Cardano (ADA) Price Prediction: Can ADA Hold Its Recovery Amid Fed Uncertainty?

Cardano is showing early signs of life again after weeks of pressure, gaining nearly 5% to trade around $0.58. The bounce comes at a time when macroeconomic signals from the Federal Reserve are becoming increasingly confusing. With policymakers split on whether to cut interest rates again in December and inflation still running above target, risk assets like cryptocurrencies are treading carefully. For ADA price , this hesitation from the Fed could dictate how sustainable its short-term rally really is.

Cardano Price Prediction: How Fed Uncertainty Shapes the Market Mood

The market’s current hesitation stems from mixed messages out of the Federal Reserve. Some officials, including Austan Goolsbee, are urging caution , saying the lack of official economic data during the ongoing government shutdown makes it risky to ease further. Others, like Trump’s appointee Stephen Miran, are pushing for faster cuts to protect the job market.

This divergence has left traders guessing about whether the next rate move in December will bring relief or disappointment. For ADA and other altcoins, rate cut expectations are crucial because lower interest rates generally drive liquidity back into risk assets. But when the Fed’s message turns foggy, traders tend to de-risk—meaning ADA’s upside momentum could face short-lived resistance if the uncertainty persists through mid-November.

Technical Analysis: Cardano Price Prediction Finds Short-Term Support

ADA/USD Daily Chart- TradingView

ADA/USD Daily Chart- TradingView

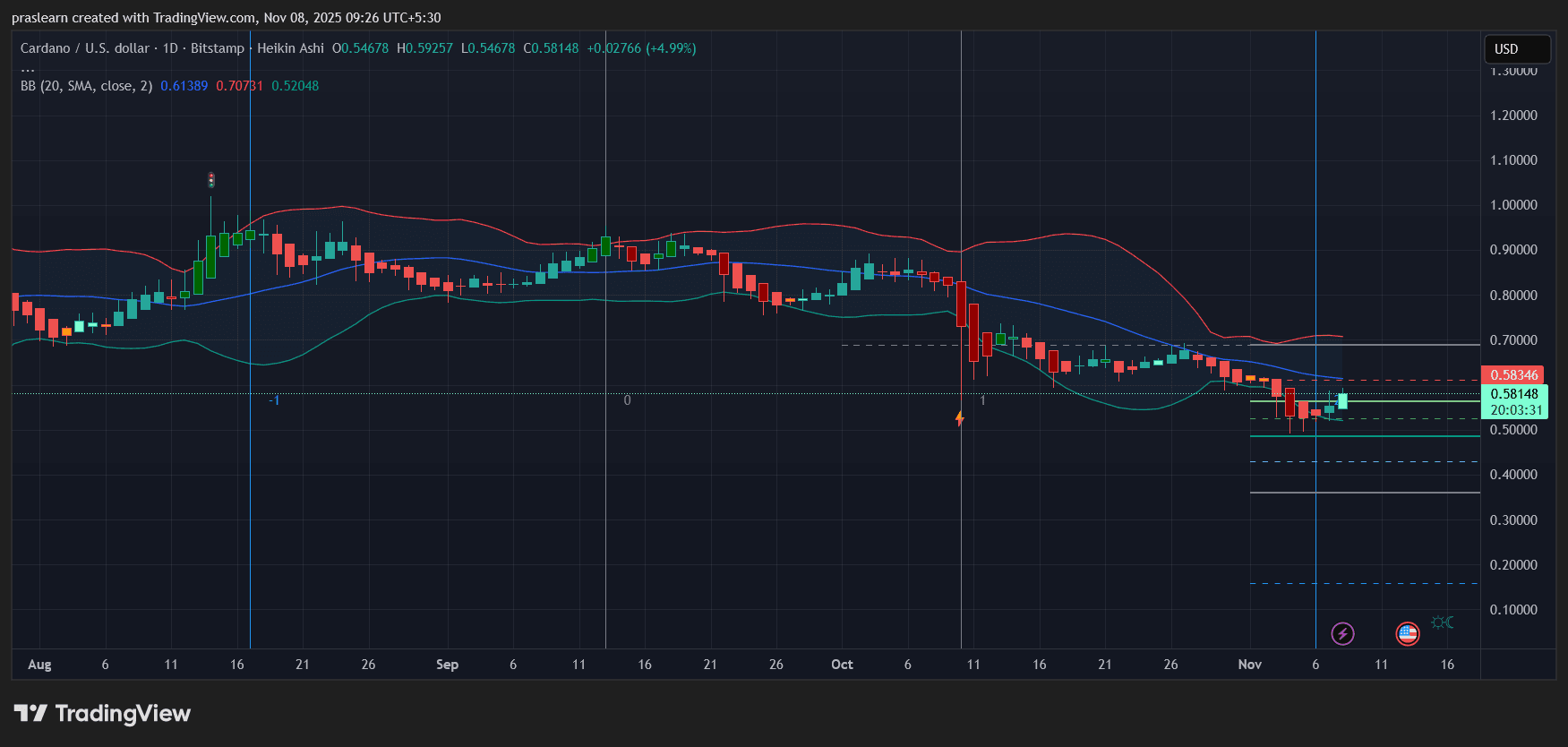

The daily chart shows ADA price consolidating after a deep correction through October. The coin has rebounded from near $0.50, forming a small bullish candle cluster within the lower Bollinger Band range. The 20-day moving average sits around $0.61, now acting as immediate resistance, while the upper Bollinger Band near $0.70 caps the next potential breakout zone.

The current move above $0.58 suggests buyers are cautiously re-entering the market. However, volume remains muted, and ADA is still trading below its mid-band average—indicating that the recovery lacks strong conviction. A sustained close above $0.61 could open a path toward $0.68–$0.70, while failure to break that level may pull prices back to the $0.52–$0.50 support range.

Momentum Indicators Point to a Fragile Reversal

The Heikin Ashi candles have turned green for the first time since late October, hinting at an early trend reversal. Still, Cardano price remains in a broader downtrend channel, and the 50-day simple moving average is curling downward. The lower wick rejection around $0.50 aligns with the Fibonacci retracement zone of 0.382 from the August rally, suggesting that level could serve as a durable short-term floor if Bitcoin remains stable.

Bollinger Band contraction also indicates volatility compression, typically preceding a decisive breakout. If ADA price can hold above $0.57 for several sessions, a mid-month surge toward $0.68 is plausible. Otherwise, a sideways drift between $0.50 and $0.60 may continue until macro conditions clarify.

Macro Correlation: Why ADA Price Mirrors Fed Tension

Crypto assets, particularly large-cap altcoins like ADA, tend to shadow broader risk sentiment. When the Fed hints at policy easing, Cardano price often benefits from renewed speculative flows. However, with inflation data unclear and rate cuts now uncertain, investors are turning selective, focusing on tokens with clearer development milestones or staking utility.

In Cardano’s case, network fundamentals remain strong, but speculative traders are waiting for a clear macro trigger. If the Fed signals even a slight dovish tilt in late November, ADA could see renewed accumulation targeting the $0.70–$0.75 range by December.

ADA Price Forecast for November 2025

Based on the current chart setup and macro backdrop:

- Bullish scenario: A break above $0.61–$0.63 confirms short-term momentum, allowing ADA price to retest $0.70. Sustained buying could extend gains to $0.75 by the month’s end if the Fed hints at further rate cuts.

- Neutral scenario: ADA price stays range-bound between $0.50 and $0.60, consolidating before a December breakout.

- Bearish scenario: Failure to hold $0.52 could trigger another leg down to $0.45 if risk sentiment worsens or if the Fed turns more hawkish.

Given current conditions, ADA’s likely path is a gradual recovery toward $0.65, but the move hinges on how the Fed resolves its internal divide.

Cardano’s November rebound is promising but fragile. Technical signals suggest a mild recovery phase, while macro uncertainty keeps traders defensive. Until the Federal Reserve provides clarity on rate cuts, $ADA is likely to trade in a cautious range. The next few weeks will determine whether this bounce marks the start of a new uptrend—or just another pause before broader consolidation resumes.

📈 Want to Trade Cardano?

Start now on Bitget: Sign Up Here

Check Live ADA Chart: ADA/USDT on Bitget

or You an check the Crypto Exchange Comparison.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Internet Computer's Latest Rally: Genuine Breakthrough or Temporary Hype?

- Internet Computer (ICP) surged 45% to $5.20 in Q3 2025, driven by institutional interest in AI-tokenized infrastructure and blockchain innovations. - Infrastructure advances like canister smart contracts and 21.4 GB on-chain storage contrast with a 22.4% decline in DApp engagement, highlighting adoption challenges. - Institutional TVL growth ($237B) and partnerships boost ICP's profile, but speculative trading (261% volume spike) overshadows organic DApp usage. - Analysts warn of a potential bubble witho

ICP Price Jumps 30%: Is This the Dawn of a New Chapter for the Internet Computer Ecosystem?

- ICP surged 30% in Q3 2025 driven by protocol upgrades, institutional adoption, and speculative momentum. - Technical indicators show strong momentum but DApp engagement fell 22.4%, highlighting adoption gaps. - Institutional interest grew through IoT solutions and DeFi integration, though ecosystem fragmentation persists. - Market forecasts suggest volatile range-bound trading ahead, with sustainability dependent on bridging innovation and user growth.

It’s not a bubble, because AI is already running the markets

The November 2025 Bitcoin Leverage Liquidation Event: Exposing Systemic Vulnerabilities in DeFi Lending and Margin Trading

- The 2025 Bitcoin leverage liquidation crisis exposed critical DeFi vulnerabilities, triggering $1.3B in liquidations and destabilizing protocols like Balancer and Stream Finance. - Exploits in stable pools and opaque Curator models caused $160M in frozen funds, with Euler facing $137M in bad debt after Stream Finance's xUSD collapse. - Experts warn of systemic risks as DeFi's interconnectedness amplifies failures, while solutions like RedStone's Credora aim to address real-time credit monitoring gaps. -