News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

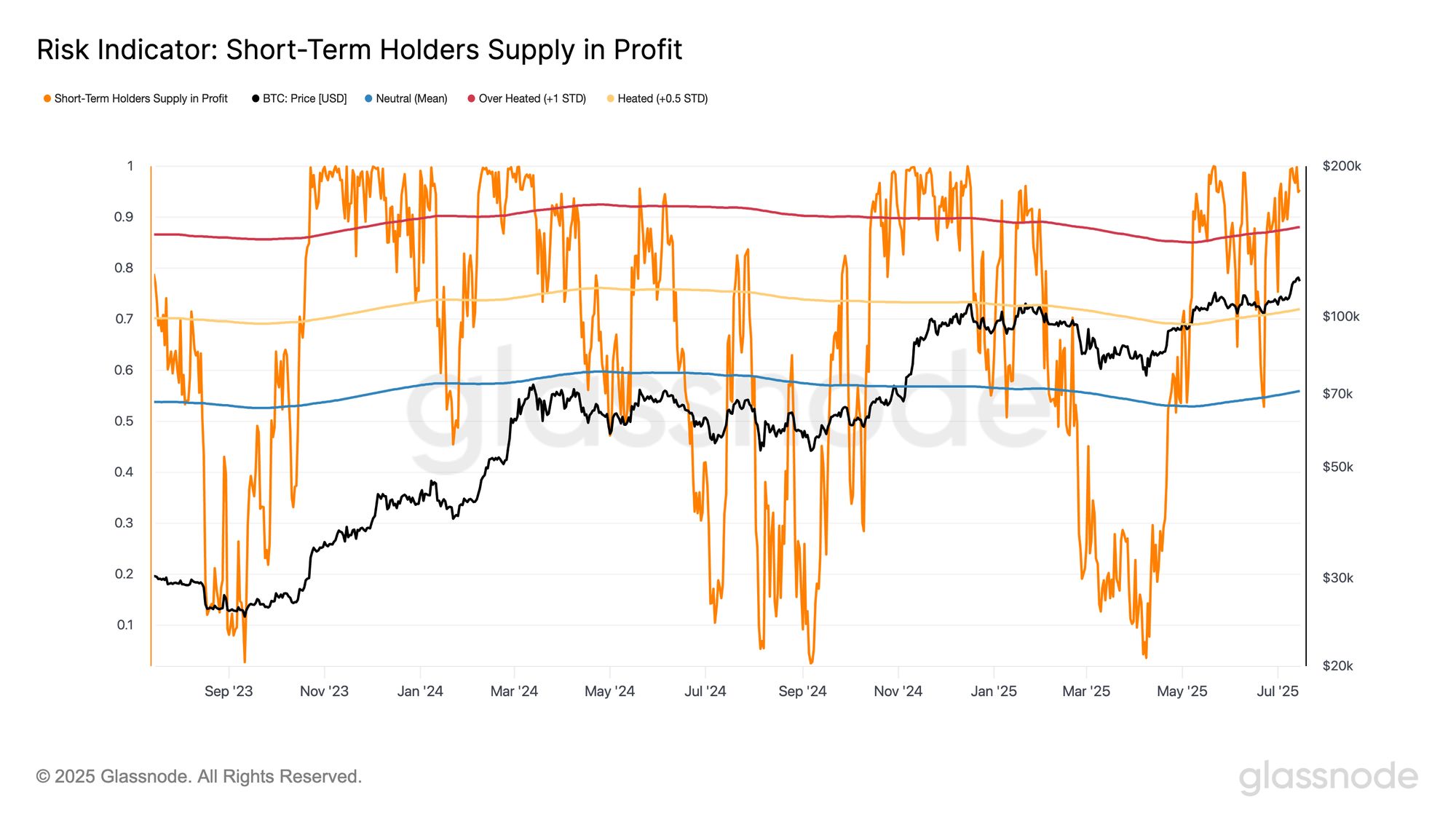

Bitcoin has reached a new all-time high, trading as high as $122.6k, putting all BTC investors back into profit. Based on key on-chain metrics, and if history acts as a guide, a potential push toward ~$130K may be on the cards before demand exhaustion sets in.

SHIB tests resistance at $0.00001434 as bullish daily patterns drive momentum Whale accumulation spikes 422% in one day, signaling growing investor confidence Analysts eye $0.00001718 short-term target, with $0.0001 long-term milestone in sight

Congressional efforts to advance cryptocurrency regulations face significant delays as Republican lawmakers remain divided on key provisions, despite President Trump’s direct intervention to secure party unity.

PayPal’s PYUSD stablecoin has expanded to the Arbitrum network, becoming the first layer-2 blockchain integration for the dollar-pegged cryptocurrency. This move aims to reduce transaction costs and improve processing speeds.

- 16:35Mizuho Bank: The Fed Has Been "Slapped by Reality," Easing Cycle Is About to BeginBlockBeats news, on September 6, Mizuho Bank stated that the US August non-farm employment report further confirmed the weakening tone of the labor market, with employment, working hours, and income growth rates having fallen back to pandemic-era levels. Regardless of inflation, the Federal Reserve is almost certain to cut interest rates at the September meeting. A 25 basis point rate cut is almost a foregone conclusion, but if August inflation is weaker than expected, a 50 basis point cut is even more likely. The Fed's previous inflation forecasts have been "slapped in the face" by reality, and its 2026 unemployment rate forecast now faces the risk of not being fulfilled. Previously, they were too pessimistic about inflation and too optimistic about the labor market. It is expected that the Fed will launch a round of sustained easing, aiming to lower interest rates to what it considers a "neutral level," that is, to around 3% by March 2026. The new Fed chair is likely to further ramp up stimulus measures, bringing rates down to near 2%. However, the risk is that if inflation resurges, at least some of the stimulus measures will be withdrawn by 2027. (Golden Ten Data)

- 16:35This week, the net inflow into US spot Bitcoin ETFs reached $250 million.BlockBeats News, September 6, according to monitoring by Farside Investors, the net inflow of US spot bitcoin ETFs this week was $250 million, including: BlackRock IBIT: + $434.3 million Fidelity FBTC: + $25.1 million Bitwise BITB: - $76.9 million ARK ARKB: - $81.5 million Invesco BTCO: + $2.2 million Franklin EZBC: - $3.2 million VanEck HODL: - $13.2 million Grayscale GBTC: - $69.7 million Grayscale Mini BTC: + $33.2 million

- 16:34JPMorgan strategists: U.S. economic growth is gradually slowing, and they do not believe that Fed rate cuts can boost economic growth.BlockBeats News, on September 6, David Kelly, Chief Global Strategist at JPMorgan Asset Management, stated in a recent interview with CNBC that the weak employment report in August and other economic data indicate that the weakness in the US economy is intensifying. "Although the current economy has not fallen into recession, it is gradually slowing down. All the data consistently show that this already faltering economy—like a turtle that always moves slowly—is now nearly exhausted." Kelly also believes that, given factors such as deteriorating employment data, the Federal Reserve's expected rate cuts will not boost the overall economy. "I see the stock market rising today, which clearly reflects the market's expectation of imminent rate cuts, but this does not solve the fundamental problem. The government needs to recognize that if rates are cut now, it will reduce interest income for retirees and send more signals of rate cuts to the market. In that case, borrowers have no reason to borrow more money. The history of the entire 21st century tells us that rate cuts do not stimulate economic growth. After the financial crisis, rate cuts had no effect at all. Don't expect the Federal Reserve to save the economy."