News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

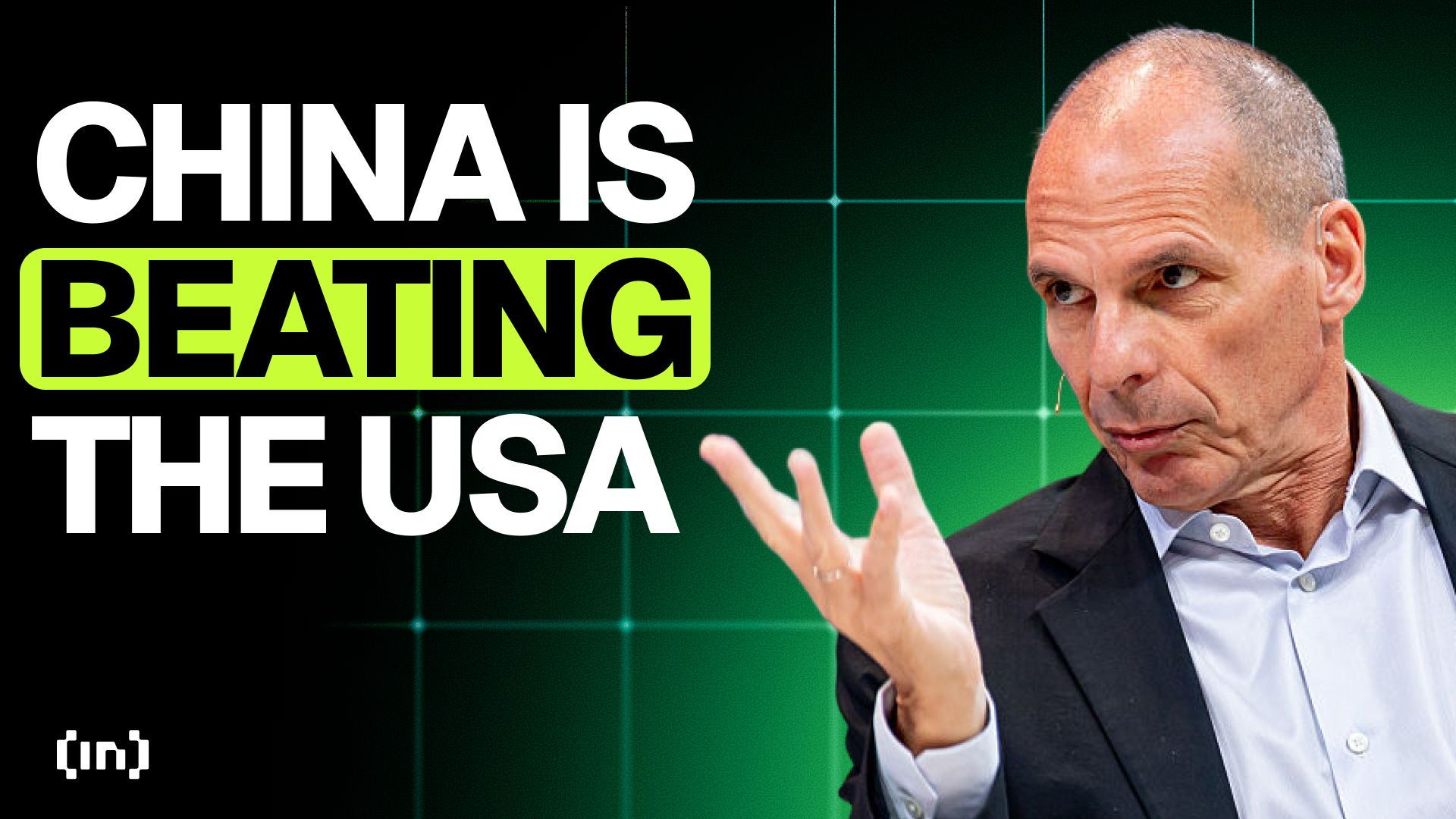

Yanis Varoufakis cautions that America’s push to dominate digital finance through stablecoins may backfire, destabilizing global markets while China’s disciplined, state-led model gains strength.

The key issue in this attack lies in the protocol’s logic for handling small transactions.

Long-standing issues surrounding leverage, oracle infrastructure, and PoR transparency have resurfaced.

Investors speculate that, with the "suspense" of high inflation gone, ZEC may follow a trajectory similar to early Bitcoin.

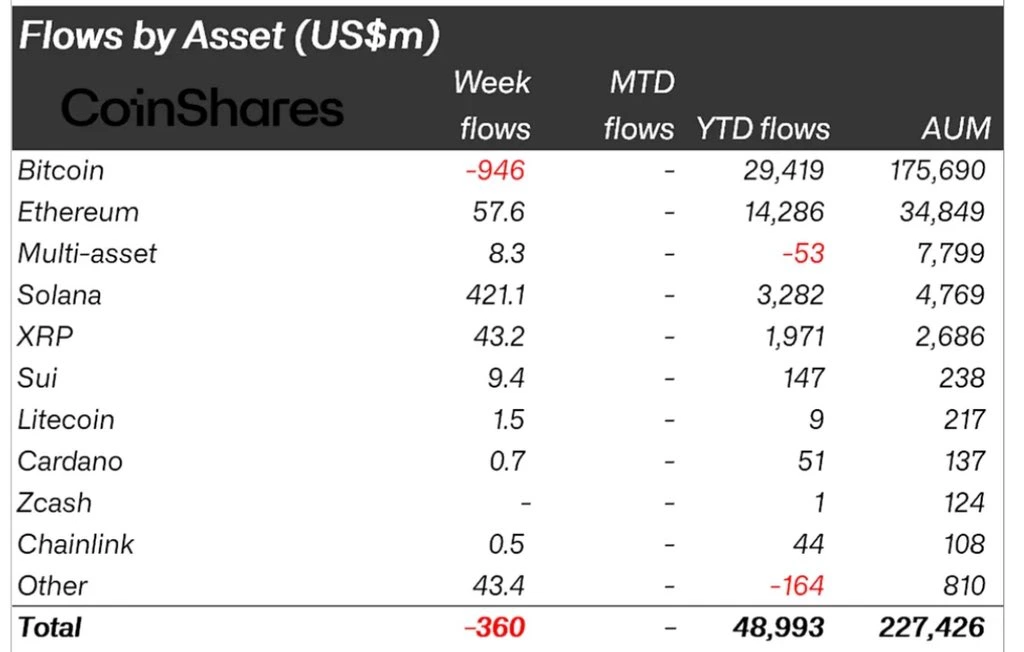

Spot bitcoin ETFs, which have long been regarded as "automatic absorbers of new supply," are also showing similar signs of weakness.

A single vulnerability exposes the conflict between DeFi security and decentralization.

Is Bitcoin's decline due to institutions not buying?

- 01:50Analyst: Bitcoin may first dip to $94,500 before entering a complex consolidation phase, with the eventual bottom around $84,000.ChainCatcher News, Chinese crypto analyst Banmuxia stated in a post, " Regarding bitcoin, many people are still underestimating the complexity of the upcoming market trend. I believe that this minor bear market will most likely end around $84,000, but this does not mean it will smoothly decline all the way to $84,000. This time, it is highly likely to be a complex sideways adjustment. At present, it may drop slightly to around $94,500, then will most likely enter an extremely complex consolidation phase, with a rebound possibly reaching above $116,000, and then gradually falling to the $84,000 level and the 6-8% range below that."

- 01:40BTC leveraged long whales sell WBTC and ETH to repay loans before approaching liquidation lineAccording to ChainCatcher, on-chain analyst Ember (@EmberCN) has monitored that a whale who previously went long a total of 1,320 WBTC (approximately $132 million) through looped lending is now close to the liquidation line after the market downturn. To reduce risk, this whale sold about 465.4 WBTC and 2,686 ETH two hours ago, exchanging them for approximately $56.52 million USDC to repay part of the loan. The average selling price for WBTC was around $102,722, and for ETH was about $3,244.

- 01:23"7 Siblings" bought 23,000 ETH in 24 hours, with total holdings exceeding $600 millionChainCatcher News, "7 Siblings" made significant purchases of Ethereum in the past 24 hours, acquiring 22,875.62 ETH at an average price of $3,417, with a total investment of approximately $78.18 millions. This entity bought from $3,595 down to $3,317, and still has some pending orders that have not been filled. Data shows that "7 Siblings" had already purchased 15,092.8 ETH at an average price of $3,654.59 in the previous 14 hours, worth $55.15 millions. Currently, this entity holds a total of 188,609 ETH, with a total value of $618 millions.