News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

When the market starts to "speak": an earnings report experiment and a trillion-dollar AI prophecy.

Ark Invest’s Cathie Wood lowered her Bitcoin forecast to $1.2 million per coin by 2030, attributing the adjustment to stablecoins’ rapid expansion in payments and savings.

Bitcoin.com partners with Concordium to offer identity verification and payment services to over 75 million wallet users, using zero-knowledge proofs for privacy.

JPMorgan projects Bitcoin could reach $170,000 within 12 months, driven by favorable volatility metrics versus gold and stabilizing futures markets post-October liquidations.

Midnight Network has recorded 1,000,000 in mining addresses, marking a robust adoption by community members.

Quick Take Stable Labs’ USDX stablecoin, built to maintain its peg using delta-neutral hedging strategies, lost its peg to the dollar on Thursday, dropping below $0.60. Protocols including Lista and PancakeSwap are monitoring the situation.

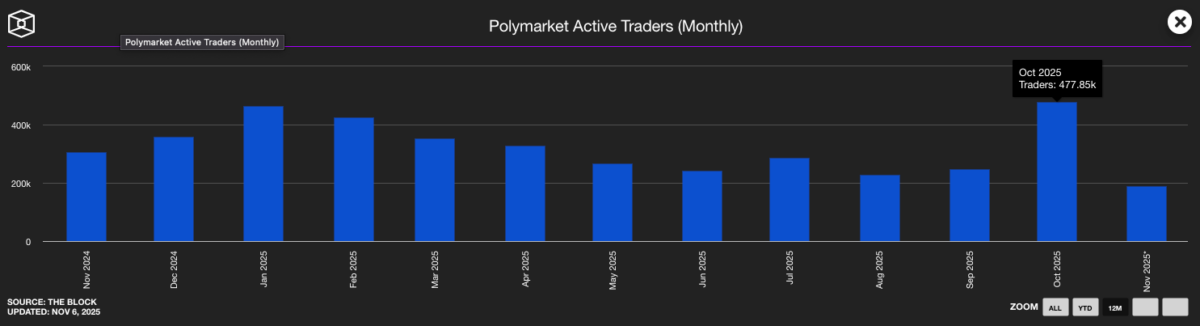

Google now displays real-time prediction market probabilities from Polymarket and Kalshi in search results, making crowd-sourced financial forecasts accessible to billions of daily users.

- 08:38Data: Machi increases 25x leveraged ETH long position to $24.76 millionAccording to ChainCatcher, monitored by HyperInsight, Huang Licheng has just increased his 25x leveraged ETH long position to $24.76 million, currently with an unrealized loss of $2.06 million. The average entry price is $3,418.22, and the liquidation price is $3,050.07.

- 08:26Data: Machi Big Brother slightly increased his long position in Ethereum to 7,745 ETH, with a liquidation price of $3,047.88.According to ChainCatcher, Hyperbot data shows that "Machi Big Brother" Huang Licheng has just slightly increased his 25x leveraged Ethereum long position, with his current holdings rising to 7,745 ETH. The liquidation price is $3,047.88, and the current unrealized loss is $1.968 million. In addition, Huang Licheng has placed 8 ETH limit sell orders in the $3,188.8–$3,400 range.

- 08:11Bitcoin market depth drops about 30% from this year's peak, crypto market cap gives back annual gainsAccording to ChainCatcher, citing Bloomberg and Kaito data, bitcoin market depth has dropped by about 30% from this year's peak, indicating that market liquidity has also shrunk significantly. In the options market, traders are increasingly betting on volatility, with rising demand for neutral strategies such as straddles and strangles. The total market capitalization of cryptocurrencies has already given back the gains made earlier this year, and market sentiment may remain subdued until further positive news emerges. Max Gokhman, an executive at Franklin Templeton, stated that the correlation between cryptocurrencies and macro risks may remain high until institutions participate more deeply in the crypto market and investment targets are no longer limited to bitcoin and ethereum.