Atlanta Hawks' Financial Management Questioned Amid Former Executive's Fraud Allegations

- Atlanta Hawks' ex-finance VP Lester Jones pleaded not guilty to wire fraud charges, accused of embezzling $3.8M via falsified expense claims and corporate credit card abuse. - Prosecutors allege Jones manipulated emails/invoices to conceal luxury travel, apparel, and vehicle costs as business expenses during 2021-2024 tenure. - Case highlights corporate governance flaws, as expense verification teams couldn't view actual credit card transactions until July 2024, enabling prolonged fraud. - Hawks remain s

Lester T. Jones Jr., who previously held a top finance role with the Atlanta Hawks, has entered a not guilty plea to a wire fraud charge, accused of siphoning more than $3.8 million from the NBA franchise by submitting fraudulent expense claims and misusing company credit cards. Federal authorities claim Jones took advantage of weaknesses in the Hawks’ reimbursement procedures to hide personal purchases, such as luxury trips, designer clothing, and car-related costs, as detailed in an

Court documents indicate that Jones, who was the Hawks’ senior vice president of finance from August 2021 to June 2024, allegedly manipulated emails and receipts to disguise personal expenses as business costs. The scheme reportedly included fake claims for spending at the Wynn Hotel during the NBA Emirates Cup, as well as multiple overseas trips to places like the Bahamas, Switzerland, and Thailand. Prosecutors allege Jones put more than $230,000 in personal charges on

The Hawks have chosen not to issue a statement regarding the situation. The team’s spokesperson did not reply to inquiries for further details. After his initial court appearance on October 29, Jones was released on bond and must notify the court within 15 days whether he intends to go to trial or change his plea, NBC News reported.

This case highlights weaknesses in how companies oversee expense accounts, as prosecutors pointed out that expense reviewers could not see actual corporate card transactions until July 2024. Jones’ authority allowed him to exploit the system, enabling the alleged long-running fraud, according to NBC News.

This incident is not the only recent legal controversy involving an NBA executive. In a separate matter, Clippers owner Steve Ballmer was named in a lawsuit related to a disputed contract extension for Kawhi Leonard, as reported by

With the trial date approaching, this case could influence how sports organizations handle financial controls and governance. For now, Jones’ not guilty plea suggests a lengthy legal process ahead, with the court yet to decide if the case will proceed to trial, NBC News noted.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash News Today: Balancing Privacy and Regulation: Zcash's Rise Challenges Compliance Boundaries

- Zcash (ZEC) surges over 1,270% YTD, hitting $600 and $10B market cap amid record Puell Multiple miner profitability. - Privacy upgrades like Project Tachyon and Zashi wallet adoption drive institutional interest, outpacing Monero in market cap. - $51M short liquidations and 83.38 RSI signal extreme overbought conditions, while 2025 halving fuels scarcity narratives. - Regulatory scrutiny of privacy tools and compliance challenges persist despite Zcash's flexible shielded transaction model.

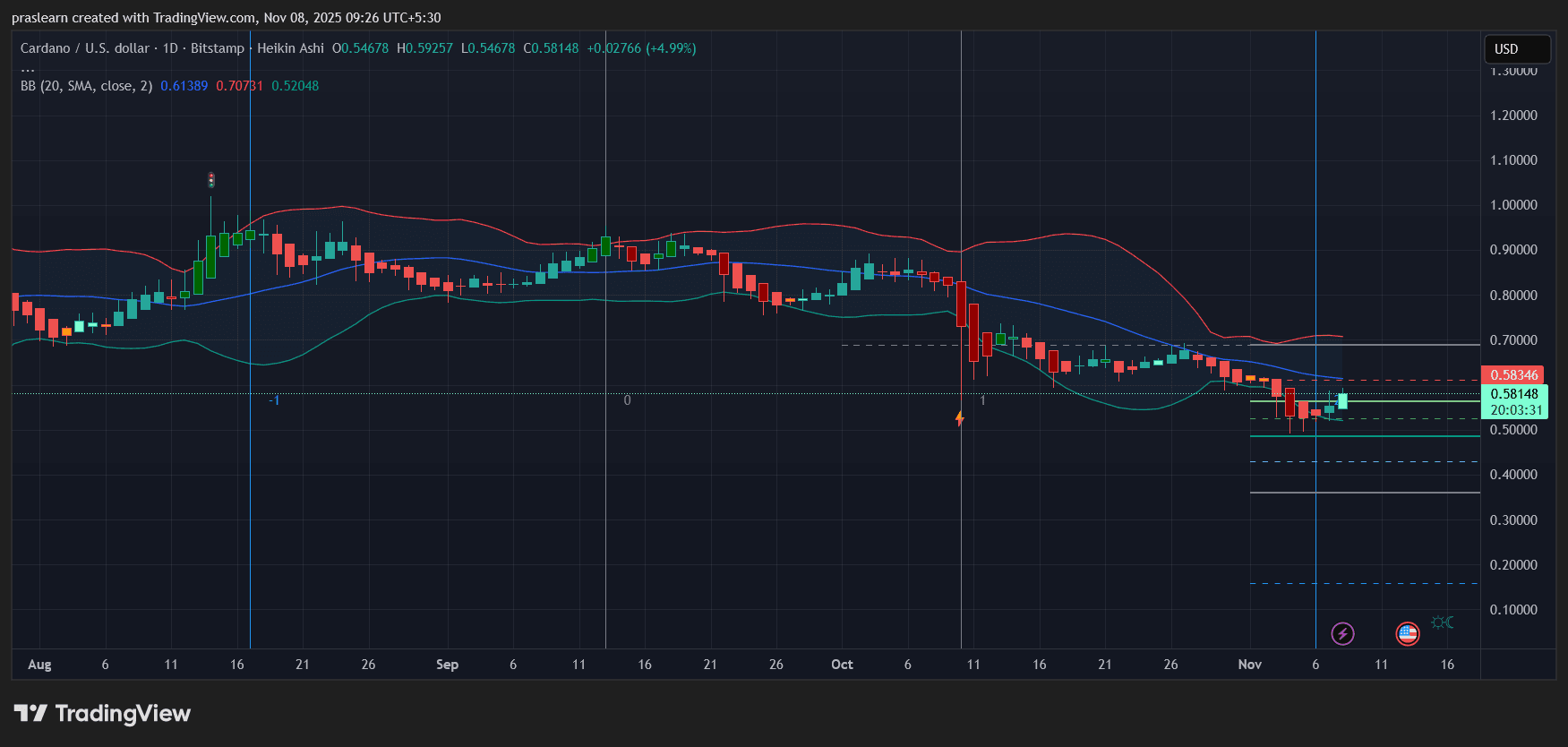

Cardano (ADA) Price Prediction: Can ADA Hold Its Recovery Amid Fed Uncertainty?

Hyperliquid's Rapid Rise: Emerging as a Major Player in Decentralized Trading?

- Hyperliquid captures 73% of decentralized perpetual trading volume with $12.9B daily trading and $9.76B open positions in October 2025. - Platform executes $645M HYPE token buybacks (46% of crypto buybacks) while 62.26% of Arbitrum's USDC liquidity flows to Hyperliquid. - Institutional adoption grows with 21Shares proposing SEC-approved HYPE ETF, while HIP-3 protocol enables permissionless market creation via HYPE staking. - Faces competition from new rivals (Aster, Lighter) and leadership risks, but exp

Bitcoin News Today: Is Bitcoin’s Recent Sell-Off Driven by Corporate Debt Reduction or Market Manipulation?

- Bitcoin fell below $100,000 on Nov. 4, 2025, with $1.3B in liquidations as whales and firms like Sequans sold BTC to reduce debt. - Analysts argue sellers may amplify bearish narratives via social media to profit from lower prices, while corporate treasury strategies face risks amid falling prices. - On-chain data shows moderate unrealized losses (3.1% stress level), suggesting potential stabilization, though some warn a $56,000 cascade could follow a $100,000 break. - Diverging strategies emerge: Americ