News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Unlike typical crypto concepts, x402 has attracted the attention of many Web2 tech giants, and these companies have already begun to adopt the protocol in practice.

Where does value accumulate? If value accumulates in equity entities, why buy tokens? Are all tokens just meme coins?

Cryptocurrency is a zero-sum game, and you really need to fight for every advantage.

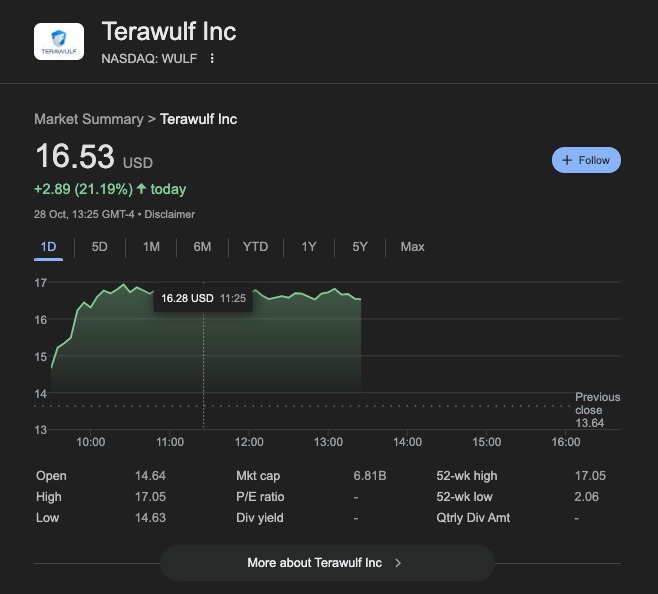

TeraWulf signed a 25-year, $9.5 billion lease with Fluidstack to deploy 168 MW of AI infrastructure at its Texas campus, with Google backing $1.3 billion.

SharpLink Gaming allocates $200 million in Ethereum to Linea’s zkEVM Layer 2, combining staking and restaking services to generate enhanced institutional yields.

Quick Take Visa is adding support for four stablecoins, running on four unique blockchains, CEO Ryan McInerney said. In the fourth quarter, stablecoin-linked Visa card spend quadrupled when compared to a year ago, he said.

Quick Take Hoodi represents the third and final testnet deployment, following successive activations on Holesky and Sepolia earlier this month. Fusaka will introduce several scalability and security improvements for Ethereum, including a paired down data sampling technique called PeerDAS.

Quick Take BitMine acquired $113 million worth of ETH on Tuesday. The company’s Monday disclosure revealed that its treasury holdings have surpassed 3.3 million ETH, worth over $13 billion.

- 08:15Data: 487.07 BTC transferred from an anonymous address, routed through an intermediary, and then sent to another anonymous addressAccording to ChainCatcher, Arkham data shows that at 16:01, 487.07 BTC (worth approximately $42.8 million) were transferred from an anonymous address (starting with bc1qcvq...) to another anonymous address (starting with bc1qglc...). Subsequently, this address transferred part of the BTC (482.95 BTC) to another anonymous address (starting with bc1q7ch...).

- 08:14Analyst Murphy: BTC Faces Little Resistance Returning to $90,000, Key Pressure Level at $92,000According to ChainCatcher, analyst Murphy pointed out that based on current data, it is not difficult for BTC to return to $90,000, and $90,000 is not a strong resistance level. The average cost of short-term holders indicates that BTC may only encounter significant selling pressure when entering the $92,000 to $99,000 range. At the same time, options market data shows that Call activity at the $92,000 strike price is significantly higher than at $90,000, especially the sell Calls at $92,000 far exceed those at $90,000, which will create strong resistance in the market. Murphy emphasized that the key battle for BTC above $92,000 is the core area that will determine the trend, especially near the $98,000 level, which is the "fair value" line for BTC over the past decade. However, the market has recently suffered a blow to confidence due to massive realized losses, making it difficult to generate effective buying power in the short term. The future trend of BTC still depends on market sentiment and the performance of key resistance zones. .

- 07:58The top MON short position on Hyperliquid has an unrealized loss of $1.23 million.According to Jinse Finance, on-chain analyst @ai_9684xtpa has monitored that the top short position on Hyperliquid MON has an unrealized loss of $1.23 million: address 0xd47...51a91 currently holds a short position of 1.81 million MON, valued at $7.67 million, with an entry price of $0.03566. In addition, he also shorted ZEC, with a $33.23 million short position currently at an unrealized loss of $6.08 million. However, he holds positions in a total of 13 tokens and remains overall profitable with an unrealized gain of $2.08 million.