News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The End of the Four-Year Cycle: Five Major Disruptive Trends in Cryptocurrency by 2026.

Hedera price dropped 3% despite $44 million ETF inflows, with investors showing preference for HBAR ETF over Litecoin, technical charts hint a potential 150% breakout to $0.50.

Mining-as-a-service is gaining traction in the UAE, with telecom giant du launching its cloud mining service via its sub-brand for local customers.

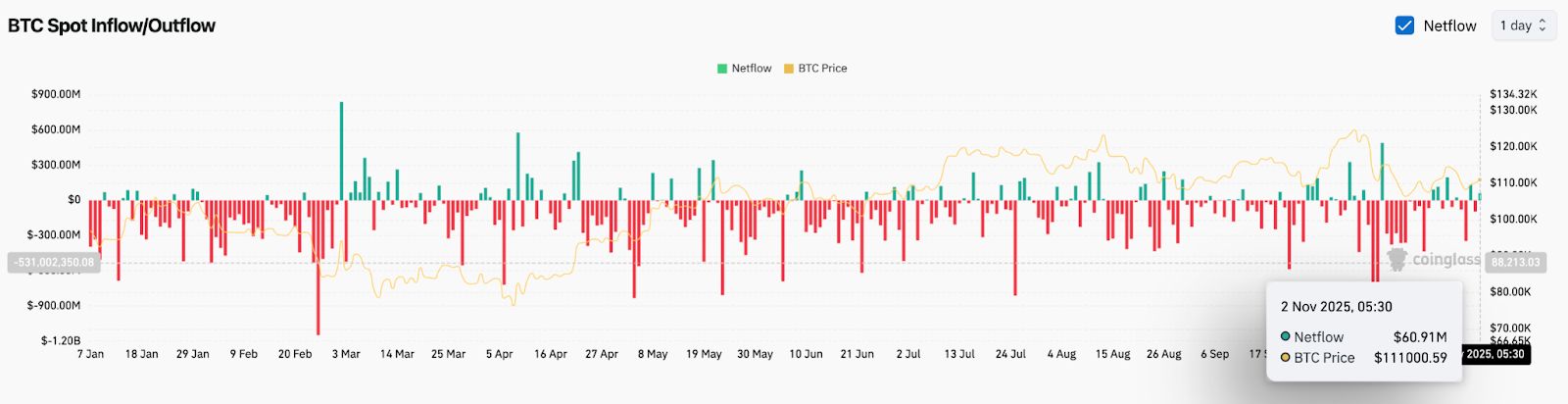

Bitcoin trades around $110,970 inside a $109K–$112K compression zone, signaling an imminent volatility breakout. Spot flows remain balanced with $60.9M inflows, while long-short ratios near 1.8 reflect cautious optimism. A breakout above $112,400 could trigger upside toward $114K–$117K, while $109K remains key support.

Quick Take The European Commission, supported by the president of the European Central Bank, will propose creating a single supervisor over crypto exchanges, stock exchanges, and clearing houses modeled after the U.S. SEC, FT reported. The proposal may extend the powers of the existing European Securities and Markets Authority to cover cross-border entities. The move is intended to make it easier for European firms to scale across borders without having to deal with scores of national and regional regulato

- 01:21BlackRock executive: Clients invest in bitcoin mainly as "digital gold," not for global payment scenariosAccording to ChainCatcher, citing a report from Cointelegraph, Robbie Mitchnick, Head of Digital Assets at BlackRock, stated that most clients of the world's largest asset management company do not consider Bitcoin's widespread use in daily payments when deciding whether to invest in it. In a podcast interview released on Friday, Mitchnick said: "I think, for us and for most of our clients today, they are not really investing based on the global payments network use case." He described the possibility of Bitcoin being widely used for daily payments in the future as "potentially an out-of-the-money-option-value upside." Mitchnick emphasized that this does not mean Bitcoin will never achieve widespread payment use, but he called this scenario "more speculative," and highlighted that investors are currently more focused on the narrative of Bitcoin as "digital gold" or a store of value. He believes that for a shift to payment use cases to occur, "a lot more needs to happen," including the development of technologies such as Bitcoin scaling and Lightning.

- 01:11Analyst: PORT3 hacker profited $166,000According to a report by Jinse Finance, on-chain analyst Yujin monitored that three hours ago, a hacker exploited a vulnerability in the PORT3 bridge to mint an additional 1 billion PORT3 tokens and dumped them on-chain, causing the price of PORT3 to drop by 76%. The hacker sold 162.75 million PORT3 tokens in exchange for 199.5 BNB, worth $166,000. Subsequently, the PORT3 project team removed on-chain liquidity, and some centralized exchanges suspended PORT3 deposits. Forty minutes ago, the hacker destroyed the remaining unsold 837.25 million PORT3 tokens.

- 01:04CoinKarma: BTC shows significant turnover and a high-volume bottoming structure, which is a typical short-term bottom signalAccording to ChainCatcher, CoinKarma, a cryptocurrency trading indicator analysis platform, posted on social media that technical indicator CVD shows BTC has faced strong selling pressure for several consecutive days after losing key medium- and long-term levels this week, resulting in an accelerated price decline. However, we also noticed that the spot trading volume at BTC daily close has reached the highest level in recent times across multiple trading platforms, indicating significant turnover in the market. This kind of large-scale turnover and increased volume to halt the decline is a typical short-term bottom signal.