News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Near blessing, AI-driven, a glimpse of SenderAI's future prospects

远山洞见·2024/11/25 09:40

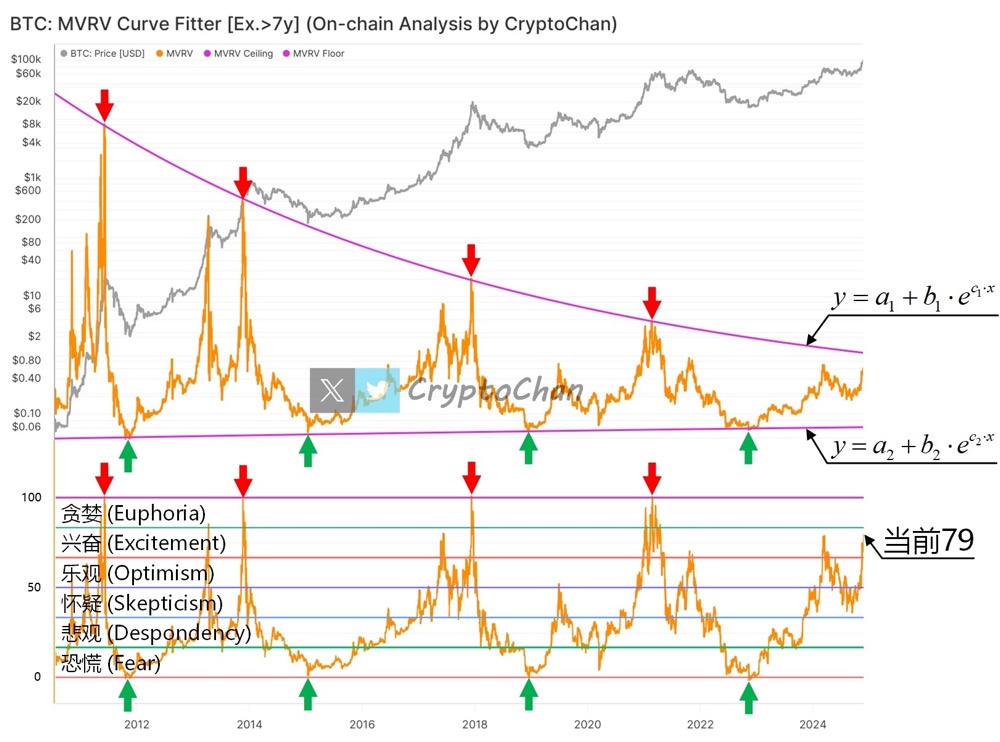

Precision tool for identifying market bottoms? Bitcoin MVRV indicator reappears, currently scoring 79

CryptoChan·2024/11/25 07:16

Zircuit Launches ZRC Token – Pioneering the Next Era of Decentralised Finance

Daily Hodl·2024/11/25 07:08

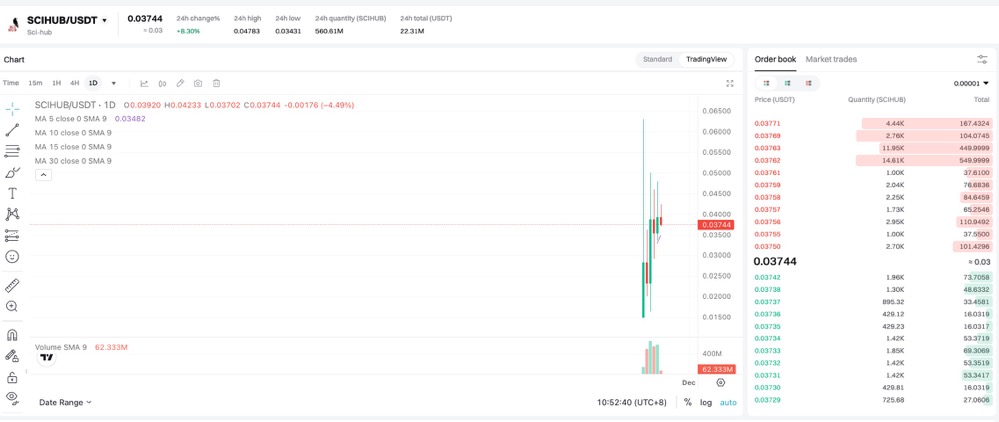

CryptoRock: Why I'm All in $scihub - Confessions of a Rebellious Hacker

推特观点精选·2024/11/23 03:09

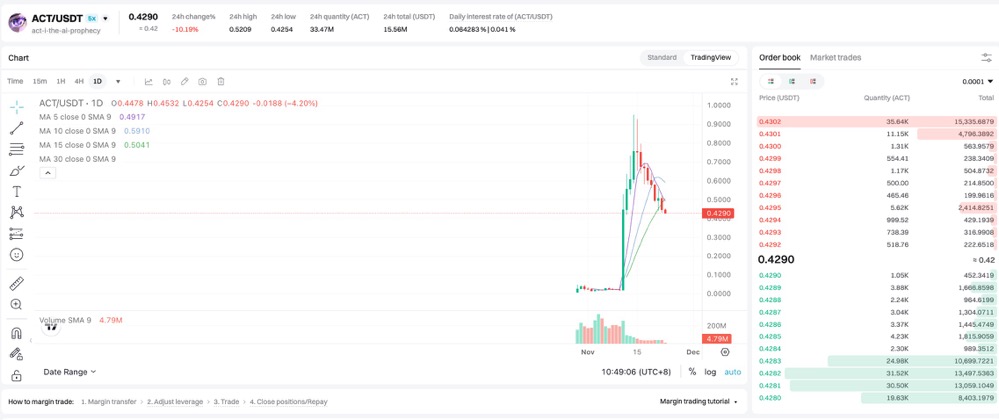

Meta Gorgonite: Why the potential of $ACT is far from exhausted

推特观点精选·2024/11/23 02:50

Zeus: Robust fundamentals of Aptos - Stripe and Circle support, promising future

Twitter Opinion Selection·2024/11/23 02:44

Yuyue: A Detailed Explanation of the Origin and New Narrative Leader of DeSci + Meme $RIF

推特观点精选·2024/11/23 02:43

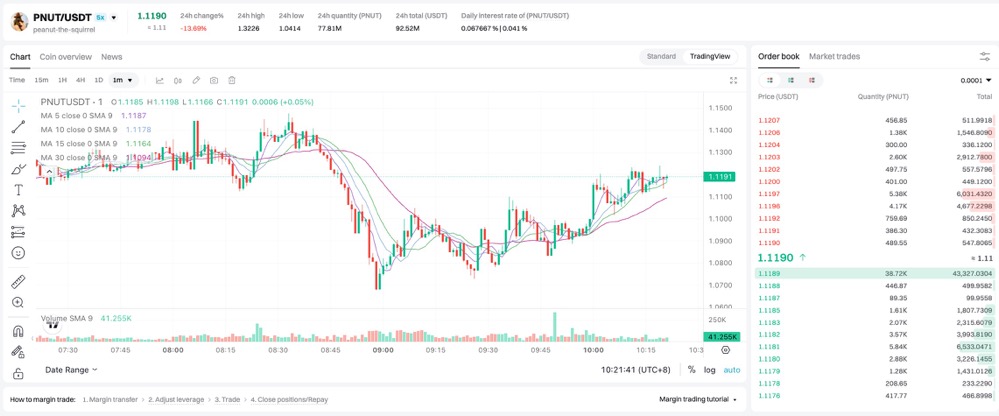

Sun and Moon Xiao Chu: Why do I continue to increase positions during the pullback of $PNUT and $ACT

Twitter Opinion Selection·2024/11/23 02:24

Flash

- 09:45Machi Big Brother increases 25x ETH long positions, current holdings exceed $13 millionChainCatcher news, according to Hyperbot data, "Brother Maji" has just increased his 25x Ethereum long position to 3,850.3333 ETH, with a position value of $13.163 million and a liquidation price of $3,320.42.

- 09:43If Ethereum falls below $3,300, the cumulative long liquidation intensity on major CEXs will reach $595 millions.BlockBeats News, November 9, according to Coinglass data, if Ethereum falls below $3,300, the cumulative long liquidation intensity on major CEXs will reach 595 millions. Conversely, if Ethereum breaks through $3,500, the cumulative short liquidation intensity on major CEXs will reach 980 millions. BlockBeats Note: The liquidation chart does not display the exact number of contracts pending liquidation, nor the precise value of contracts being liquidated. The bars on the liquidation chart actually show the relative importance, or intensity, of each liquidation cluster compared to adjacent clusters. Therefore, the liquidation chart demonstrates the extent to which the underlying price reaching a certain level will be affected. A higher "liquidation bar" indicates that once the price reaches that point, there will be a stronger reaction due to a wave of liquidity.

- 09:42Sign signs agreement with Sierra Leone Ministry of Technology to build digital identity and stablecoin payment systemBlockBeats News, November 9, the Ministry of Technology of Sierra Leone and Sign officially signed a memorandum of understanding, jointly launching a new chapter in the construction of national blockchain infrastructure. The first phase of cooperation will focus on building a Digital ID system and a local stablecoin payment system, aiming to provide secure, transparent, and inclusive digital services to all citizens at extremely low cost, and to promote the country's leapfrog development. During this visit, the Sign team also met with the Minister of Finance of Sierra Leone, the Governor of the Central Bank, the CEO of the eGov App, and representatives from the Christex Foundation, reaching consensus on technical roadmap, policy coordination, and implementation plans. This cooperation marks an important milestone in Sierra Leone's digital economic transformation and also highlights Sign's leading position in promoting "national-level blockchain infrastructure".