XRP News Today: Bitcoin Faces Key Level—Will It Trigger a Bear Market or Spark a 2025 Bull Run Revival?

- Bitcoin dips below $108,000, breaking key Fibonacci levels with RSI at 41 and MACD contraction signaling bearish momentum. - Ethereum consolidates near $3,300 after retreating from 100-day EMA, with $3,171 support critical for short-term recovery. - XRP surges 12% post-$500M funding and Mastercard partnership, but faces volatility risks above $2.16 support. - Analysts debate bear market entry vs. 2025 bull cycle reset, citing macro factors like U.S. rates and potential Trump-era policies.

Written by [Author Name]

Bitcoin (BTC) and

Earlier in November, Bitcoin slipped below $108,000, breaching important Fibonacci retracement points and sparking a bearish

There is still no consensus on whether

Ethereum (ETH) has managed to find short-term support around $3,171, but its recovery remains in question. Based on an

Traders using platforms such as

Ripple’s XRP has jumped more than 12% in recent days, fueled by a $500 million investment round led by Fortress Investment Group and Citadel Securities, which raised the company’s valuation to $40 billion, according to a

XRP has broken past the $2.30 resistance level, and technical analysis suggests it could reach $2.50, according to a

The overall cryptocurrency market continues to be unstable, with Bitcoin’s market share and global economic factors playing crucial roles. While some analysts believe the current pullback is a normal correction, others warn of steeper losses if major support levels are breached. Institutional interest in XRP and Ethereum’s on-chain activity provide some positive signs, but a lasting recovery will require clearer macroeconomic signals and renewed buying momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

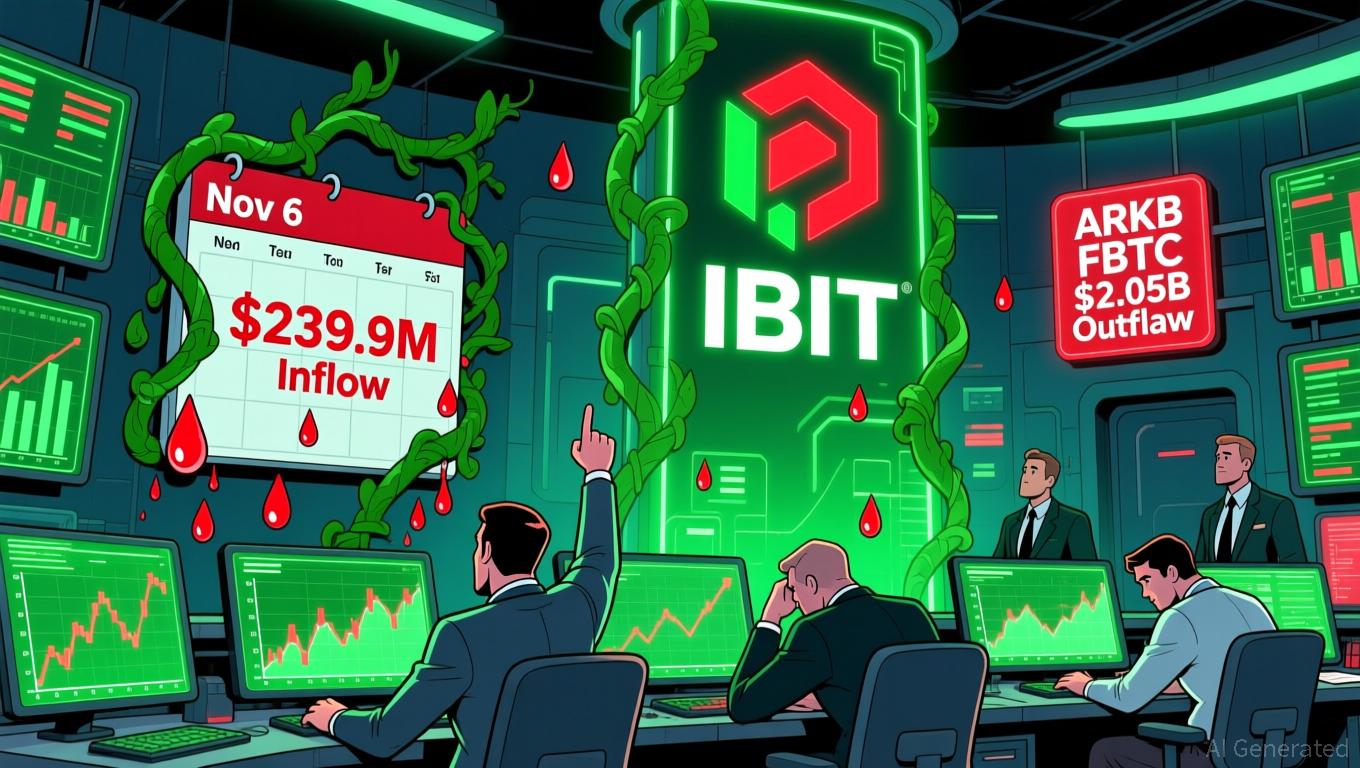

Bitcoin Updates: Investor Optimism Grows as Bitcoin ETFs End Outflow Trend

- U.S. spot Bitcoin ETFs ended a six-day outflow streak with $239.9M net inflows on Nov 6, led by BlackRock's IBIT ($112.4M) and Fidelity's FBTC ($61.6M). - Bitcoin's price rebounded to $103,000 from below $99,000 as improved liquidity and reduced macro volatility drove inflows, though risks persist without sustained buying pressure. - Ethereum ETFs saw smaller $12.5M inflows while Grayscale's ETHE continued outflows, highlighting diverging investor preferences between BTC and ETH. - Solana ETFs emerged as

Bitcoin News Update: Bitcoin Drops Under $100K Amid Diverging Analyst Opinions on Market Direction

- Bitcoin dropped below $100,000 on Nov. 7, driven by macroeconomic risks and $2B+ ETF outflows amid U.S.-China tensions and Fed inaction. - Analysts highlight $113,000 as critical resistance and $100,000 as key support, with breakdowns risking $88,000 liquidation levels. - Institutional views diverge: Ark Invest cut targets to $120,000 while JPMorgan raised fair value to $170,000 amid shifting adoption narratives. - Market eyes December's "Santa Rally" potential but recovery hinges on Bitcoin holding abov

Bitget Connects Speculation and Risk Control through STABLEUSDT Futures

- Bitget launched STABLEUSDT pre-market futures with 25x leverage, offering 24/7 trading since Nov 6, 2025. - The contract features 4-hour funding settlements and 0.00001 tick size to enable flexible positioning. - As the world's largest UEX, Bitget aims to boost market depth for emerging tokens through strategic liquidity initiatives. - Partnerships with LALIGA/MotoGP and a $2M loan program highlight its mission to democratize crypto access. - Risk warnings emphasize volatility concerns for leveraged prod

Token Unlock Releases and Large Holder Sell-Offs Drive Ethena's 80% Value Decline

- Ethena's ENA token dropped 80% to $0.31 amid massive unlocks and whale selling, with 45.4% of tokens released in November. - Robinhood listing and Binance's USDe buyback program offer limited support as 6.8B tokens circulate and 5.99B remain locked until 2026. - USDe's $8.9B TVL and multi-chain expansion highlight potential, but technical indicators signal a possible 37% further price decline. - Analysts warn ongoing unlocks, whale activity, and crypto market volatility could prolong ENA's bearish trend