News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 21) | U.S. September Nonfarm Payrolls Unexpectedly Increase by 119,000; BTC Falls Below $86,000, Crypto Market Sees $834M in Liquidations; OpenAI Launches ChatGPT Group Chat Feature Globally2Bitcoin slump to $86K brings BTC closer to ‘max pain’ but great ‘discount’ zone3Bitcoin, stocks crumble after Nvidia earnings and Fed uncertainty over next rate cut

Bitcoin bulls need 2 things: Positive BTC ETF flows and to reclaim $112,500

CryptoSlate·2025/11/07 01:02

Institutional Outflows Hit Bitcoin and Ether ETFs as Solana Demand Accelerates

Cointribune·2025/11/07 00:48

Bitcoin Price Stalls Below $105K Amid Heavy Selling and Pending Tariff Ruling

Cointribune·2025/11/07 00:48

36 Days of Shutdown in the USA: The Crypto Bill Threatens to Derail for Good

Cointribune·2025/11/07 00:48

Render (RENDER) Holds Key Support — Could This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/11/07 00:45

JPMorgan sees Bitcoin as more attractive than gold after price dip

Coinjournal·2025/11/07 00:24

Dogecoin faces $0.15 test as analysts predict a massive price ‘burst’ ahead

Coinjournal·2025/11/07 00:24

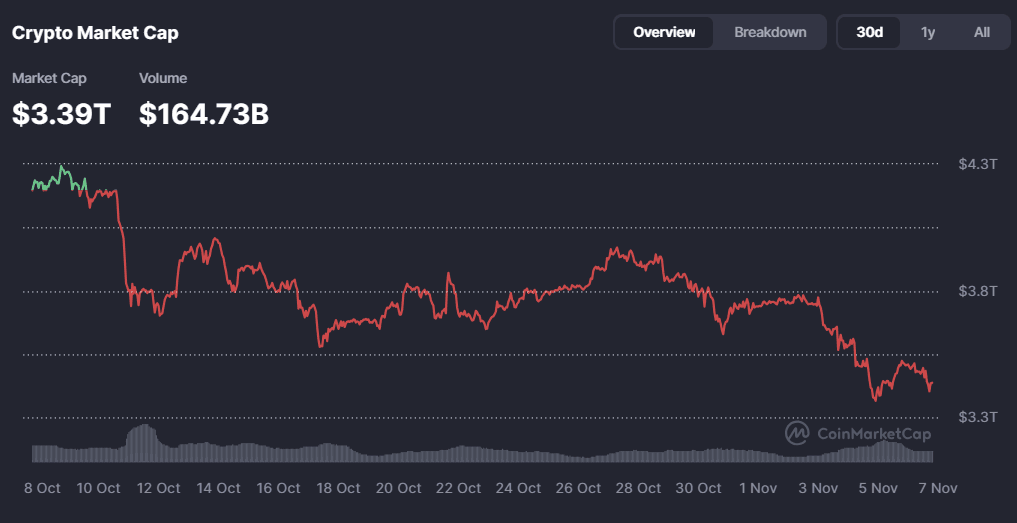

Why Is the Crypto Market Flat Today? November 6, 2025

Cryptoticker·2025/11/07 00:12

DeAgentAI (AIA) Explodes 862% in 24 Hours after Piverse Partnership

DeAgentAI’s explosive 862% rally showcases its breakout from Bitcoin’s influence, but thin inflows and speculative trading suggest that volatility—and a possible correction—may follow.

BeInCrypto·2025/11/06 23:21

Bitcoin holds above $100,000, but for how long?

market pulse·2025/11/06 22:42

Flash

- 02:44Data: 18,600 SOL withdrawn from a certain exchange, valued at approximately $2.3868 millionAccording to ChainCatcher, Arkham data shows that at 10:39 (UTC+8), 18,600 SOL (worth approximately $2.3868 million) were transferred from one exchange to another.

- 02:41The total net inflow for the US Solana spot ETF was $10.58 million yesterday.Jinse Finance reported, according to SoSoValue data, that yesterday (Eastern Time, November 21), the total net inflow of Solana spot ETFs was $10.58 million. The SOL spot ETF with the highest single-day net inflow yesterday was the 21Shares SOL ETF TSOL, with a single-day net inflow of $5.97 million. Currently, TSOL's historical total net inflow has reached $7.17 million. Next is the Fidelity SOL ETF FSOL, with a single-day net inflow of $2.97 million. Currently, FSOL's historical total net inflow has reached $12.81 million. As of press time, the total net asset value of Solana spot ETFs is $719 million, with a Solana net asset ratio of 1.01%, and the historical cumulative net inflow has reached $510 million.

- 02:35Moonrock Capital founder: An exchange's acquisition of VECTOR suspected of insider trading, $TNSR surged 8x in two days before plunging 40%ChainCatcher news, Moonrock Capital founder Simon Dedic posted on X, saying, "The acquisition of VECTOR by a certain exchange was a brilliant internal pump. $TNSR surged 8 times during the two days of the market crash, only to plummet 40% after the announcement. Secondly, the actual developer behind Vector, Tensor Foundation, still appears to be independent of this acquisition, including the token itself. Although there is no official announcement yet, it is basically certain that Tensor will cash out a large undisclosed amount, while $TNSR holders, as always, get nothing. This is a case of severe misalignment between equity and token value." Simon Dedic finally called for tokens to be equivalent to on-chain equity.