a16z Elevates Wuollet to Lead Crypto Regulatory Affairs and Drive Innovation Strategy

- Andreessen Horowitz promoted Guy Wuollet to crypto general partner, focusing on infrastructure, DeFi, and DePIN to drive blockchain innovation. - U.S. regulatory clarity on crypto ETP staking and CFTC discussions on domestic spot trading align with a16z's advocacy for market-friendly policies. - The firm's investments in projects like Pakistan's ZAR stablecoin and stakes in Solana/EigenLayer highlight its strategy to bridge traditional and decentralized finance. - Wuollet's track record of 20+ crypto inv

The crypto arm of Andreessen Horowitz (a16z) has elevated Guy Wuollet to the position of General Partner, solidifying his influence over the firm's investment direction as the digital asset industry adapts to ongoing regulatory and market changes. Wuollet, who began his journey at a16z in 2020 following an internship during his time at Stanford University, now stands as the fourth general partner in the crypto division.

This advancement comes at a time when a16z and other leading crypto investors are adapting to a shifting regulatory environment, highlighted by recent U.S. policy updates. In the previous month, the Treasury Department and IRS released new rules permitting crypto exchange-traded products (ETPs) to engage in staking and share rewards with investors, a development praised by industry giants like a16z and Paradigm as a significant step forward for innovation.

At the same time, a16z has been proactive in urging the U.S. to establish regulatory frameworks that nurture the crypto sector. In a recent submission to the Commodity Futures Trading Commission (CFTC), the firm highlighted the need for leveraged spot crypto products to be launched on U.S. exchanges, aiming to reduce the migration of retail trading overseas.

a16z’s impact is not limited to policy advocacy. The firm has also strategically invested in projects that enhance crypto infrastructure and accessibility. For example, it recently supported ZAR, a fintech company in Pakistan focused on providing stablecoin solutions to the country’s unbanked communities.

Wuollet’s new role underscores a16z’s dedication to nurturing leadership and expertise within the crypto landscape. Having overseen more than 20 investments—including interests in

With the digital asset sector advancing, a16z’s combined emphasis on regulatory involvement and venture investment positions the firm to help define the future of crypto adoption. Wuollet’s knowledge, together with the division’s expanding portfolio, equips a16z to tackle both technical and regulatory hurdles in the evolving market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US Government Reopens After 41 Days – What It Means for Bitcoin, Crypto, and Global Markets

Dogecoin Price Prediction: Can DOGE Reach $0.40 Before 2025 Ends?

Enterprise AI’s Upheaval Drives Crypto’s Push into Private Markets

- C3 AI faces potential sale after founder Thomas Siebel's health-related CEO exit triggered a 6% stock surge. - The company reported $116.8M Q1 losses and 54% share price decline, now exploring private capital raises under new CEO Stephen Ehikian. - IPO Genie's $0.0012 presale token aims to bridge crypto and private markets using AI-driven deal-screening, attracting 300,000+ participants. - With $500M in regulated assets and CertiK-audited security, IPO Genie contrasts C3 AI's struggles by targeting 750×

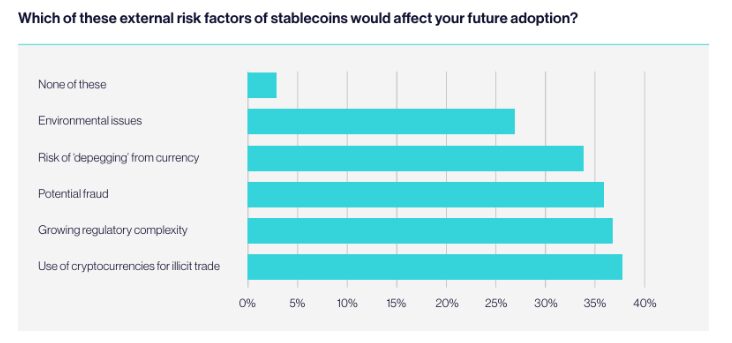

European Tech Startups Eye Stablecoins, But Risks Stall Adoption