News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 5) | 21Shares Launches 2x Leveraged SUI ETF on Nasdaq; U.S. Treasury Debt Surpasses $30 Trillion; JPMorgan: Strategy’s Resilience May Determine Bitcoin’s Short-Term Trend2Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?3The Chainlink ETF Disappoints Despite $41 Million Inflows — Why?

Cardano (ADA) to $1: What Remains

CryptoNewsNet·2025/08/23 19:20

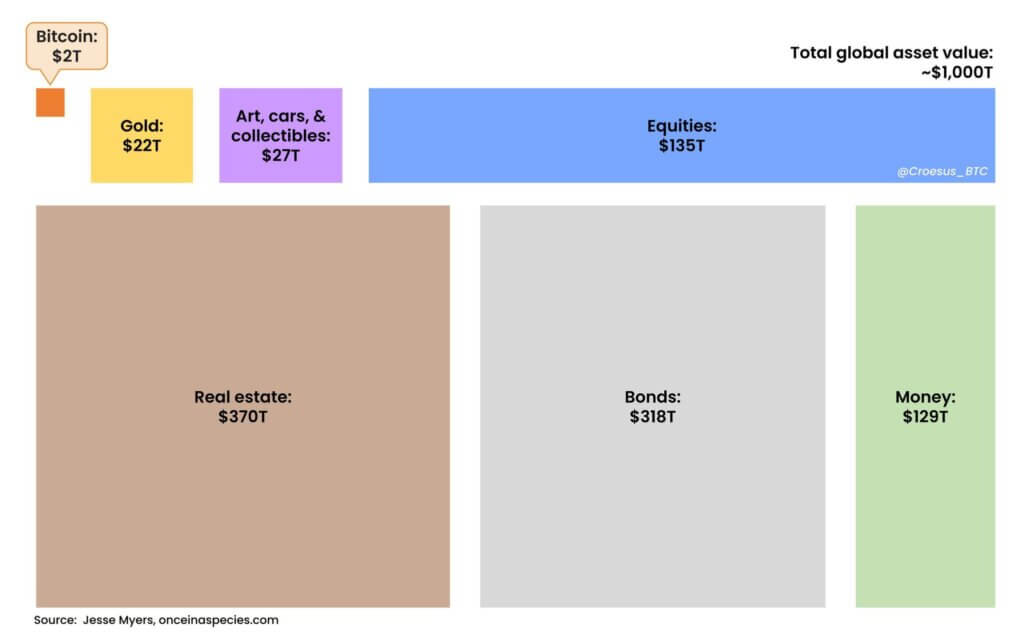

Real estate’s quiet crash: your home is worth less than ever in Bitcoin

CryptoNewsNet·2025/08/23 19:20

Anonymous Hacktivist Group Founder Spearheads Meme Coin While Facing 5 Years in Prison

CryptoNewsNet·2025/08/23 19:20

Eric Trump Makes Bitcoin Price Predictions as He Reportedly Gets Ready to Visit Metaplanet

CryptoNewsNet·2025/08/23 19:20

Europe Fast-Tracks Digital Euro as US Stablecoin Law Raises Global Stakes

European policymakers are accelerating work on the digital euro after Washington’s landmark stablecoin legislation heightened fears of eroding the euro’s global influence.

DeFi Planet·2025/08/23 19:10

Check If Your Bitcoins are Threatened by Quantum

Cointribune·2025/08/23 19:10

The US Crypto Market in Danger Facing DeepSeek's New AI Chip

Cointribune·2025/08/23 19:10

SharpLink Gaming Launches $1.5B Buyback Program to Strengthen Ethereum Holdings

Cointribune·2025/08/23 19:10

James Wynn Bets Big: 25x Ether Long as Token Breaks Records

Cointribune·2025/08/23 19:10

Render (RENDER) To Soar Further? Key Harmonic Pattern Hints at Potential Upside Move

CoinsProbe·2025/08/23 19:05

Flash

- 07:00Rainbow Foundation will announce the TGE date early next week.ChainCatcher reports, the crypto wallet Rainbow Foundation will announce the TGE date early next week. In addition, upon token issuance, the Rainbow Foundation will become the largest single shareholder of Rainbow company, holding 20% of the company's equity. Token holders and shareholders will be able to share the same benefits. If Rainbow is acquired in the future, the foundation will be gradually dissolved, and its net assets (including the proceeds from its 20% equity holding) will be distributed to token holders.

- 06:4421Shares founder: Bitcoin unlikely to regain the momentum that led to its January all-time highAccording to ChainCatcher, citing a report from Cointelegraph, 21Shares founder Ophelia Snyder stated that January typically sees a “peak in bitcoin inflows,” as investors rebalance and adjust their portfolios at the beginning of the year, which also leads to activity in exchange-traded funds. However, the current market conditions will make it difficult for bitcoin to replicate the price surge seen at the start of 2025 in 2026: the factors driving current market volatility are unlikely to be fully resolved in the short term, and whether similar results can be achieved next January will largely depend on overall market sentiment.

- 06:36CryptoOnchain: BitMine currently holds about 3% of the total Ethereum supply, and any additional buying pressure could trigger a surge in ETH prices.Jinse Finance reported that CryptoOnchain posted an analysis on X, stating: Is an Ethereum supply squeeze imminent? The BitMine effect emerges, with institutions taking the lead: According to reports, BitMine currently controls about 3% of the total Ethereum supply (3.7 million ETH). In the past 30 days, net outflows from exchanges reached $1.6 billion, confirming this large-scale accumulation trend. Liquidity continues to dry up: Ethereum reserves on exchanges have dropped sharply, with a single-day outflow on November 23 soaring to $3.1 billion, setting a historical record. Currently, the number of withdrawal addresses exceeds deposit addresses by 40%, and circulating inventory is rapidly moving to cold wallet storage. A supply shock is brewing: Record-high staking deposits, combined with continued absorption of circulating tokens by whales like BitMine, are causing market depth to shrink. This constitutes a typical supply squeeze scenario—tradable sell orders in the market will decrease sharply. Conclusion: Data indicates that the current market is exhibiting active accumulation behavior, rather than simple holding. As tradable supply contracts, any new buying pressure could trigger an explosive price surge.

News