News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1. On-chain funds: $61.9M flowed into Hyperliquid today; $54.4M flowed out of Arbitrum. 2. Largest price changes: $SAPIEN, $MMT. 3. Top news: ZEC surpassed $500, marking a 575% increase since Naval’s call.

Robinhood's crypto revenue grew by 300% in the third quarter, with total revenue reaching $1.27 billions.

When the market starts to "speak": an earnings report experiment and a trillion-dollar AI prophecy.

Some crypto funds have outperformed bitcoin during bull markets through leverage or early positioning, offering risk hedging and diversification opportunities; however, their long-term performance has been inconsistent.

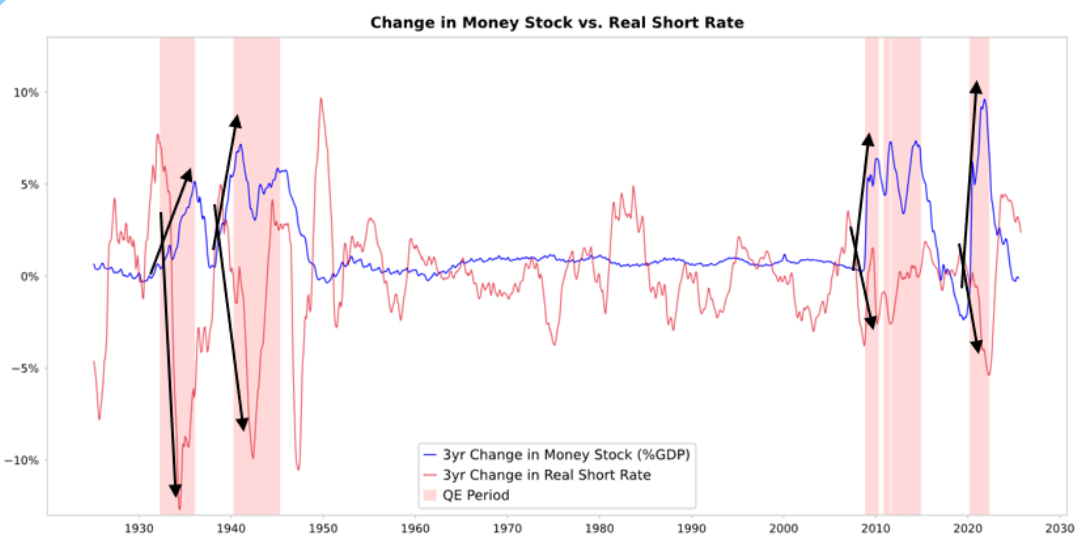

Due to the highly stimulative nature of current government fiscal policies, quantitative easing will effectively monetize government debt rather than simply reinjecting liquidity into the private system.

- 04:06Multiple U.S. hedge funds reduced holdings in the "Tech Magnificent Seven" in Q3According to Jinse Finance, the latest quarterly disclosure documents show that Wall Street's largest hedge funds shifted their stance on tech giants in the third quarter, reducing their holdings in some of the "Tech Magnificent Seven" stocks, including Nvidia, Amazon, Alphabet, and Meta, while placing new bets in areas such as application software, e-commerce, and payments. During the quarter ending September 30, several funds also cut their positions in well-known companies in the healthcare and energy sectors. The overall market rose in the third quarter, with the S&P 500 index up nearly 8%, and the tech-heavy Nasdaq 100 index gaining about 9% for the season.

- 04:06DCR is currently priced at $37.04, up 10.6% in the past 24 hours.Jinse Finance reported that according to market data, Decred (DCR) is currently priced at $37.04, with a 24-hour increase of 10.6%. The market is experiencing significant volatility, so please manage your risks accordingly.

- 03:44STRK surpasses $0.23, up 29.3% in 24 hoursJinse Finance reported that according to market data, Starknet (STRK) has surpassed $0.23 and is now trading at $0.232, with a 24-hour increase of 29.3%. The market is experiencing significant volatility, so please manage your risks accordingly.