News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 18) | Fidelity Solana Spot ETF Launches Tonight in U.S. Markets; Public Companies Net-Buy Over $847 Million in BTC Last Week; All Three Major U.S. Indexes Close Lower2Young Bitcoin holders panic sell 148K BTC as analysts call for sub-$90K BTC bottom3Ethereum Falls Under $3,100 Amid Spot ETF Outflows, Viewed as Riskier Than Bitcoin

Microsoft Strikes $9.7B Deal With IREN as AI Demand Surges

Cointribune·2025/11/05 20:30

XRP ETF: Nate Geraci predicts a launch within two weeks

Cointribune·2025/11/05 20:30

Sequans Sells 970 Bitcoins, Unsettling the Markets

Cointribune·2025/11/05 20:30

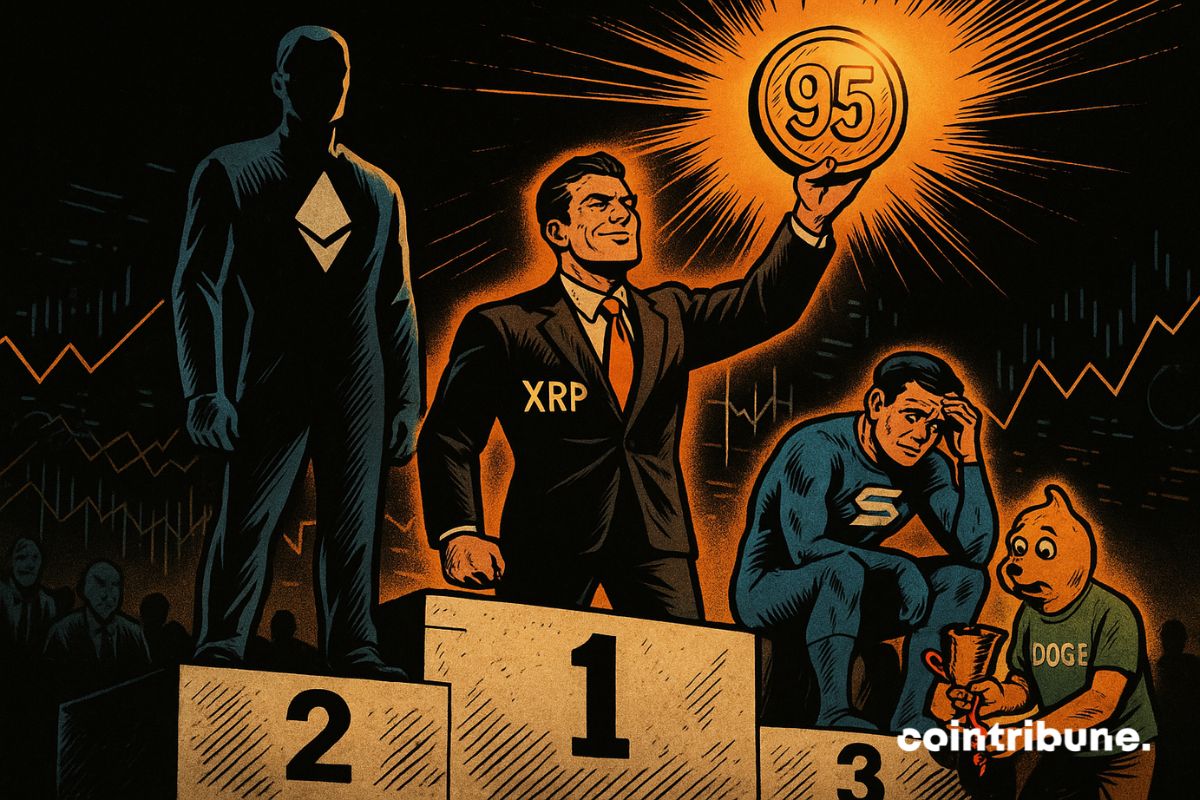

Crypto: Kaiko ranks XRP above Solana and Dogecoin in 2025

Cointribune·2025/11/05 20:30

Solana Treasury Firm Forward Industries Announces $1B Share Buyback

Cointribune·2025/11/05 20:30

EU’s Plan to Expand ESMA Powers Sparks Debate Over Crypto Innovation and Market Control

Cointribune·2025/11/05 20:30

Stellar (XLM) Holds Key Support — Could This Pattern Trigger an Rebound?

CoinsProbe·2025/11/05 20:30

Is Monero (XMR) Gearing Up for a Bullish Breakout? Key Pattern Formation Suggest So!

CoinsProbe·2025/11/05 20:30

Solar Price Prediction 2025, 2026 – 2030: Is SXP A Good Investment?

Coinpedia·2025/11/05 20:21

Canada’s 2025 Federal Budget Reveals Plans to Regulate Stablecoins

Coinpedia·2025/11/05 20:21

Flash

- 08:33BTC.D fell 0.98% intraday, currently at 58.85%.BlockBeats News, November 18, according to market data, Bitcoin dropped to a daily low of $89,253 today. Bitcoin dominance (BTC.D) fell by 0.98% during the day and is now reported at 58.85%. Compared to the high on November 4 (61.4%), it has retreated by 4.13%.

- 08:32Glassnode: The number of whale addresses holding over 1,000 BTC has risen significantly since last FridayBlockBeats News, November 18 — Despite continued pressure in the crypto market this week, the number of Bitcoin whale wallets has surged against the trend. Glassnode data shows that since the end of October, whales have continued to accumulate, and the number of addresses holding more than 1,000 BTC has risen significantly since Friday. On October 27, when the BTC price was at a high of $114,000, the number of whale wallets dropped to an annual low of 1,354. However, as of this Monday, the figure has rebounded by 2.2% to 1,384, reaching a four-month high. Meanwhile, Glassnode indicators show that smaller investors holding more than 1 BTC may be one source of selling pressure. The total number of such wallets has continued to decline from 980,577 on October 27 to an annual low of 977,420 as of November 17. This confirms a typical pattern in the crypto market: when retail investors panic sell during sharp declines, whales often take the opportunity to accumulate. Markus Thielen, founder of 10X Research, stated that there is still some whale selling pressure and emphasized that the Federal Reserve's October 29 FOMC meeting has had a profound impact on the current market. The meeting statement broke the fragile balance between buyers and sellers, specifically between the super whales holding 1,000–10,000 BTC selling and the whales holding 100–1,000 BTC buying. Although super whales are absorbing some of the sell orders, 30-day net flow data shows that selling still dominates.

- 08:32Current mainstream CEX and DEX funding rates indicate that the market has basically returned to neutral after being oversold.BlockBeats News, November 18, according to Coinglass data, the current funding rates on major CEX and DEX platforms show that after the recent sharp unilateral decline in the crypto market, although a new low was reached this morning since the start of this downturn, the overall bearish sentiment among participants has significantly weakened (on November 12, almost all funding rates were negative), and the funding rates for more asset trading pairs have returned to neutral. BlockBeats Note: Funding rates are fees set by cryptocurrency trading platforms to maintain the balance between contract prices and the prices of underlying assets, typically applied to perpetual contracts. It is a mechanism for the exchange of funds between long and short traders. The trading platform does not charge this fee; it is used to adjust the cost or profit of holding contracts for traders, so that contract prices remain close to the prices of the underlying assets. When the funding rate is 0.01%, it represents the benchmark rate. When the funding rate is greater than 0.01%, it indicates that the market is generally bullish. When the funding rate is less than 0.005%, it indicates that the market is generally bearish.