News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 11)|Trump Announces 100% Tariffs on China, Triggering Market Turmoil; Crypto Industry Liquidations Exceed $19.1 Billion in 24 Hours, Setting New Record.2Is Monero (XMR) Poised for a Bullish Rally? This Key Emerging Fractal Saying Yes!3Is This the Last Chance for Bitcoin to Break $130K in 2025?

Bitcoin Asset Manager Parataxis to Go Public in $400M SPAC Deal Backed by SilverBox

CryptoNewsNet·2025/08/06 22:50

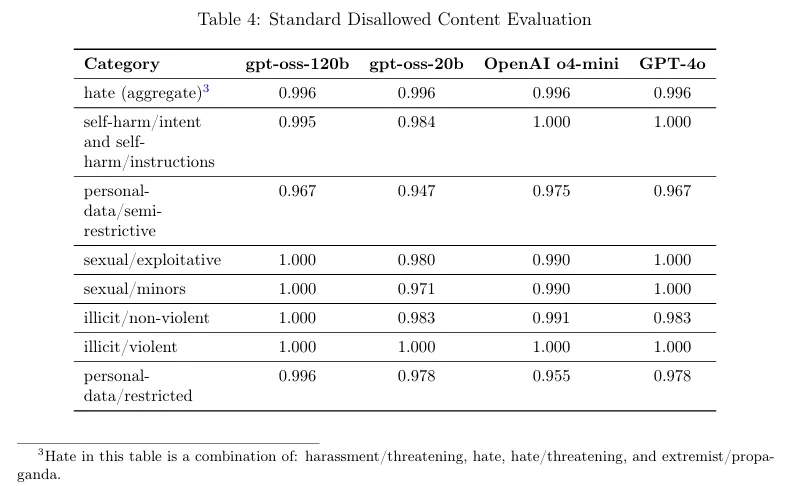

OpenAI's 'Jailbreak-Proof' New Models? Hacked on Day One

CryptoNewsNet·2025/08/06 22:50

Revolutionary Trustless BTC Vaults: Unlock Bitcoin’s Full DeFi Potential

BitcoinWorld·2025/08/06 22:45

USDC Minted: Unveiling the Crucial Impact of 250 Million on Crypto

BitcoinWorld·2025/08/06 22:45

AI Search Features: Google’s Crucial Stance on Website Traffic Challenges

BitcoinWorld·2025/08/06 22:45

US Stock Market Soars: Major Indexes Close Higher, Boosting Investor Confidence

BitcoinWorld·2025/08/06 22:45

Iren’s Astounding Ascent: Dominating Bitcoin Mining in July

BitcoinWorld·2025/08/06 22:45

Trump’s Bold 100% Semiconductor Tariff: Unveiling the Economic Earthquake

BitcoinWorld·2025/08/06 22:45

Revolutionizing Korean Stablecoin: Tech Giants Propel Digital Currency Market

BitcoinWorld·2025/08/06 22:45

Credefi x Vayana : One Step Closer to Credit Tokenization in Emerging Markets

Cointribune·2025/08/06 22:40

Flash

- 05:14BlockRock: Black Swan strategy options achieved up to 60x returns during this round of declineAccording to Jinse Finance, BlockRock's official announcement states that the forward out-of-the-money options configured in its latest "Black Swan Strategy" product achieved up to 60x returns during the recent market crash, making it one of the few strategies to rise against the trend in this round. BlockRock's Black Swan product utilizes an "on-chain tail risk hedge" to help investors defend steadily and profit inversely during extreme market conditions. BlockRock emphasized that the goal of the Black Swan Strategy is not to predict crashes, but to enable investors to capture significant gains when a "black swan event" occurs through structured allocation.

- 05:12"BTC OG whale" scoops up BTC, SOL, and ETH at low prices, with total profits exceeding $91 millionBlockBeats News, on October 11, according to HyperInsight monitoring, the [BTC OG Whale] sub-address closed and took profit on BTC, SOL, and ETH short positions 5 hours ago. At the same time, in the past 3 hours, it opened new short positions in BTC and SOL at $184 and gradually increased its positions. Currently, it has added about 84 BTC and 64,000 SOL. The total holdings at this address are approximately $21.78 million, with a profit of $9 million today. In addition, according to monitoring, due to the extreme market conditions last night, the [BTC OG Whale] main address 0xb31 gradually reduced and took profit on BTC short positions 6 hours ago, earning more than $91 million in profit. It still holds 821 BTC short positions, with holdings of about $92.15 million.

- 05:12Yilihua: The crash was caused by multiple factors, and meme mania drained market liquidity, stifling altcoins.BlockBeats News, on October 11, Liquid Capital (formerly LD Capital) founder Yi Lihua posted that this is the first time he has fully liquidated his positions (on-chain and transparent) since calling for ETH, whereas previously he only used leveraged lending. There are several reasons he can share: · First, bitcoin has risen to a new high resistance level, and without significant positive news to break through, a pullback is likely. · Second, the US stock market is at new highs, and AI and semiconductor companies are playing capital games, which cannot be sustained. · Third, after Japan changes its prime minister, the risk of interest rate hikes will increase and rates have been rising continuously. · Fourth, altcoins in the crypto market have been in a prolonged decline, and the MEME frenzy is draining liquidity.