News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Cow Protocol (COW) To Soar Higher? This Key Pattern Formation Suggests Potential Upside Move

Coinsprobe·2026/01/13 12:48

Ukraine Blocks Polymarket Amid Prediction Market Scrutiny

Cryptotale·2026/01/13 12:45

JPMorgan Chase (NYSE:JPM) Announces Q4 CY2025 Results Meeting Projections

101 finance·2026/01/13 12:45

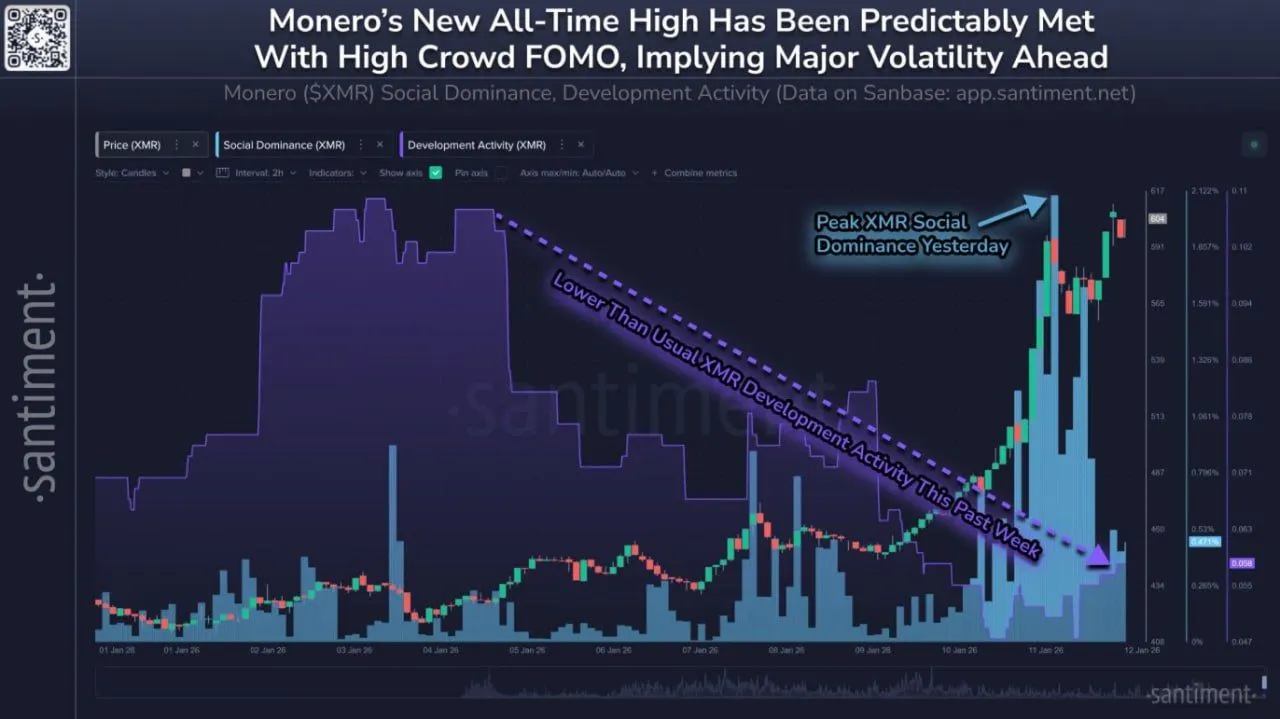

Monero Breaks Multi-Year Range as XMR Surges Past $600

CryptoNewsNet·2026/01/13 12:42

Altcoins, led by dash, heat up as bitcoin nears breakout: Crypto Markets Today

CryptoNewsNet·2026/01/13 12:42

BNB coin on the verge: possible breakout could propel price toward $1,000

Coinjournal·2026/01/13 12:42

Bitcoin is walking into a perfect setup for a long-term bull run but first faces a brutal 72-hour gauntlet

CryptoSlate·2026/01/13 12:42

Intra‑EU trade share of GDP drops from 23.5% to 22%, commission data shows

Cointelegraph·2026/01/13 12:36

December’s $910B crypto flush separates pros from panic‑selling tourists: Finestel

Crypto.News·2026/01/13 12:36

Superorganism secures $25 million to support startups focused on biodiversity

101 finance·2026/01/13 12:36

Flash

18:57

The cost range of long-term holders is creating supply pressureThe supply distribution heatmap for long-term holders shows that the cost range is concentrated between $93,000 and $109,000, forming a significant supply zone above. Any sustained upward movement must first absorb this supply, and breaking through this range is usually a necessary condition for reaching new highs in the long term.

18:38

JPMorgan CFO says stablecoin yield products are similar to a "parallel banking system"JPMorgan CFO Jeremy Barnum stated that JPMorgan will compete with cryptocurrency-related products, but warned that stablecoin yield products are similar to the banking system yet are not subject to the same level of regulation.

18:30

The Federal Reserve accepted $3.277 billion in reverse repo operations.The Federal Reserve accepted a total of $327.7 million from five counterparties in its fixed-rate reverse repurchase operations.