News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Ahead of Tesla's annual shareholders meeting, Norway's sovereign wealth fund, with assets totaling 1.9 trillion, has publicly opposed Elon Musk's 100 million compensation package. Musk previously threatened to resign if the proposal was not approved.

Multiple negative factors are weighing on the market! Trading sentiment in the cryptocurrency market remains sluggish, and experts had previously warned of a potential 10%-15% correction risk.

The AI stock rally has been targeted by "the Big Short" investor! Scion Asset Management, led by Michael Burry, has made a major shift in its 13F holdings, taking short positions against Nvidia and Palantir. Not long ago, he broke his long silence to warn about a market bubble.

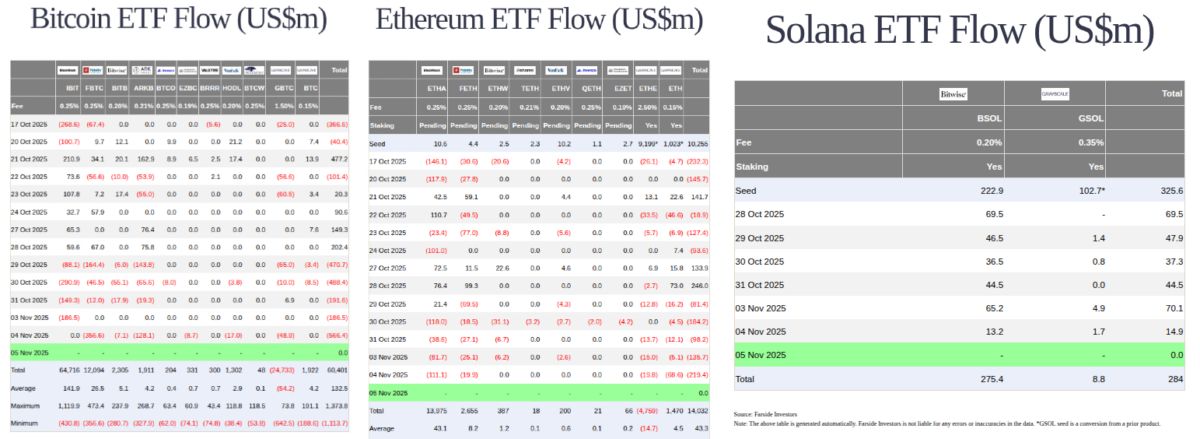

Solana ETFs attracted $14.9 million in net inflows on November 4, led by Bitwise’s BSOL, while Bitcoin and Ethereum ETFs experienced significant outflows totaling $785.8 million combined.

Bitget completes full integration with Morph Chain layer-2 blockchain, allowing users to trade Morph ecosystem assets directly from Bitget wallets using USDT without swaps or bridges.

Quick Take The Bank of England remains on track to publish a consultation on stablecoin regulation on Nov. 10, according to Bloomberg. The proposals are expected to include temporary caps on stablecoin holdings for both individuals and businesses.

- 12:53Analysis: EU Regulatory Threats on Chat Control Could Lead to Centralized Surveillance RisksJinse Finance reported that recently, Europe nearly passed a proposal called "Chat Control," which would have imposed large-scale surveillance on private communications. The proposal faced strong opposition from all sectors of society because it would have forced service providers to scan all private messages. The proposal was ultimately rejected because Germany refused to support it. Among EU member states, only nine countries opposed the proposal, twelve supported it, and six had yet to decide. This narrow voting margin highlights the fragility of legal consensus around privacy. Even within the EU, which has the Charter of Fundamental Rights, the Declaration on European Digital Rights and Principles, and some of the world's strictest personal data protection laws, policymakers are increasingly inclined to view privacy and encryption as issues requiring careful scrutiny rather than as key attributes of digital infrastructure that must be defended. The mistaken argument that security needs can justify and prove the reasonableness of large-scale surveillance is gaining more and more support on the regulatory agenda, which is a worrying development.

- 12:46Survey: The proportion of traditional hedge funds holding cryptocurrencies has risen to 55%Jinse Finance reported that a joint survey by the Alternative Investment Management Association (AIMA) and PwC shows that the proportion of traditional hedge funds holding cryptocurrencies has risen from 47% in 2024 to 55% this year. The survey covered 122 institutional investors and hedge fund management companies worldwide, with nearly $1 trillion in assets under management. 47% of the institutional investors surveyed indicated that the current regulatory environment encourages them to increase their cryptocurrency allocations, mainly benefiting from Trump appointing crypto-friendly regulatory agency heads and signing the GENIUS Act. Among crypto-focused funds, Bitcoin remains the most popular asset, followed by Ethereum and Solana. Traditional hedge funds allocate an average of 7% of their assets under management to cryptocurrencies, up from 6% last year. 71% of respondents plan to increase their cryptocurrency exposure in the next twelve months.

- 12:35Galaxy Research: Over 70% of the Top 100 Cryptocurrencies by Market Cap Have Dropped More Than 50% from Their All-Time HighsAccording to ChainCatcher, Galaxy Research stated in an article that "among the top 100 cryptocurrencies by market capitalization, 72 have dropped by 50% or more from their all-time highs."