Asset management company Superstate issues tokenized US Treasury bond funds on Ethereum

According to CoinDesk, blockchain-based asset management company Superstate has issued tokenized US Treasury bond funds on Ethereum. Superstate creates private funds that directly hold short-term treasury bills, aiming for a return rate consistent with the federal fund rate.

Investors can deposit in USD or USDC and receive USTB tokens representing their investment in the fund. Users can self-custody the tokens or choose custody services from Superstate's partners Anchorage Digital and BitGo. Robert Leshner, founder and CEO of Superstate, stated that USTB tokens are intended as an alternative stablecoin solution for US institutional investors (venture capital funds, hedge funds, digital asset companies) to store their on-chain cash and earn profits.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

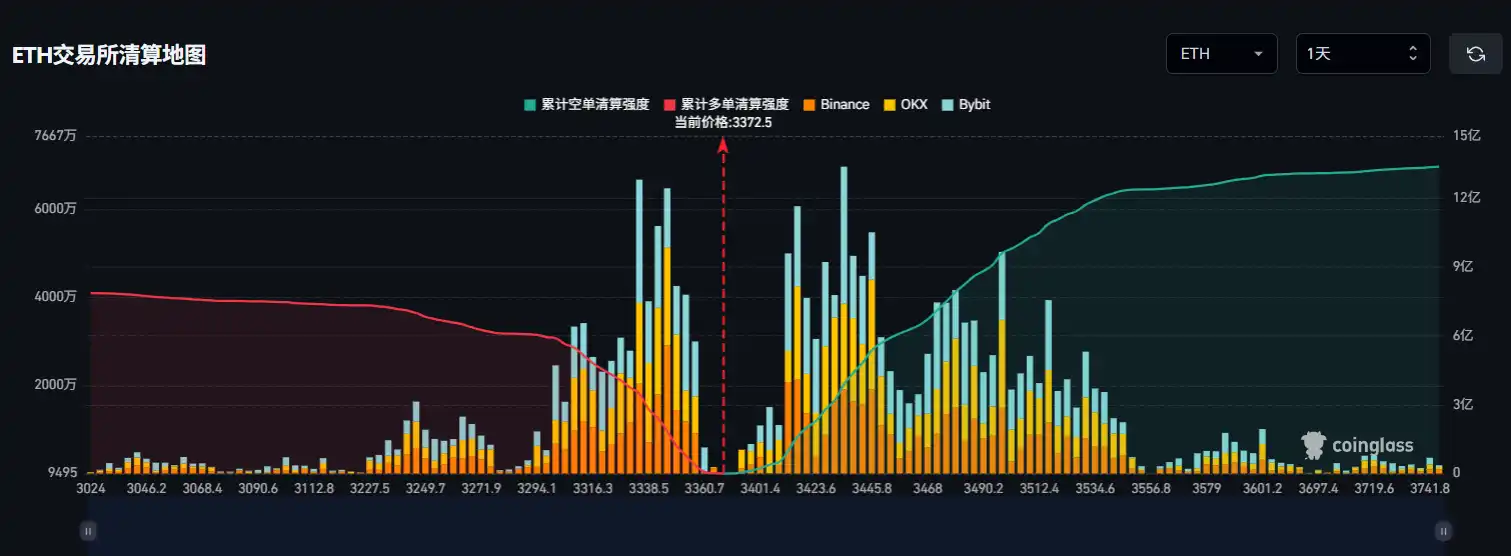

Data: Jeffrey Huang increases 25x ETH long position to $13.2 million, liquidation price at $3,321.4

CITIC Securities: The AI narrative has only affected the market slope, not the trend

Machi Big Brother increases 25x ETH long positions, current holdings exceed $13 million