News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The Philippines introduced a bill to acquire 10,000 BTC over five years, locking holdings for two decades. Supporters highlight diversification benefits, while critics warn of risks as global governments accelerate sovereign Bitcoin accumulation.

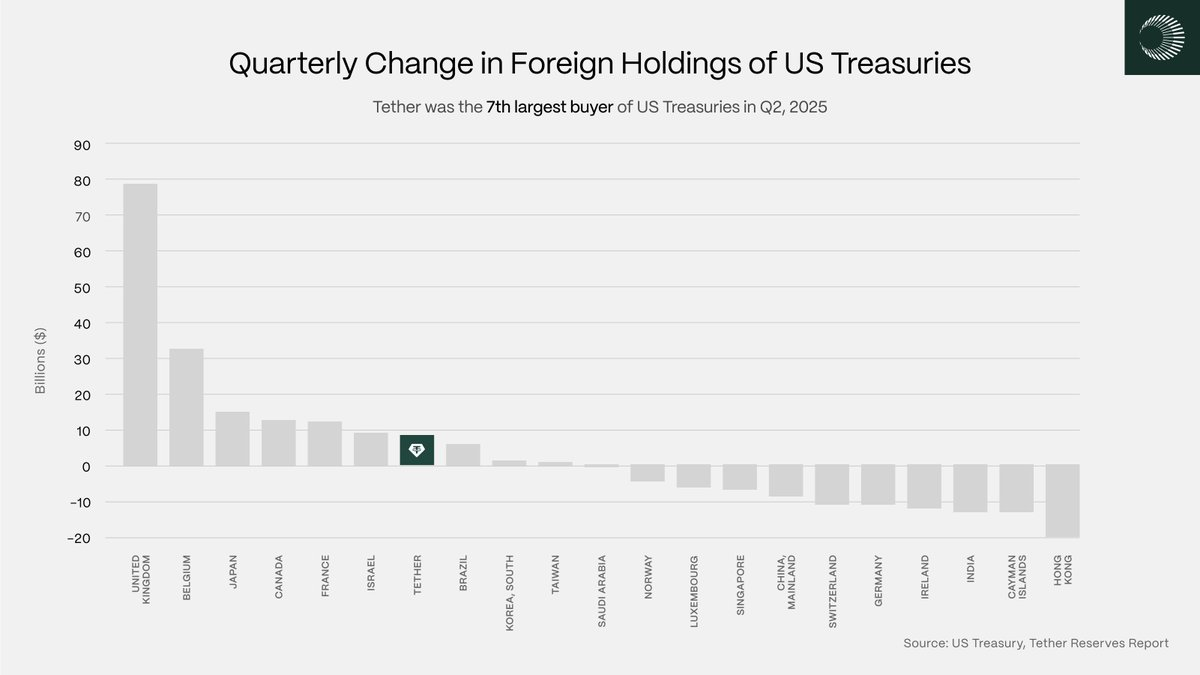

Tether’s ascent as a top-10 foreign buyer of Treasurys signals stablecoin issuers are no longer just liquidity users

BTC and ETH rally on dovish Fed signals

Japan’s Financial Services Agency (FSA) is preparing sweeping changes to its digital asset framework. The changes, which combine tax reforms and regulatory upgrades, could introduce exchange-traded funds (ETFs) tied to cryptocurrencies. The initiative signals Japan’s intent to integrate crypto into mainstream finance and attract broader investment. Tax Burden Under Review The reform package, reported domestically, … <a href="https://beincrypto.com/japan-fsa-crypto-tax-overhaul-etf-reforms-2026/">Con

- 05:17SOL spot ETF records net inflows for 14 consecutive trading days, with total inflows reaching $382 millionAccording to ChainCatcher, citing monitoring by Farside Investors, the US SOL spot ETF has recorded net inflows for 14 consecutive trading days since its launch on October 18, with total inflows reaching $382 million. Among them, Bitwise's BSOL saw net inflows of $357.8 million, while Grayscale's GSOL recorded net inflows of $24.4 million.

- 04:38Data: The current Crypto Fear & Greed Index is 9, indicating an extreme fear state.ChainCatcher news, according to Coinglass data, the current cryptocurrency Fear and Greed Index is 9, down 2 points from yesterday. The 7-day average is 18, and the 30-day average is 28.

- 04:06Multiple U.S. hedge funds reduced holdings in the "Tech Magnificent Seven" in Q3According to Jinse Finance, the latest quarterly disclosure documents show that Wall Street's largest hedge funds shifted their stance on tech giants in the third quarter, reducing their holdings in some of the "Tech Magnificent Seven" stocks, including Nvidia, Amazon, Alphabet, and Meta, while placing new bets in areas such as application software, e-commerce, and payments. During the quarter ending September 30, several funds also cut their positions in well-known companies in the healthcare and energy sectors. The overall market rose in the third quarter, with the S&P 500 index up nearly 8%, and the tech-heavy Nasdaq 100 index gaining about 9% for the season.