巨鯨拋售與降息博弈:加密市場為何陷入焦慮?

Original: Odaily (@OdailyChina)

Author:Dingdang (@XiaMiPP)

Original Title: The Rate Cut Game Remains Unresolved, Whale Sell-offs Continue, Where Is the Market Heading?

Anxious, very anxious. I always feel like I haven't made any money yet, but the market is already shouting about turning bearish, and all kinds of news are making me dizzy. Bitcoin is facing a weekly MACD death cross, and Ethereum is barely holding on. Trend Research, which recently achieved impressive results by calling for ETH at the bottom, had also been firmly bullish on the Ethereum ecosystem, but quietly cut losses and liquidated PENDLE and ENS this morning.

At such a moment, should I hold on or retreat? I can only keep checking the market's voices, hoping someone can "recharge my faith" and find an outlet for this anxiety.

The Ethereum and Bitcoin Game Stirred by Whales

In the past two weeks, the main character in the crypto market has been none other than an ancient whale. Their large-scale sell-off of BTC to switch to ETH can be said to be the "culprit" behind Bitcoin's weak performance. This big player has cumulatively dumped 34,110 BTC, cashing out about $3.7 billions, and bought 813,298.84 ETH, worth about $3.66 billions. Now, the two remaining wallets still hold 49,816 BTC, valued at about $6 billions. The question is: will they continue to sell? How much will they sell? It's like a sword of Damocles hanging over Bitcoin. All that can be said is, the sellers are too strong.

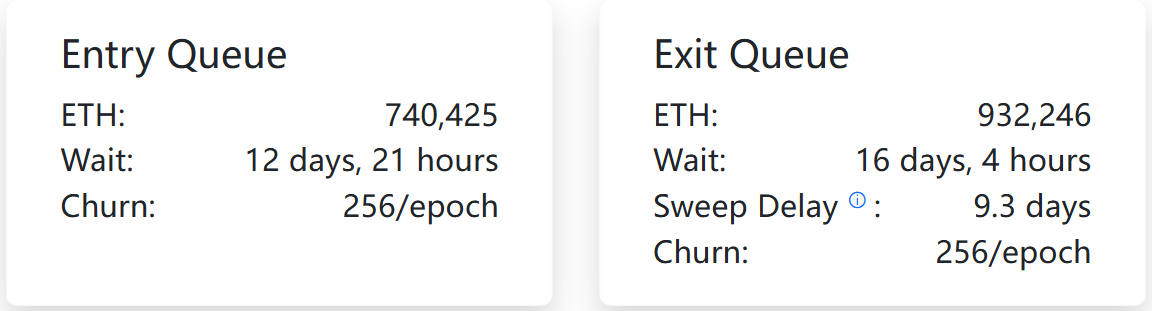

For Ethereum, the whale's reallocation is an obvious positive. This may be one of the important reasons why ETH has been stronger than BTC recently. However, the next two weeks won't be easy for Ethereum either, as 932,246 ETH are queued for unstaking, equivalent to about $400 millions in potential sell pressure that could hit the market.

Now it's all about the whale's actions—if they can absorb Ethereum, it will inevitably deal a heavy blow to Bitcoin. The zero-sum game continues.

Super Week: Data Collides with Rate Cuts

In the coming weeks, the global market's attention is almost entirely on the Federal Reserve. According to today's CME "FedWatch" data, the probability of a 25bps rate cut in September is 87.4%, and investors are betting that the Fed will soon start a new round of easing.

This week is a true "Super Week"—ADP small nonfarm employment data, ISM services PMI, and especially the core nonfarm payroll report—all of these will influence the Fed's FOMC meeting decision on September 16-17. If a series of data, especially nonfarm, comes in weak, the market may bet that the Fed will start cutting rates sooner and faster; if the data is strong, it will dampen expectations for a rate cut. Either way, this week is bound to be extremely volatile. For investors, caution is the only answer.

Although Powell's speech on August 22 sent dovish signals, it did not provide strong guidance on the duration or magnitude of rate cuts. The latest research from CICC points out that the market should not overinterpret Fed Chair Powell's "dovish" remarks at Jackson Hole. With the US facing higher tariffs and tighter immigration policies, both employment and inflation risks coexist. If inflation risk outweighs employment, the Fed may halt rate cuts. Even if there is a 25bps cut in September, it does not mean the start of a sustained easing cycle. CICC warns that if "stagflation-like" pressures intensify, the Fed will face a dilemma and market volatility may increase.

On the Trump side, efforts are being made to push the Fed Board to form a closer team to steer policy in a dovish direction. The Fed Board has seven seats; currently, excluding Cook (who is in a legal dispute with Trump), two members appointed by the Biden administration—Jefferson and Barr—stand with Powell, as does Cook. Bowman, Waller, and Mullan are generally seen as Trump supporters. If the court rules that Trump can fire Cook, he will quickly nominate a successor, gaining a 4-3 majority on the Board. But this ruling is unlikely before the September meeting, and Cook's absence could result in a tie between Trump's three appointees, Biden's two, and Powell. The September rate meeting may become a watershed for market direction.

Tom Lee, head of research at Fundstrat Global Advisors, said it is right for investors to remain cautious in September. After a long pause, the Fed is restarting a mild rate cut cycle, making it hard for traders to determine positions. The long-time US stock bull expects the S&P 500 to fall 5% to 10% this fall, then rebound to between 6,800 and 7,000 points.

WLFI Siphoning the Market?

Another "super bomb" is also counting down. The Trump family crypto project World Liberty Financial (WLFI) will go live at 8pm tonight. Many can't help but recall the previous TRUMP token: enriching a small group while crashing the entire market. So, the big question is: will the TRUMP scenario repeat with WLFI?

According to on-chain analyst @ai_9684 xtpa's summary of WLFI investors' purchase costs, WLFI had eight rounds of public fundraising, raising a total of $2.26 billions. At the current pre-market price of $0.32, the lowest cost in the first round was only $0.015, meaning a profit margin of over 20x, which suggests a high likelihood of "dumping" after WLFI goes live.

Two public sale rounds have confirmed 20% TGE unlock, with the remaining 80% pending community vote. Team/advisor/partner tokens are locked, but whether strategic round tokens are unlocked remains unclear. The whole network is watching TGE circulation. Coinmarketcap.com data shows a circulating supply of 27.2 billions, worth about $8.7 billions. The CMC CEO said this data was repeatedly confirmed with the project, meaning strategic round tokens will also circulate at TGE. If so, immediate "dumping" at launch is almost certain.

However, crypto KOL @0xDylan_ (suspected to be a WLFI Wallet team member) posted that the WLFI tokenomics have been updated: 8% allocated to Alt 5 Public Company and locked, 10% reserved for future incentives and points (locked, details to be announced). Team and institutional investor shares are locked. In addition, 3% is for CEX liquidity and DEX LP, and 5% for investors. This means the circulating supply is the unlocked 5% plus 3% for liquidity, totaling 8%, or 8 billions in circulation, worth $2.56 billions.

Odaily predicted in "WLFI Halved Pre-market, Will It Rise or Fall on September 1?" that another possibility is that WLFI, also endorsed by Trump, may see Trump congratulate or hype WLFI on social media on launch day, giving it more room for speculation due to its ambiguous relationship with the president.

If only 8% is circulating, WLFI's price may be pushed up at launch. But high FDV and potential strategic round sell pressure are ticking time bombs—if unlock ratios rise or hype cools, a sharp correction may still occur.

Other Market Voices: Bitcoin Remains a Belief, But Caution Is Needed Short-term

Hedging Logic: Gold and Bitcoin in Parallel

Robert Kiyosaki, author of "Rich Dad Poor Dad," mentioned Bitcoin again, saying Europe is facing a severe debt crisis, France is close to a "Bastille Day-style" revolt, and Germany faces internal turmoil due to high manufacturing costs from energy policy. He noted that since 2020, US Treasuries have fallen 13%, European bonds 24%, and UK bonds 32%, with global markets losing confidence in major economies' debt repayment abilities. Kiyosaki said Japan and China are selling US Treasuries and turning to gold and silver, again urging investors to protect themselves by holding gold, silver, and Bitcoin.

Bitwise Europe research head André Dragosch also said gold is usually the best hedge when stocks fall, while Bitcoin is more resilient when US Treasuries are under pressure. Historical data shows gold often rises in stock bear markets, while Bitcoin is more supported during US Treasury sell-offs. By 2025, gold prices have risen over 30%, and Bitcoin about 16.46%, reflecting investors' differentiated choices amid rising yields, stock volatility, and President Trump's pro-crypto stance.

Traders' Caution and Waiting: Uptrend Expected in Fall 2025

Trader Eugene Ng Ah Sio posted on his channel that he is not currently trading, but wants to clarify (for followers) that for altcoins to see real volatility, Bitcoin must break upward, but Bitcoin's current performance has not met bulls' expectations.

Previously, on August 14, Eugene had closed most of his ETH positions to greatly reduce risk exposure, and on August 24 said the bull cycle was ending and his ETH trading was over.

In the latest "Matrix onTarget" report, Matrixport also said it has turned more conservative, noting that this correction may continue. Seasonal weakness has been evident since late July, and stage pressure is accumulating.

This week, US employment data will be released, and Bitcoin is at a key technical level. If the price falls further, it may surprise most traders, but this risk cannot be ignored. History shows that rate cuts are often seen as bullish for crypto, but usually come with twists and turns.

CryptoQuant analyst Crypto Dan said the crypto market cycle is slowing, and an uptrend is expected in fall 2025. Looking at the proportion of Bitcoin held for over a year (based on realized market cap), past cycles (first and second stages) saw the market surge and peak. However, in the current (third) stage, the uptrend slope is flattening and the cycle is lengthening.

CryptoQuant research head Julio Moreno posted on X that from a short-term valuation perspective, if Bitcoin cannot quickly recover $112,000, the next support is around $100,000. The current BTC price is $107,420.

Conclusion

Whether it's whale reallocation, macro rate cut games, or professional traders' caution, almost all voices convey a common point: the current market is in a gray area, and waiting and caution are the only strategies.

Anxiety may not disappear; it will continue to accompany us through every market swing. But perhaps, this is the market's norm—it never offers certainty, only choices.

What we can do is not anxiously look for someone to "recharge our faith," but to find our own stance amid uncertainty, and build patience through repeated testing.

免責聲明:文章中的所有內容僅代表作者的觀點,與本平台無關。用戶不應以本文作為投資決策的參考。

您也可能喜歡

為什麼BlackRock儘管與Ripple有密切聯繫,仍未申請XRP ETF

KAS價格飆升66%:動能能否推動Kaspa邁向12月更高目標?

VIRTUAL價格上漲17%,下跌楔形突破預示十二月上行空間

Charles Hoskinson透露ADA、XRP和ETH等山寨幣何時將創下新高