MMT Token's Initial Token Generation Event and Its Impact on the Digital Asset Industry

- Momentum (MMT) Token's November 2025 TGE triggered an 885% price surge to $0.8859, driven by institutional backing and hybrid tokenomics. - Regulatory clarity via the U.S. CLARITY Act and EU MiCA 2.0 supports MMT's commodity classification, aligning with DeFi's institutional adoption trends. - MMT's deflationary mechanisms, cross-chain expansion, and $12B DEX volume highlight its strategic position in a maturing crypto market. - Supply unlocks and competitive pressures pose risks, but ve(3,3) governance

Strategic Initiatives and Institutional Backing

MMT’s TGE was built on a carefully designed tokenomics structure. The project distributes 1 billion tokens among community incentives, early supporters, and the core team, balancing inflation with deflationary measures like 20% marketplace fee buybacks and quarterly burns of 15% of profits, according to Bitget. This approach is intended to maintain price stability and encourage long-term engagement.

Backing from major institutions further reinforced MMT’s legitimacy. Investments from

Regulatory Evolution and Market Context

The regulatory environment after 2025 is redefining the direction of DeFi. Under Chairman Paul Atkins, the U.S. Securities and Exchange Commission (SEC) has launched "Project Crypto," aiming to update securities regulations and establish the U.S. as a leader in the crypto space, as reported by a

At the same time, the EU’s MiCA 2.0 and regulatory sandboxes in Asia are shaping varied approaches to DeFi regulation, as described in a

Competitor Analysis and Risk Factors

Comparing MMT to its competitors reveals both advantages and potential risks. The ve(3,3) governance system, set to launch on November 11, as mentioned in a

The token’s supply structure presents challenges: 79.6% of all MMT tokens are still locked, with significant unlocks planned from 2026 onward, as noted in the CoinMarketCap prediction. A single wallet’s sale of 89 million tokens (representing 43% of the circulating supply) just five days after listing, according to the CoinMarketCap prediction, exposes the token to potential downward pressure. While Sui’s DeFi network supports MMT’s leading position (accounting for 60% of total value locked), as stated in the CoinMarketCap prediction, competition from platforms like

Grayscale’s Q3 2025 analysis highlights broader DeFi expansion, with protocols such as

Future Outlook and Strategic Significance

MMT’s prospects depend on three core elements: expanding utility, regulatory compliance, and ecosystem development. The ve(3,3) governance and RWA integration, as reported by Bitget, are designed to drive real-world use, while Sui’s DeFi progress will be key to MMT’s scalability. Regulatory certainty from the CLARITY Act, as mentioned in the Relmin Insurance article, could attract more institutional investors and help manage volatility.

Nonetheless, the project must address upcoming token unlocks and competitive threats. If MMT can maintain effective buyback mechanisms and broaden its cross-chain collaborations, it could establish itself as a bridge between DeFi and traditional finance. On the other hand, failing to resolve liquidity or regulatory issues could weaken its strategic position.

Conclusion

MMT’s TGE represents a major milestone in the post-2025 crypto world, reflecting the convergence of innovation, institutional confidence, and regulatory progress. Despite challenges from price swings and supply management, the project’s hybrid tokenomics, cross-chain initiatives, and strong institutional support make it a noteworthy example for the future of digital assets. Investors should consider these dynamics alongside broader market trends, recognizing that MMT’s path will likely parallel the evolution of DeFi itself.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

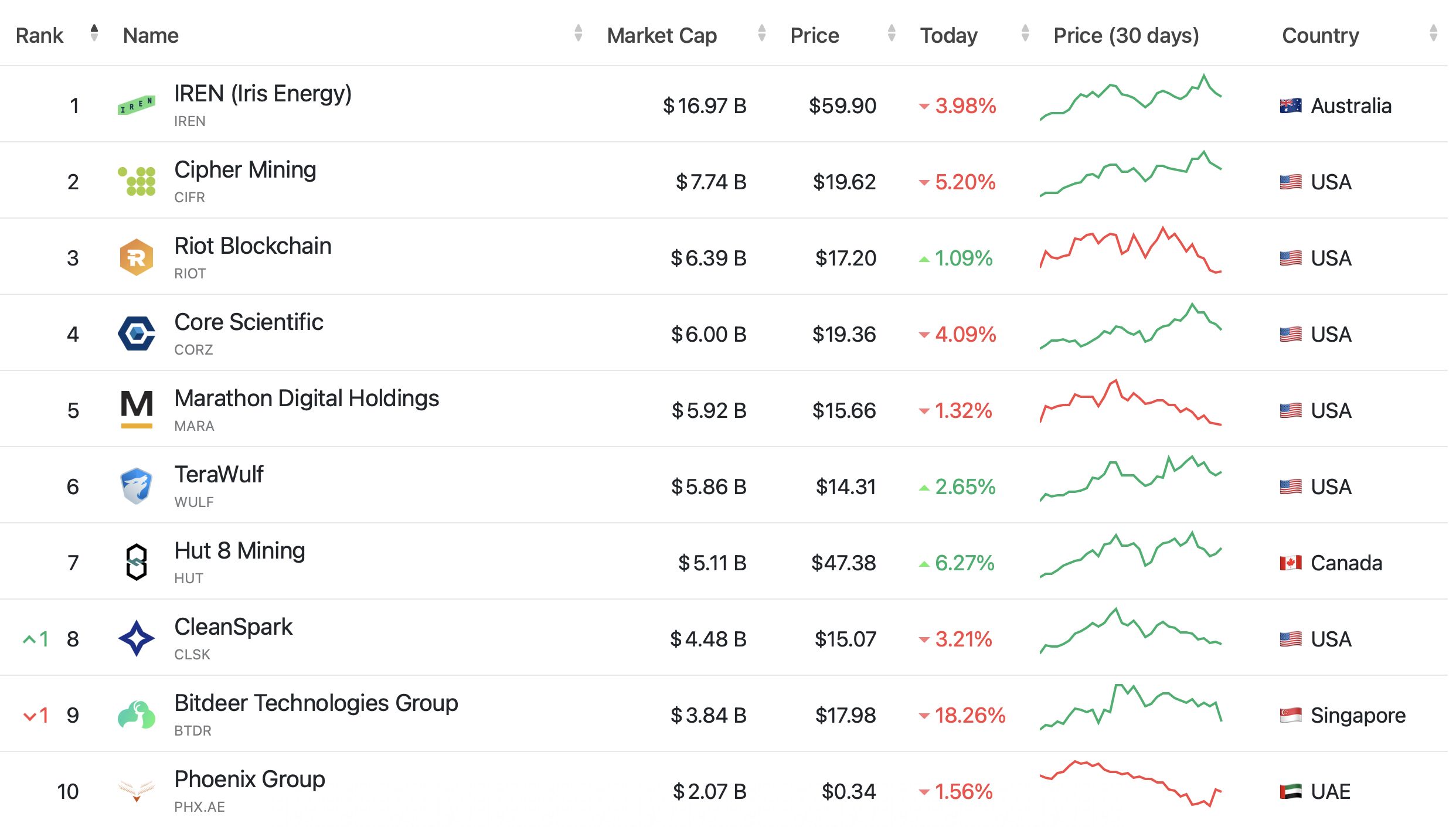

Bitdeer shares drop 20% after posting $266M quarterly loss

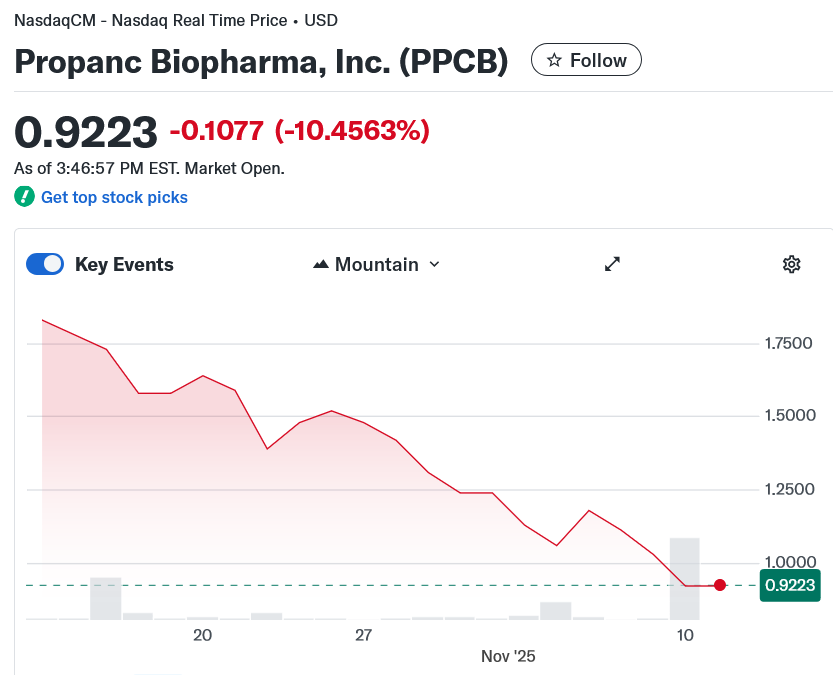

Biopharma raises $100M for crypto treasury to back cancer treatment

Ripple sets sights on TradFi as XRP volumes soar and deals stack up