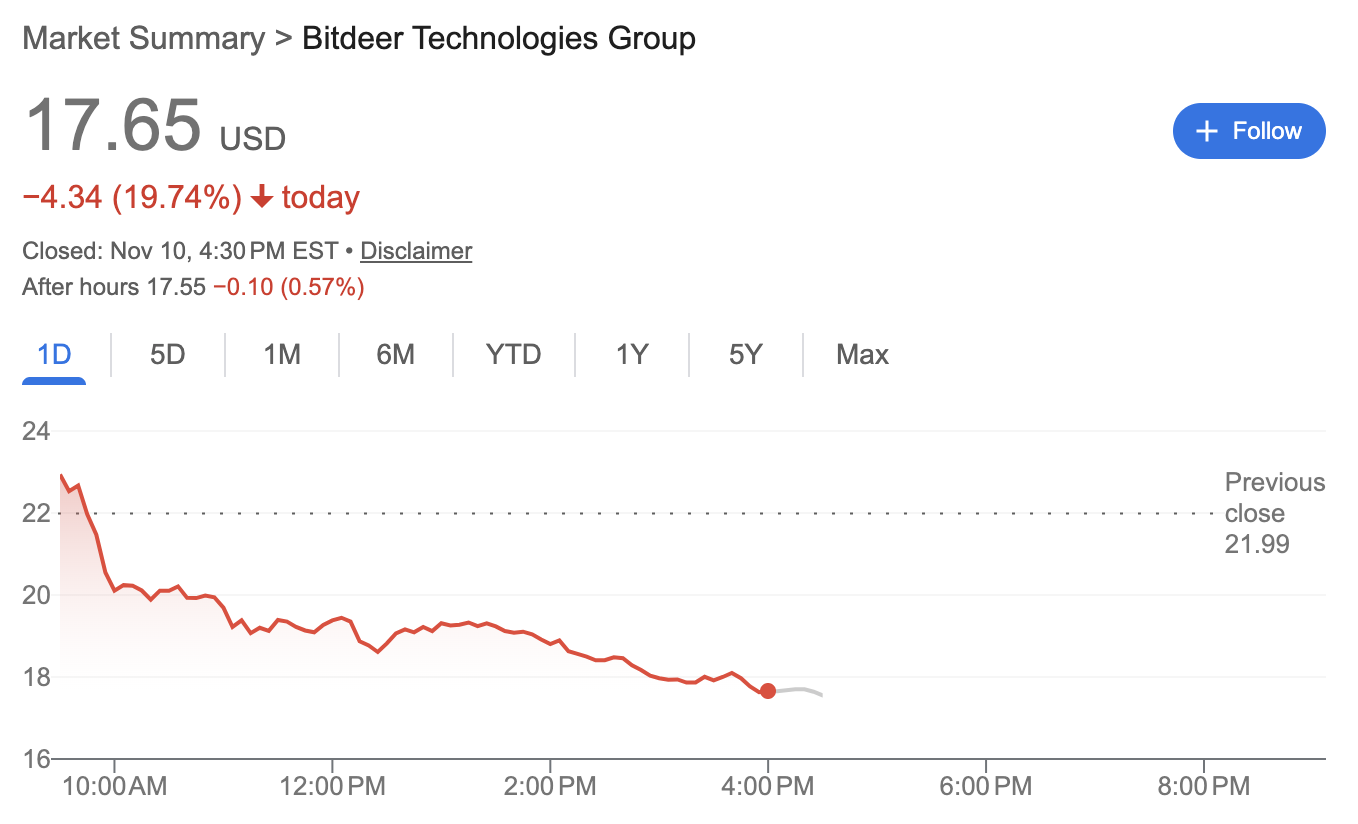

Bitdeer shares drop 20% after posting $266M quarterly loss

Shares of Singapore-based Bitcoin miner Bitdeer Technologies fell nearly 20% on Monday after the company reported a jump in quarterly losses.

Bitdeer recorded a net loss of $266.7 million for the third quarter of 2025, compared with a net loss of $50.1 million for the same period a year ago, largely due to non-cash losses resulting from the revaluation of its convertible debt.

Revenue climbed to $169.7 million, up 174% from the previous year, driven by the expansion of its self-mining operations, according to the company.

Bitdeer also reported gains in its operating performance, with adjusted EBITDA rising to $43 million from a $7.9 million loss in the same period in 2024. The company also doubled its Bitcoin production, mining 1,109 BTC during the quarter.

Bitdeer reported its first revenue from high-performance and AI cloud services, bringing in $1.8 million in Q3 as it began shifting part of its computing power toward artificial intelligence.

Matt Kong, chief business officer at Bitdeer, said the company was “uniquely positioned to capitalize” on AI and the surge in demand for computing power. He added that allocating “200 MW of power capacity to AI cloud services could generate an annualized revenue run-rate exceeding $2 billion by the end of 2026.”

Bitdeer ended the quarter holding 2,029 BTC, up from 258 BTC a year earlier, and managed 241,000 mining rigs, compared with 165,000 at the same time last year.

Related: EToro stock jumps on Q3 results, $150M buyback plan

Bitcoin miners turn to AI

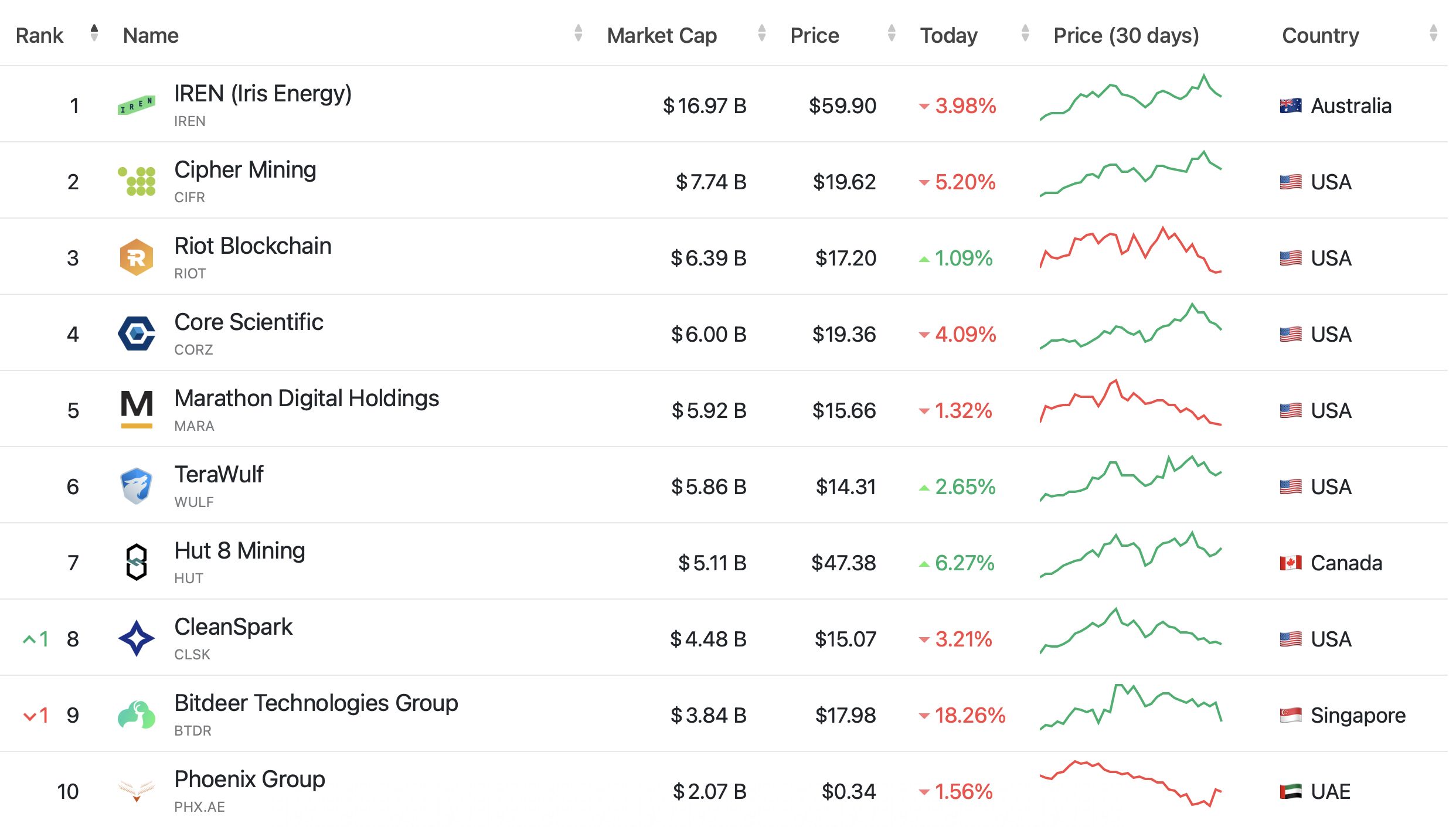

An increasing number of Bitcoin mining companies are pivoting to AI and high-performance computing (HPC), repurposing a portion of their power capacity to meet the fast-growing demand for computing power.

In August, MARA Holdings announced a $168 million deal to acquire a 64% stake in Exaion, a subsidiary of France’s EDF, to expand into low-carbon AI infrastructure, while TeraWulf signed 10-year colocation agreements with AI company Fluidstack worth $3.7 billion in contract revenue.

On Nov. 3, Bitcoin miner IREN announced a five-year, $9.7 billion GPU cloud services deal with Microsoft, giving the tech giant access to Nvidia GB300 chips hosted in IREN’s data centers.

While the pivot by Bitcoin miners into AI and HPC has been picking up momentum this year, it isn’t entirely new.

In July 2023, HIVE Blockchain Technologies rebranded as HIVE Digital Technologies, reflecting its shift to an HPC strategy, alongside its traditional cryptocurrency mining operations.

In March 2024, Core Scientific signed a multi-year, $100 million deal with GPU cloud firm CoreWeave to host HPC workloads at its Texas data center.

Magazine: How Chinese traders and miners get around China’s crypto ban

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

a16z Elevates Wuollet to Lead Crypto Regulatory Affairs and Drive Innovation Strategy

- Andreessen Horowitz promoted Guy Wuollet to crypto general partner, focusing on infrastructure, DeFi, and DePIN to drive blockchain innovation. - U.S. regulatory clarity on crypto ETP staking and CFTC discussions on domestic spot trading align with a16z's advocacy for market-friendly policies. - The firm's investments in projects like Pakistan's ZAR stablecoin and stakes in Solana/EigenLayer highlight its strategy to bridge traditional and decentralized finance. - Wuollet's track record of 20+ crypto inv

Rumble's $767 Million Agreement with Northern Data Drives Growth in AI Infrastructure

- Rumble agreed to acquire Northern Data in a $767M all-stock deal to expand AI infrastructure and cloud computing. - Tether , owning 48% of Rumble, committed $250M in GPU services and advertising to support the merged entity. - The transaction requires regulatory approval and includes potential $200M cash payment if Northern Data sells a Texas data center. - Shareholders controlling 72% of Northern Data agreed to the 15% discounted stock exchange ratio, with 30.4% ownership in the combined company. - Rumb

Uniswap News Today: Uniswap Revamps Governance Structure to Enhance Token Holder Benefits Through Yearly Token Burns

- Uniswap proposes "UNIfication" to burn millions of UNI tokens annually and redirect protocol fees to stakeholders, aligning incentives for token holders. - The plan includes retroactive burning of 100M UNI, PFDA auctions for fee discounts, and v4's on-chain aggregation to expand revenue streams. - Governance restructuring merges Uniswap Labs and Foundation teams, halting product monetization to prioritize protocol growth and community alignment. - UNI surged 30-50% post-announcement, driven by supply red

COAI Token Fraud: An Urgent Alert for Cryptocurrency Investors