News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

In Brief Arthur Hayes rapidly ramps up altcoin purchases amid market optimism. His acquisitions include Ethereum, Pendle, Lido DAO, and Ether.fi. Market sentiment shifts to "greed" territory, aligning with Hayes’s strategic timing.

In Brief HBAR displays a sideways trend, declining 2% in 24 hours against market uptrends. Coinglass data shows $6.42 million outflows, indicating cautious investor sentiment. Technical indicators suggest continued weakening, with potential price pressure intensifying.

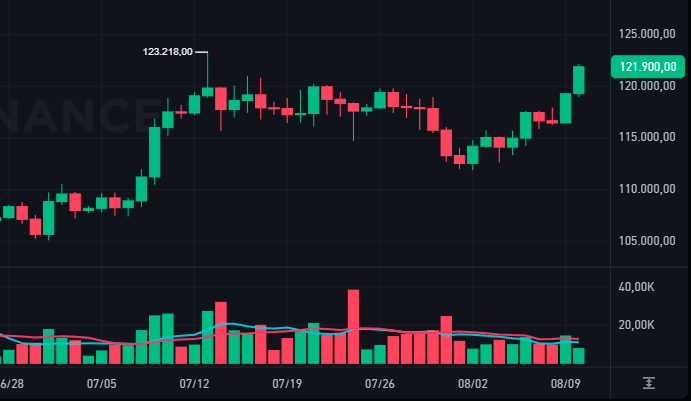

Whales have been accumulating Chainlink, Cardano, and PEPE in anticipation of the US CPI release, with LINK rising by 30%, ADA reaching a 14-day high, and PEPE seeing a 17% increase.

Global M2 money supply is climbing again, raising hopes for a potential Bitcoin price surge.Why M2 Matters for CryptoThe Road Ahead for BTC

Etherex sees a massive 503% TVL surge in 7 days, hitting $119.6M on Ethereum Layer 2 network Linea.What’s Driving the Surge?Implications for DeFi and Layer 2 Adoption

Large investors are scooping up millions in Chainlink, signaling rising confidence in LINK’s future.Millions Spent in Hours on LINKWhat This Means for the Market

- 22:42Roman Storm asks the open-source software community: Are you worried about being prosecuted for developing DeFi platforms?Jinse Finance reported that Roman Storm, developer of the Tornado Cash privacy protocol, asked the open-source software community whether they are concerned about being prosecuted retroactively by the US Department of Justice for developing decentralized finance (DeFi) platforms. Storm asked DeFi developers: How can you be sure you won't be prosecuted by the Department of Justice for "MSB" (building non-custodial protocols), and then be accused of having to build custodial protocols instead? If SDNY can charge developers for building non-custodial protocols... then what safety is left?

- 22:24ECB President: Europe Must Establish Its Own Digital Asset Market to Maintain Financial StabilityAccording to a report by Jinse Finance, Bloomberg analyst Walter Bloomberg released market news stating that European Central Bank President Piero Cipollone said Europe must establish its own digital asset market to maintain financial stability. He supports the use of the digital euro for daily payments and warned that if deposits shift to foreign tokens, stablecoins could weaken banks and monetary policy. Although stablecoins can facilitate cross-border payments, he pointed out that Europe already provides fast and secure central bank fund transfer services.

- 21:55Sentinel Global founder: Stablecoins have all the risks of CBDCs as well as their own unique risksJinse Finance reported that Jeremy Kranz, founder and managing partner of venture capital firm Sentinel Global, stated that investors should "proceed with caution" when considering privately issued stablecoins, as stablecoins not only carry all the risks of central bank digital currencies (CBDCs) but also have their own unique risks. He noted that if JPMorgan were to issue a USD stablecoin and control it through the Patriot Act or other future legislation, they could freeze your funds and deprive you of your bank account. Investors should "discern right from wrong" and read the fine print of any stablecoin.