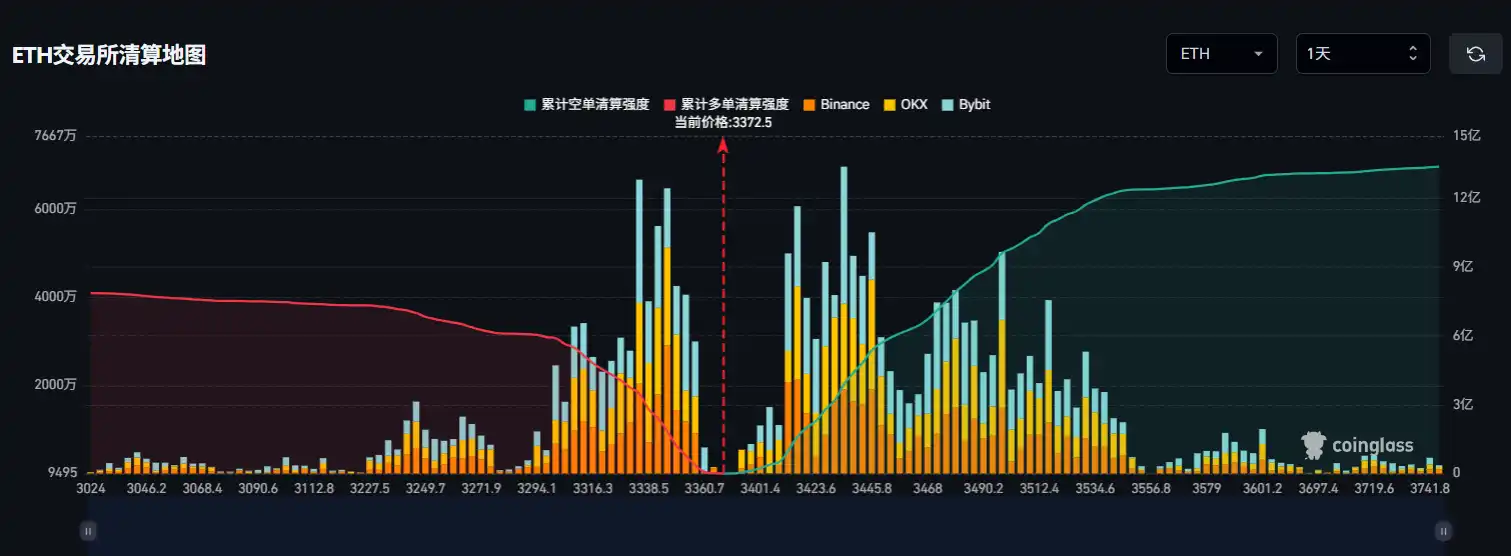

Data: Jeffrey Huang increases 25x ETH long position to $13.2 million, liquidation price at $3,321.4

CITIC Securities: The AI narrative has only affected the market slope, not the trend

Machi Big Brother increases 25x ETH long positions, current holdings exceed $13 million