Bitcoin Updates: The Two Sides of Leverage—A Whale Faces $3 Million Loss While an Insurer Gains €1.12 Billion

- Unipol Assicurazioni (UNI) reported €1.12B net profit in Q1-Q3 2025, driven by BPR Banca gains and strong life/property segments despite market shifts. - Crypto whale "BTC OG" incurred $3M unrealized loss on leveraged BTC/ETH longs, contrasting UNI's stability amid volatile leveraged trading risks. - UNI's 158% solvency ratio and cost-cutting/digital transformation efforts highlight traditional insurers' resilience versus crypto's amplified market sensitivity. - Divergent outcomes underscore institutiona

Unipol Assicurazioni (UNI), the leading insurance provider in Italy, announced a net income of €1.12 billion for the first three quarters of 2025. This result was fueled by a one-off benefit from the BPR Banca transaction and solid outcomes in both life and property & casualty divisions, as outlined in the

On the other hand, a well-known crypto investor referred to as "BTC OG" experienced an unrealized loss of $3 million on long positions in

This recent setback for the crypto whale underscores the inherent instability of leveraged trading, even for experienced investors. In contrast, UNI's financial results highlight the reliability of established financial firms, with leadership crediting the performance to continued cost reductions and digital upgrades, as described in the

The differing outcomes for UNI and the crypto sector reflect larger economic trends. UNI's success is rooted in disciplined underwriting over time, while crypto investors contend with heightened risks from leverage and shifting sentiment. The BTC

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

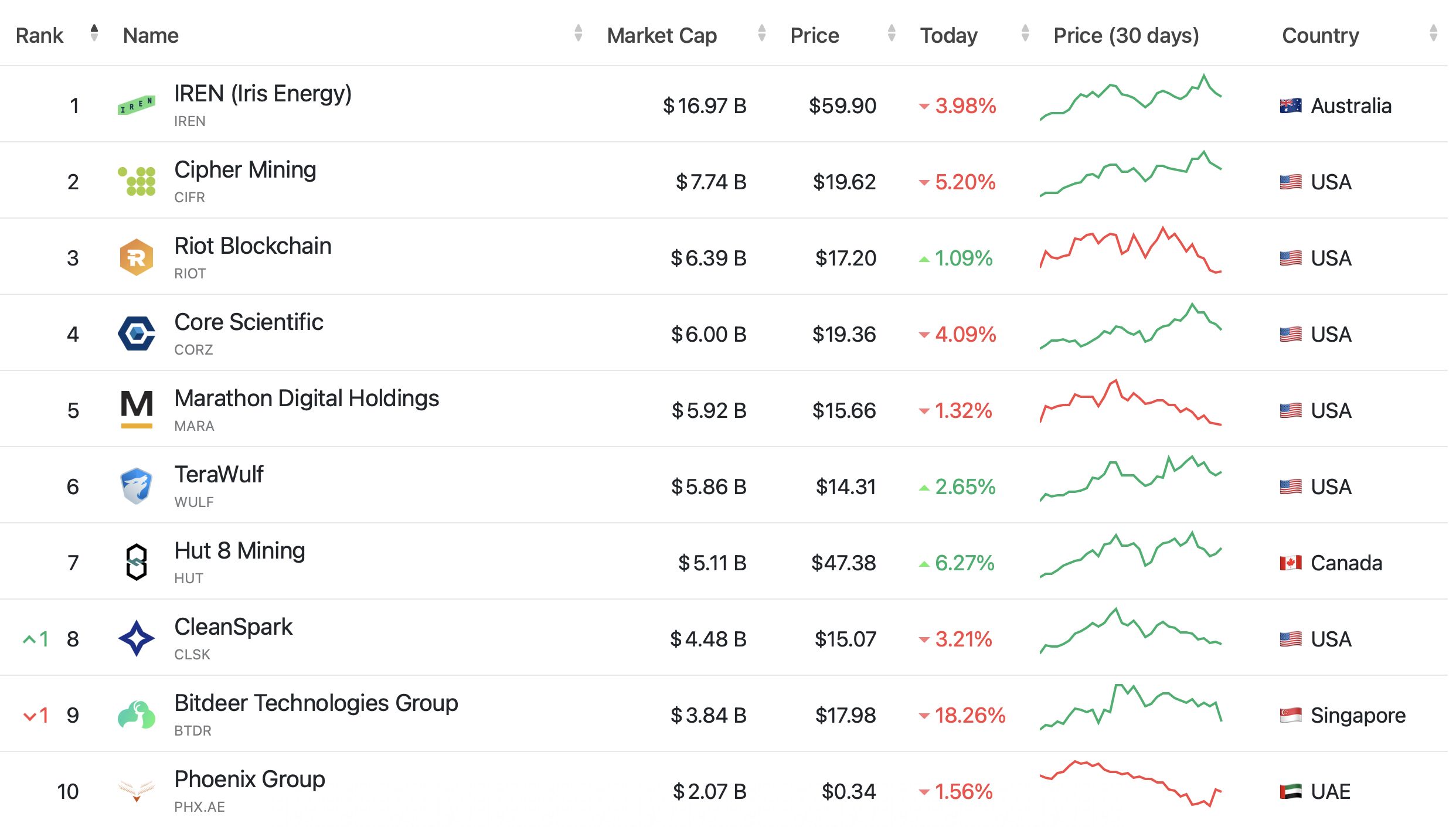

Bitdeer shares drop 20% after posting $266M quarterly loss

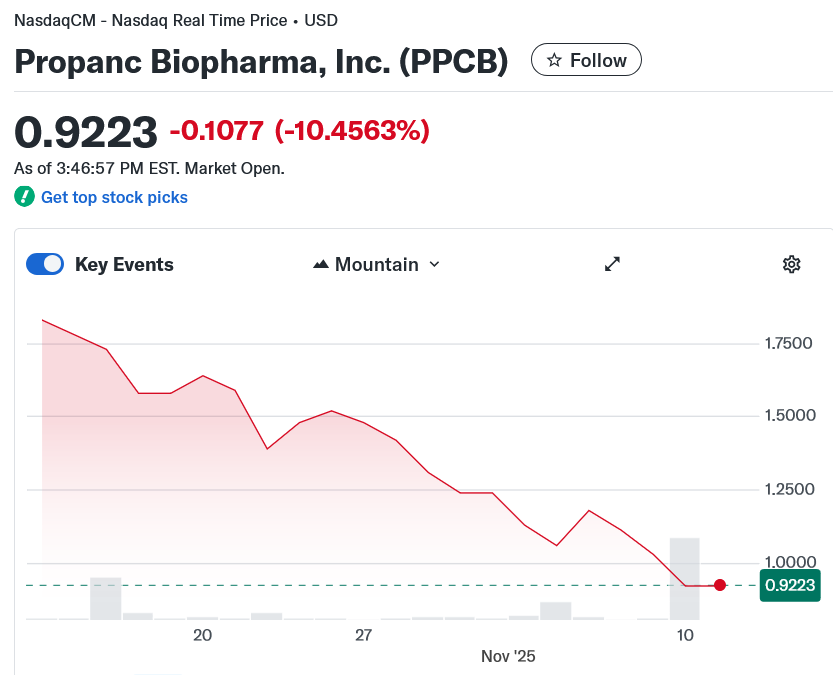

Biopharma raises $100M for crypto treasury to back cancer treatment

Ripple sets sights on TradFi as XRP volumes soar and deals stack up