Bitget Daily Digest(Nov 29)|All Major U.S. Stock Indices Closed Lower; Next Year’s FOMC Voters Emphasize Inflation Risks and Oppose Further Rate Cuts; 72 out of Top 100 Tokens Down More Than 50% from All-Time Highs

Today's Outlook

- The SEC is expected to make a decision on Grayscale’s Polkadot (DOT) ETF application by November 8, 2025.

- 72 out of the top 100 cryptocurrencies by market capitalization are down more than 50% from their all-time highs.

- Circle has submitted comments to the U.S. Treasury on the implementation of the GENIUS Act.

Macroeconomics & Hot Topics

- Deribit: Over $5 billion in Bitcoin and Ethereum options are set to expire this Friday.

- The USDC Treasury saw 10 minting and burning transactions exceeding $50 million each in the past 12 hours.

- Next year’s FOMC voting members emphasize inflation risks and oppose further rate cuts.

Market Trends

- BTC and ETH are consolidating in the short term as market sentiment remains cautious and leans towards fear. Around $563 million in liquidations occurred in the past 24 hours, mainly long positions.

- All three major U.S. stock indices closed lower: the Dow fell 0.84%, the Nasdaq plunged 1.90%, and the S&P 500 dropped over 1%.

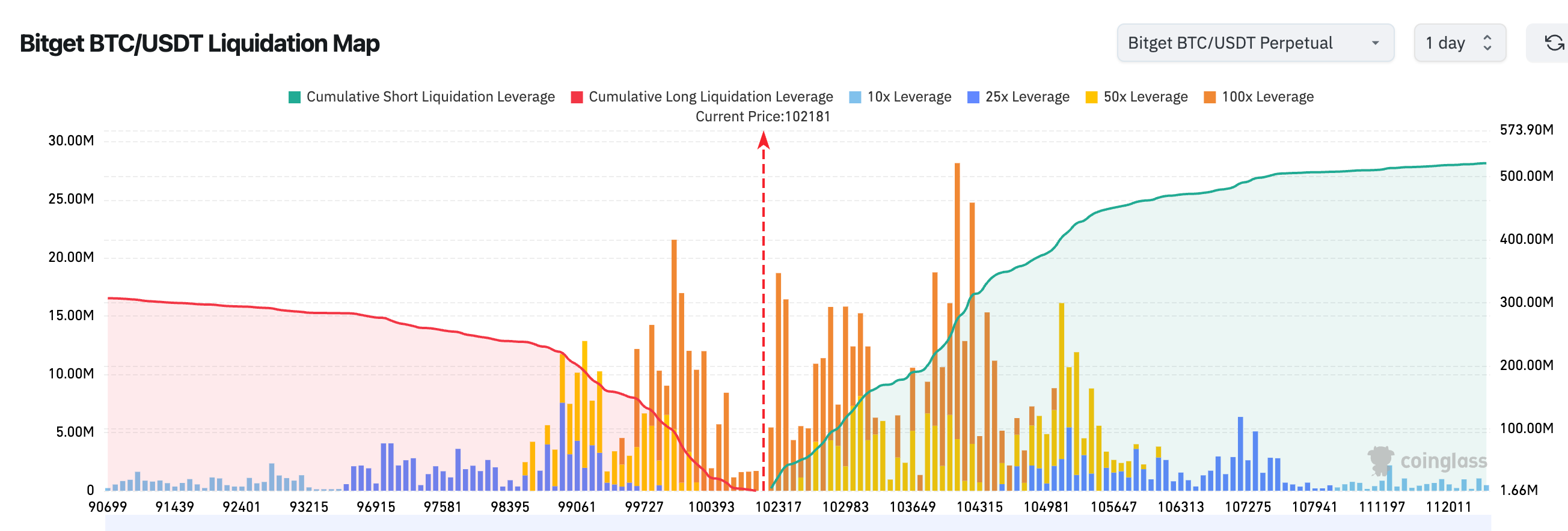

3.According to Bitget’s BTC/USDT liquidation map, BTC is currently priced at $102,181 USDT. There is a concentration of short liquidations in the 101,057 - 102,389 range. A breakdown below this range could trigger a chain reaction of liquidations and significantly increase short-term risks.

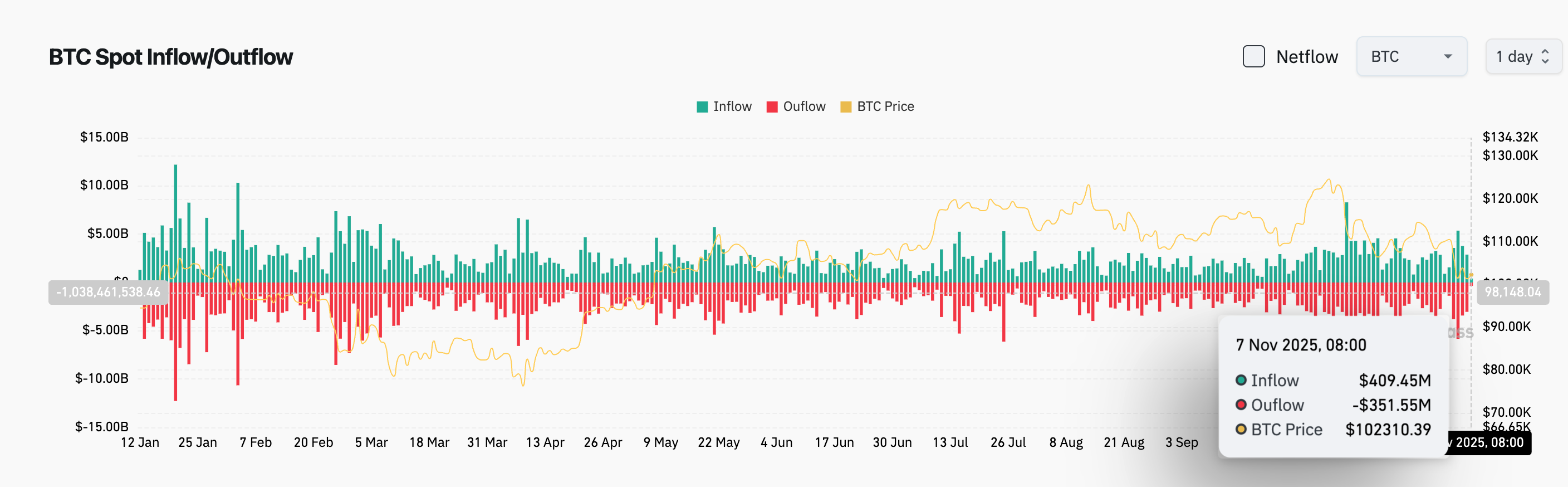

4.In the past 24 hours, BTC spot inflows reached $409 million, outflows were $351 million, for a net inflow of $58 million.

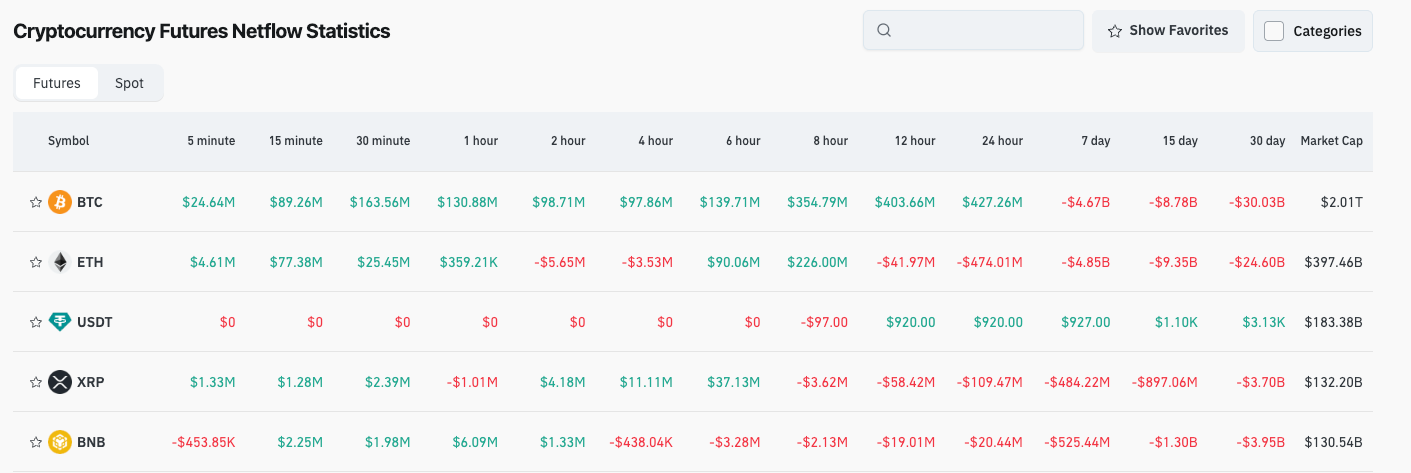

5.Over the last 24 hours, derivatives trading in BTC, ETH, USDT, XRP, and BNB saw net outflows. It's recommended to continue monitoring major cryptocurrencies for potential trading opportunities.

News Updates

- Elon Musk: SpaceX should become a publicly traded company.

- Block posted nearly $2 billion in Bitcoin revenue in Q3, accounting for almost one-third of its total revenue.

- Google will integrate prediction data from Kalshi and Polymarket into Google Finance.

- OpenAI CEO: Does not seek "government guarantees" for its data centers; annualized revenue is expected to surpass $20 billion by the end of this year.

Project Developments

- Credit Blockchain: Launched an AI-driven intelligent financial platform, combining AI with blockchain innovation.

- Ondo Finance appoints former McKinsey executive Ian De Bode as President.

- Aave founder: Gauntlet has suspended Compound withdrawals.

- Aerodrome: Major system upgrades to be released, including Slipstream V2 and Autopilot.

- Folks Finance: Native token FOLKS officially launched on November 6 with an initial circulation of 25.4%.

- Cipher issues $1.4 billion in high-yield bonds to fund Google-related data center construction.

- ORE mining program is now available on the Solana Mobile dApp Store for Seeker users.

- Berachain: Plans to launch a claims page for fund returns early next week and may execute an additional hard fork.

- ZachXBT collaborates with BNB Chain to strengthen Web3 security infrastructure.

- Hourglass: Adjusts Stable pre-deposit activity limits, clarifies KYC and settlement times.

Disclaimer: This report is AI-generated and has been manually verified for accuracy. It does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO Price Drops 7.18% Over the Past Week as Earnings Remain Mixed and Strategic Moves Unfold

- ALGO stock fell 7.18% over 7 days despite 24-hour gains, reflecting mixed business updates from Light AI and Aligos Therapeutics. - Light AI increased R&D spending to $1.2M in Q3 2025 but faced $3.4M non-cash compensation expenses, signaling financial strain amid innovation focus. - Aligos advanced hepatitis B trials but reported $31.5M net loss in Q3 2025, highlighting clinical progress versus immediate financial challenges. - Market uncertainty persists as investors weigh innovation potential against h

The Revival of Community Journalism as a Barrier Against Misinformation: A Tactical Opportunity for Investors Focused on Impact

- Local journalism's collapse has left 70M+ Americans vulnerable to disinformation, as AI-driven falsehoods and partisan content thrive in fragmented digital ecosystems. - Startups like Community News Lab (digital kiosks) and Factchequeado (AI fact-checking) are rebuilding trust through hyper-local reporting and marginalized community outreach. - Impact investors gain unique opportunities by funding scalable models like Plucky Works' SaaS tools and collaborative journalism networks, which combine tech inno

XRP News Today: Bitcoin Faces Key Level—Will It Trigger a Bear Market or Spark a 2025 Bull Run Revival?

- Bitcoin dips below $108,000, breaking key Fibonacci levels with RSI at 41 and MACD contraction signaling bearish momentum. - Ethereum consolidates near $3,300 after retreating from 100-day EMA, with $3,171 support critical for short-term recovery. - XRP surges 12% post-$500M funding and Mastercard partnership, but faces volatility risks above $2.16 support. - Analysts debate bear market entry vs. 2025 bull cycle reset, citing macro factors like U.S. rates and potential Trump-era policies.

Zcash Latest Updates: ZEC's Soaring Surge Causes 250% Downturn for Hyperliquid's Leading Short Position

- Hyperliquid's largest ZEC short (0xd47) faces $14.5M unrealized loss as ZEC surges past $580, marking 250% losses on a $29.26M bet. - ZEC's 48.74% weekly gain boosts market cap to $8.6B, surpassing Sui/Hedera, driven by institutional interest and Solana integration potential. - Hyperliquid's $780M HYPE buyback generated 65% returns, but HYPE price fell 4.33% amid crypto volatility, contrasting ZEC's bullish momentum. - ZEC futures open interest hits $773.84M all-time high, with 0x96ea whale's $16. 3M lon