News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Citigroup is considering offering custody services for stablecoin and crypto ETF collateral, exploring stablecoins as a viable option to improve payment systems.

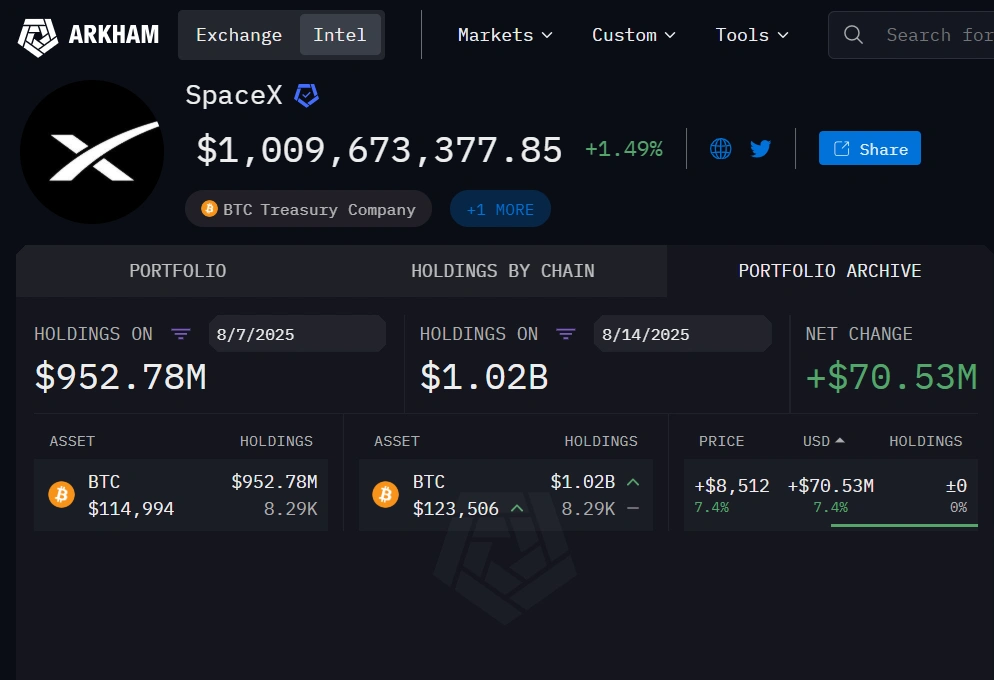

Share link:In this post: Tesla’s sales in Norway have surged despite growing discontent among Norwegians regarding Elon Musk’s political stance. SpaceX’s BTC holdings have crossed the $1 billion mark again. Tesla’s deep ties in Norway influence its consistent sales numbers, but it is slowly losing its dominance as more rivals make headway.

Share link:In this post: Elon Musk says Google currently has the highest probability of leading AI due to its compute and data advantage. Google will invest $9 billion in Oklahoma to expand AI and cloud infrastructure over the next two years. The plan includes a new Stillwater data center campus and expansion of its Pryor facility.

Share link:In this post: Hon Hai Precision Industry (Foxconn) reported a 27% increase in Q2 profits, driven by sales in its AI server business. The company reported a net income of NT$44.36 billion for the period, surpassing an average analyst projection of NT$36.14 billion. It also expects significant growth in Q3 and the rest of the year.

Share link:In this post: US PPI jumped 3.3% in July, the highest annual gain since February. Monthly PPI rose 0.9%, blowing past the 0.2% forecast. Service costs surged, led by machinery wholesaling and portfolio fees.

Share link:In this post: The EU is preparing a 19th sanctions package against Russia, targeting next month for adoption. Trump will meet Putin in Alaska without Zelenskyy, raising concern among European and Ukrainian officials. Trump warned of “very severe consequences” if Putin refuses to pursue a ceasefire.

- 12:22Tom Lee: Continued Surge in Ethereum On-Chain Activity Provides Solid Basis for Major Market Movements by Year-EndForesight News reported that Tom Lee stated in an interview with CNBC: "Cryptocurrencies have just experienced the largest deleveraging event in history, with an impact magnitude that could be several times that of the FTX incident, yet bitcoin's ultimate decline was maintained within the 3%-4% range. This fully demonstrates that bitcoin itself is becoming a highly resilient store of value. Imagine if a similar shock occurred in the gold market: even in the face of a massive liquidity crisis, if gold only dropped by a few percentage points, the market would see this as solid proof of its value anchoring. This is exactly what we are seeing with bitcoin right now. Driven by stablecoins, both Ethereum Layer 1 and Layer 2 networks are experiencing significant growth in activity, but this fundamental improvement has not yet been fully reflected in token prices—there is typically a lag in market pricing. From my observation, the ongoing increase in on-chain fundamental activity actually provides a solid basis for major market movements before the end of the year."

- 12:18A whale deposited 7,081 GIGGLE, accumulated two weeks ago, into an exchange; if sold, the profit would be nearly $700,000.According to ChainCatcher, Arkham monitoring shows that about one hour ago, a certain whale deposited 7,081 GIGGLE tokens to an exchange, worth 1.61 million US dollars. Historical data indicates that this whale accumulated these tokens two weeks ago, when they were worth approximately 925,000 US dollars. If sold, this whale would make a profit of nearly 700,000 US dollars.

- 11:46Next Week's Macro Outlook: The Federal Reserve Will Announce Its Interest Rate Decision on Thursday, Followed by a Press Conference by PowellChainCatcher news, according to Golden Ten Data, next week, due to the continued U.S. government shutdown, there will be fewer important data releases from the United States, but several central banks will hold interest rate meetings, including the Federal Reserve, the European Central Bank, and the Bank of Japan. The following are the key points that the market will focus on in the new week (all times are in GMT+8): Thursday 02:00, the Federal Reserve announces its interest rate decision; Thursday 02:30, Federal Reserve Chairman Powell holds a monetary policy press conference; Friday 01:15, 2026 FOMC voting member and Dallas Fed President Logan delivers a speech; Friday 21:30, 2026 FOMC voting member and Dallas Fed President Logan delivers a speech; Before gaining a clearer understanding of inflation and the labor market, it is unlikely that Powell will significantly change his wording on the future policy path while announcing a 25 basis point rate cut. Therefore, considering the recent tensions in trade relations and the ongoing government shutdown, Powell and his colleagues may sound slightly dovish in their statements on Thursday, but the extent may not be significant. Even dovish members like Waller are unwilling to pre-commit to a series of rate cuts. If the Federal Reserve questions the market-expected path of another 100 basis points of rate cuts after October, the risk of disappointment among traders will increase.