News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Ahead of Tesla's annual shareholders meeting, Norway's sovereign wealth fund, with assets totaling 1.9 trillion, has publicly opposed Elon Musk's 100 million compensation package. Musk previously threatened to resign if the proposal was not approved.

Multiple negative factors are weighing on the market! Trading sentiment in the cryptocurrency market remains sluggish, and experts had previously warned of a potential 10%-15% correction risk.

The AI stock rally has been targeted by "the Big Short" investor! Scion Asset Management, led by Michael Burry, has made a major shift in its 13F holdings, taking short positions against Nvidia and Palantir. Not long ago, he broke his long silence to warn about a market bubble.

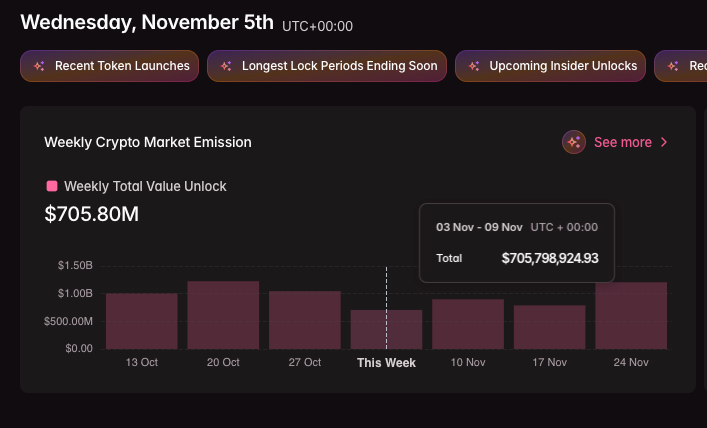

November 2025 brings $705.8 million in token unlocks, with Ethena and Aptos leading major releases amid market recovery from recent liquidations.

Four major financial institutions collaborate to process traditional card payments through regulated stablecoin technology, marking a milestone in blockchain adoption.

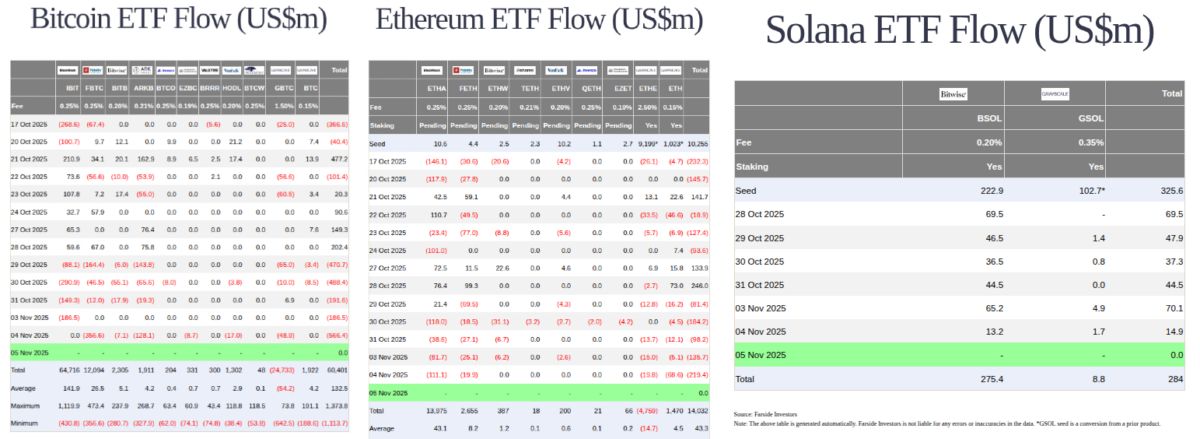

Solana ETFs attracted $14.9 million in net inflows on November 4, led by Bitwise’s BSOL, while Bitcoin and Ethereum ETFs experienced significant outflows totaling $785.8 million combined.

Bitget completes full integration with Morph Chain layer-2 blockchain, allowing users to trade Morph ecosystem assets directly from Bitget wallets using USDT without swaps or bridges.

Quick Take The Bank of England remains on track to publish a consultation on stablecoin regulation on Nov. 10, according to Bloomberg. The proposals are expected to include temporary caps on stablecoin holdings for both individuals and businesses.

- 16:171inch: $12 billion in DeFi liquidity remains idle, with 95% of funds unusedJinse Finance reported that a report released by 1inch shows that 83%-95% of liquidity in major decentralized finance (DeFi) pools such as Uniswap and Curve is idle, with billions of dollars in funds not generating fee income or any returns. This inefficiency particularly affects retail liquidity providers: 50% of retail users have suffered losses due to impermanent loss, with total net losses exceeding $60 million. 1inch proposes to address this issue through its Aqua protocol—which allows DeFi applications to share a unified liquidity pool, aiming to optimize liquidity utilization, reduce capital fragmentation, and increase returns for liquidity providers.

- 16:11Solana co-founder toly: The core role of Layer 1 is only to minimize structural advantages as much as possibleJinse Finance reported that Solana co-founder toly stated on the X platform that the core function of Layer 1 is merely to minimize structural advantages. Even if one competitor holds 95% of the market share, as long as it cannot prevent the remaining 5% from capturing market share with a better product, it does not matter.

- 16:05Spot Solana ETF saw a net inflow of $127.9 million in the past weekJinse Finance reported that SolanaFloor posted on X that the spot Solana ETF saw a net inflow of $127.9 million over the past week, with a cumulative net inflow reaching $510 million. Among them, Bitwise's spot Solana ETF BSOL had an inflow of $86.3 million, surpassing the total of all other Solana ETFs combined.