News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(8.11)|LD Capital Founder: New ETH Target at $5,000, Rate Cut Expectations Could Ignite Quality Altcoin Season; $LAYER and $BB Heavy Unlocks Today2Bitcoin Surges Past $122,000 Amid Policy Optimism and Short Squeeze Dynamics3Ethereum’s Breakout May Signal Growth Opportunities for Altcoins Amid Shifting Market Sentiment

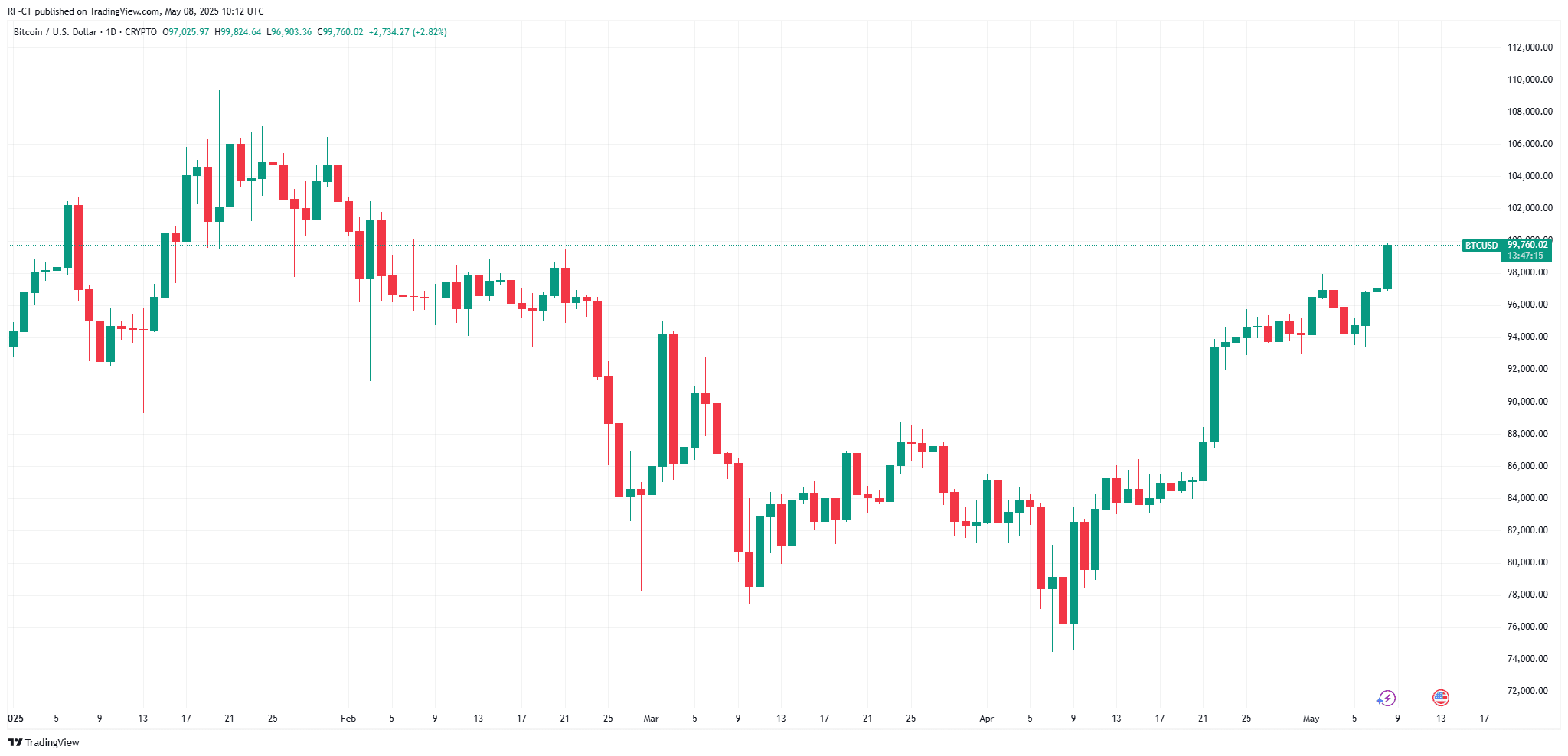

Bitcoin Breaks $100K as BTC Nears New ATH with Bulls Roar in May 2025

Cryptoticker·2025/05/09 01:33

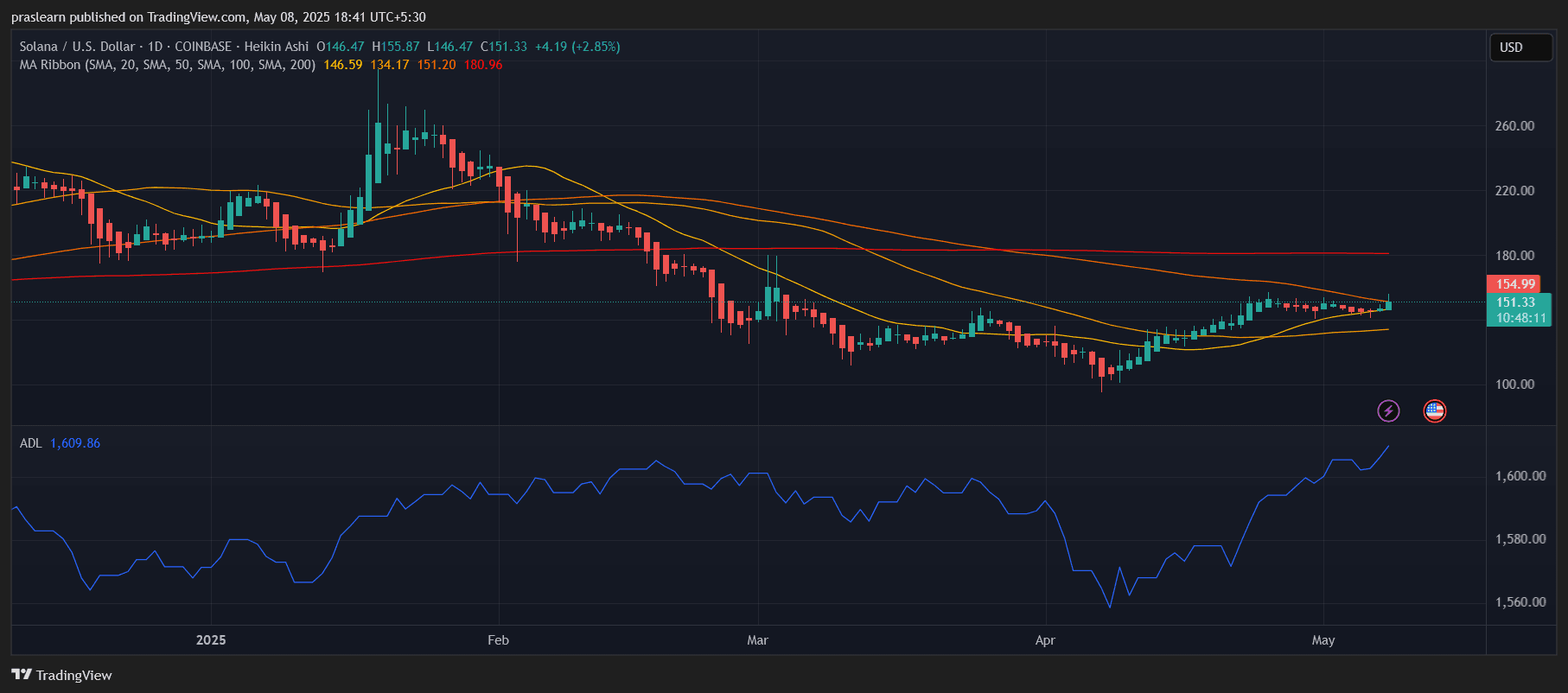

SOL Price Explodes Past $150—What’s Next?

Cryptoticker·2025/05/09 01:33

Ethereum Price Prediction: ETH Surges Above $2,000 as Crypto Market Soars

Cryptoticker·2025/05/09 01:33

XRP Price Prediction: $4 Target in Sight as Bitcoin Breaks $100K

Cryptoticker·2025/05/09 01:33

PEPE Coin Price Prediction: Could PEPE DOUBLE After 33% Daily Surge?

Cryptoticker·2025/05/09 01:33

Space and Time debuts $SXT token as mainnet goes live

Grafa·2025/05/09 01:20

SUI price breakout? Technical pattern signals move toward $4.25

Coinjournal·2025/05/08 23:33

Memecoin rally gains momentum: MOG jumps 40% as Bitcoin approaches $100,000

Coinjournal·2025/05/08 23:33

Will Polygon price hit $1 in 2025? Data shows wide volatility range

Coinjournal·2025/05/08 23:33

Flash

- 08:16Analysis: Wall Street Recognition Signals Emerge as Ether Climbs to Four-Year HighAccording to Jinse Finance, as Ether, the world’s second-largest cryptocurrency, surged to its highest level in nearly four years, US-based Ether-focused exchange-traded funds recorded their largest single-day inflow. Data shows that on Monday, spot Ether ETFs collectively attracted just over $1 billion in inflows. Since the beginning of this year, the total inflow for these nine funds has exceeded $8.2 billion. It has become evident that Ether-focused “treasury companies” are a significant driving force behind the token’s rally. These publicly listed companies are continuously expanding their digital asset reserves. According to data compiled by Strategic EthReserve.xyz, so-called “Digital Asset Treasury Companies (DATs)” have so far accumulated more than $15 billion worth of Ether. Peter, Head of Research at quantitative trading firm Presto, stated: “The recently passed stablecoin legislation and the US Securities and Exchange Commission Chairman’s speech on cryptocurrency initiatives both indicate that the Ethereum blockchain behind Ether is now poised to gain Wall Street’s recognition.”

- 08:07Ethereum Leads July Crypto Market Rally as 24 Companies Add It to Their Balance SheetsAccording to a report by Jinse Finance, charts released by @ImCryptOpus indicate that Ethereum is leading the cryptocurrency market in July, with corporate holdings surging to 2.7 million ETH. Additionally, 24 companies have added Ethereum to their balance sheets.

- 08:02Data: AguilaTrades goes long on 7,700 ETH with 15x leverage, valued at approximately $33.58 millionAccording to ChainCatcher, analyst Yu Jin has monitored that AguilaTrades is currently holding a long position on ETH with 15x leverage, having opened positions totaling 7,700 ETH, valued at approximately $33.58 million.