News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(Nov 29)|All Major U.S. Stock Indices Closed Lower; Next Year’s FOMC Voters Emphasize Inflation Risks and Oppose Further Rate Cuts; 72 out of Top 100 Tokens Down More Than 50% from All-Time Highs2Bitcoin’s Current Correction: At the End of the “Four-Year Cycle,” Government Shutdown Intensifies Liquidity Shock3Zcash Price Prediction 2025: Why ZEC Might Hit $360, Shedding 35% From ATH?

Cryptocurrencies continue to "crash" on Monday, with some tokens falling back to the flash crash lows of October

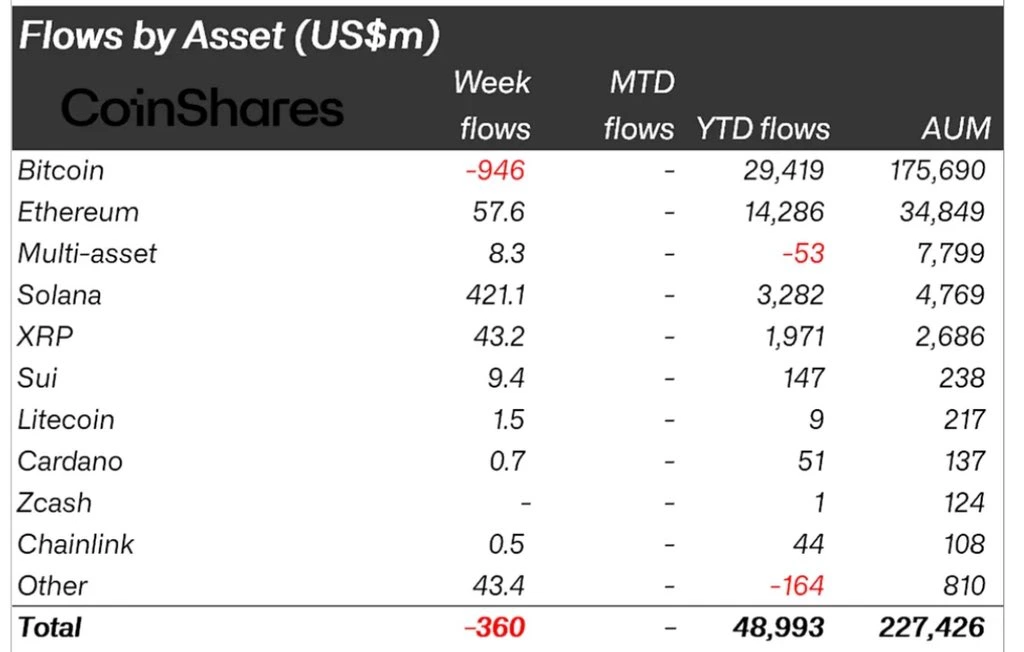

Institutional demand for Bitcoin has fallen below the rate of new coin mining for the first time in seven months, suggesting that major buyers may be pulling back.

ForesightNews·2025/11/04 07:01

How Zcash reclaimed the privacy crown from Monero

CryptoSlate·2025/11/04 07:00

BlackRock’s $213 Million Bitcoin Move Exacerbates Fears of Sub-$100,000 Drop

BlackRock’s $213 million Bitcoin transfer to Coinbase has rattled traders, reigniting fears of a drop below $100,000.

BeInCrypto·2025/11/04 06:54

Crypto Market Crash: Henrik Zeberg Says Capitulation Is Setting Stage for a Massive Bull Run

Coinpedia·2025/11/04 06:51

Ripple Unlocks 1 Billion XRP Amid Market Weakness What It Means for Investors

Coinpedia·2025/11/04 06:51

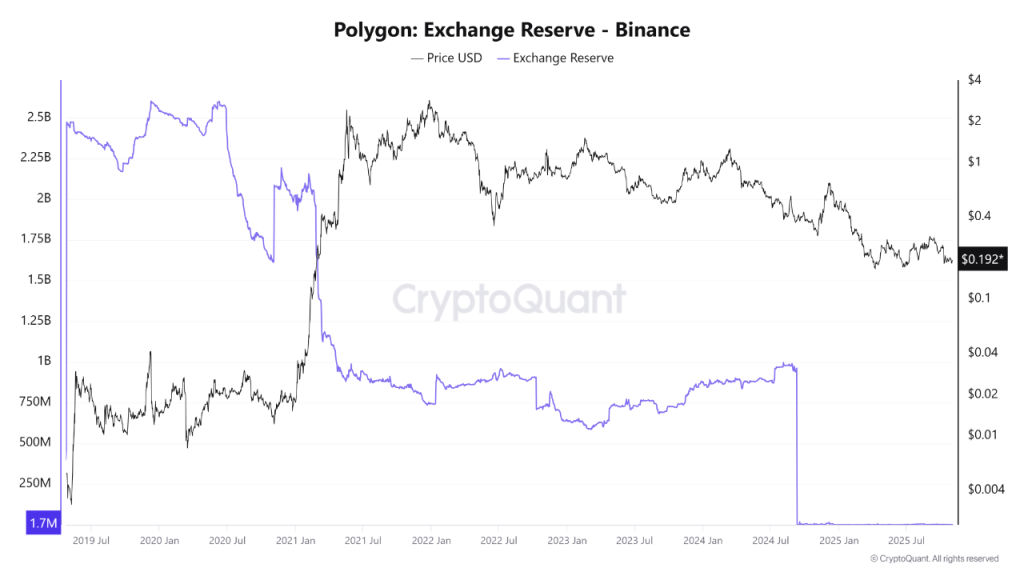

Can Polygon Rise 500%? A Look at Polygon Price Prediction 2025

Coinpedia·2025/11/04 06:51

Cycle Scientist Says No Altcoin Season Is Coming as Bitcoin Nears Its Peak

Coinpedia·2025/11/04 06:51

Crypto Bloodbath: Bitcoin and Ethereum Drop Sharply Amid Market Sell-Off

Coinpedia·2025/11/04 06:51

Bitcoin Price Drop is Likely a Pause and Not a Reversal; LMAX Strategist Joel Kruger Says

Coinpedia·2025/11/04 06:51

Solana Whales Aggressively Accumulate Amid Midterm Bearish Sentiment

Coinpedia·2025/11/04 06:51

Flash

- 07:05Goldman Sachs: Volatility at this time of year is "normal," nothing "unusual"Jinse Finance reported that Goldman Sachs believes the recent approximately 5% correction in the US stock market is a typical year-end seasonal fluctuation within the AI cycle, and not an abnormal signal indicating the end of the rally. Goldman Sachs traders pointed out that although the market has experienced a pullback, there is still room for an upward move before the end of the year. Supported by seasonal factors, the early stage of the AI investment cycle, and relatively light institutional positions, the index still has the potential to rise further. According to Shreeti Kapa, a trader in Goldman Sachs' fixed income, foreign exchange, and commodities division, a 5% decline at this time of year is a normal phenomenon in the current cycle. She believes that although the market has experienced a strong rebound since the April low, overall, "it is not excessive."

- 06:35El Salvador has accumulated 8 more BTC in the past 7 days, bringing its total holdings to 6,375.18 BTC.Jinse Finance reported that El Salvador has accumulated 8 more bitcoins in the past 7 days, bringing its total bitcoin holdings to 6,375.18, with a total value of $649 million.

- 06:17The US Treasury provides tax breaks to private equity, cryptocurrency, and other companies without legislative approval.ChainCatcher News, According to Golden Ten Data citing The New York Times, the U.S. Treasury Department has provided tax breaks to private equity firms, cryptocurrency companies, foreign real estate investors, and other large corporations through proposed regulations. For example, in October this year, the U.S. Internal Revenue Service (IRS) issued new proposed regulations that would offer benefits to foreign investors investing in U.S. real estate. In August this year, the IRS proposed relaxing rules designed to prevent multinational companies from avoiding taxes by claiming duplicate losses in multiple countries. These announcements have not yet made media headlines, but have already drawn attention from accounting and consulting firms. Kyle Pomerleau, Senior Fellow at the American Enterprise Institute, stated: "The U.S. Treasury Department is clearly implementing tax cuts without legislative approval. Congress decides tax law. The Treasury is asserting greater authority over the tax law structure than Congress has granted, undermining this constitutional principle."