News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 20) | US to Release Nonfarm Payrolls and Unemployment Rate; Ethereum Advances Post-Quantum Cryptography; LayerZero and KAITO Tokens Face Major Unlocks Today2Bitcoin charts flag $75K bottom, but analysts predict 40% rally before 2025 ends33 SOL data points suggest $130 was the bottom: Is it time for a return to range highs?

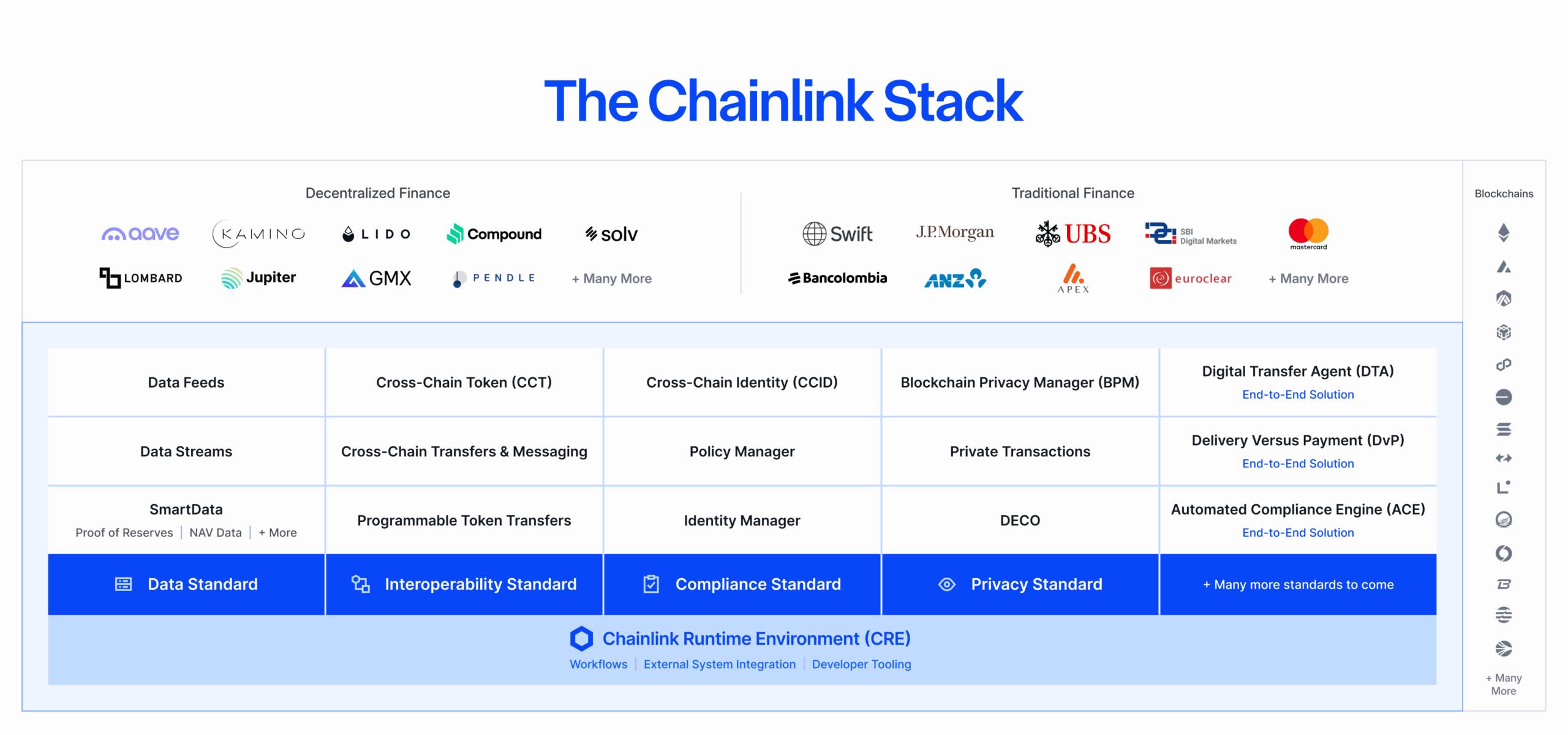

Chainlink's LINK Rallies 12% to New 2025 High Amid Token Buyback, Broader Crypto Rally

CryptoNewsNet·2025/08/22 18:01

Ethereum Soars to New Heights: Historic Moments Unfold – ATH on the Horizon – Here’s Why and the Current Situation

CryptoNewsNet·2025/08/22 18:01

Ether Price Prediction: Arthur Hayes Unleashes Stunning $20K Forecast

BitcoinWorld·2025/08/22 18:00

WLFI ETH Purchase: World Liberty Makes a Bold $5M Ethereum Investment

BitcoinWorld·2025/08/22 18:00

Google Drive Unleashes Powerful AI Video Editing with Vids Shortcut

BitcoinWorld·2025/08/22 18:00

Bitcoin OG’s Astounding $84 Million Ethereum Flip on Hyperliquid

BitcoinWorld·2025/08/22 18:00

Fed Rate Cuts: Why Caution Prevails and September Looks Unlikely

BitcoinWorld·2025/08/22 18:00

Crypto Market Cap Soars: An Impressive $4 Trillion Recovery

BitcoinWorld·2025/08/22 18:00

TON gains momentum with $780 million treasury and Ledger staking integration

Coinjournal·2025/08/22 17:55

Powell puts September rate cut on the table as Bitcoin rises 2% and Fed odds swing to 90%

Coinjournal·2025/08/22 17:55

Flash

- 17:49Data: 105.89 BTC transferred from an anonymous address and, after intermediaries, flowed into Cumberland DRWAccording to ChainCatcher, Arkham data shows that at 01:34, 105.89 BTC (worth approximately $8.3386 million) was transferred from an anonymous address (starting with 168Bv...) to Cumberland DRW.

- 17:29Fear Index VIX rises to 27.15, reaching a more than one-month highAccording to ChainCatcher, citing Golden Ten Data, the Fear Index VIX rose by 3.49 points to 27.15, reaching a new high in over a month.

- 17:29U.S. stocks opened higher but closed lower as rate cut uncertainties and risk-off sentiment weighed on the marketChainCatcher news, according to Golden Ten Data, US stock analyst Hannah Erin Lang stated that after a strong opening, the major US stock indices slipped into the red during intraday trading, with momentum fading rapidly. The reasons include the boost from artificial intelligence appearing to be short-lived, and the information technology sector leading the decline in the S&P 500 index. In addition, market doubts about whether the Federal Reserve will cut interest rates in December and ongoing risk-averse sentiment are also putting pressure on the market.