Bitget Introduction to Institutional Loans(UTA)

Product rules

Institutional Loans with 5x leverage for unified trading accounts

|

Product name

|

Institutional Loans with 5x leverage for unified trading accounts

|

|

Eligibility

|

Users of PRO1 and above with institutional identity verification (KYB)

|

|

Borrowable assets

|

USDT、USDC、BTC、ETH

|

|

Loan leverage

|

5x

|

|

Supported accounts

|

|

|

Collateral assets

|

Collateral amount refers to the total USDT value of all institutional lending collateral assets in your unified trading account,more details:Institutional Loan Supporting Collateral Assets

Note: When placing a spot order, if you convert collateral assets for your institutional loans into non-collateral assets or collateral assets with a lower haircut, your LTV may reach or exceed the liquidation threshold, causing the order to be immediately liquidated. Please manage your risk to avoid potential asset losses.

|

|

Loan term

|

1–12 months

|

|

Interest calculation

|

Daily interest accrual and monthly interest settlement

Daily interest accrued = outstanding loan principal x daily interest rate

|

|

Lending account

|

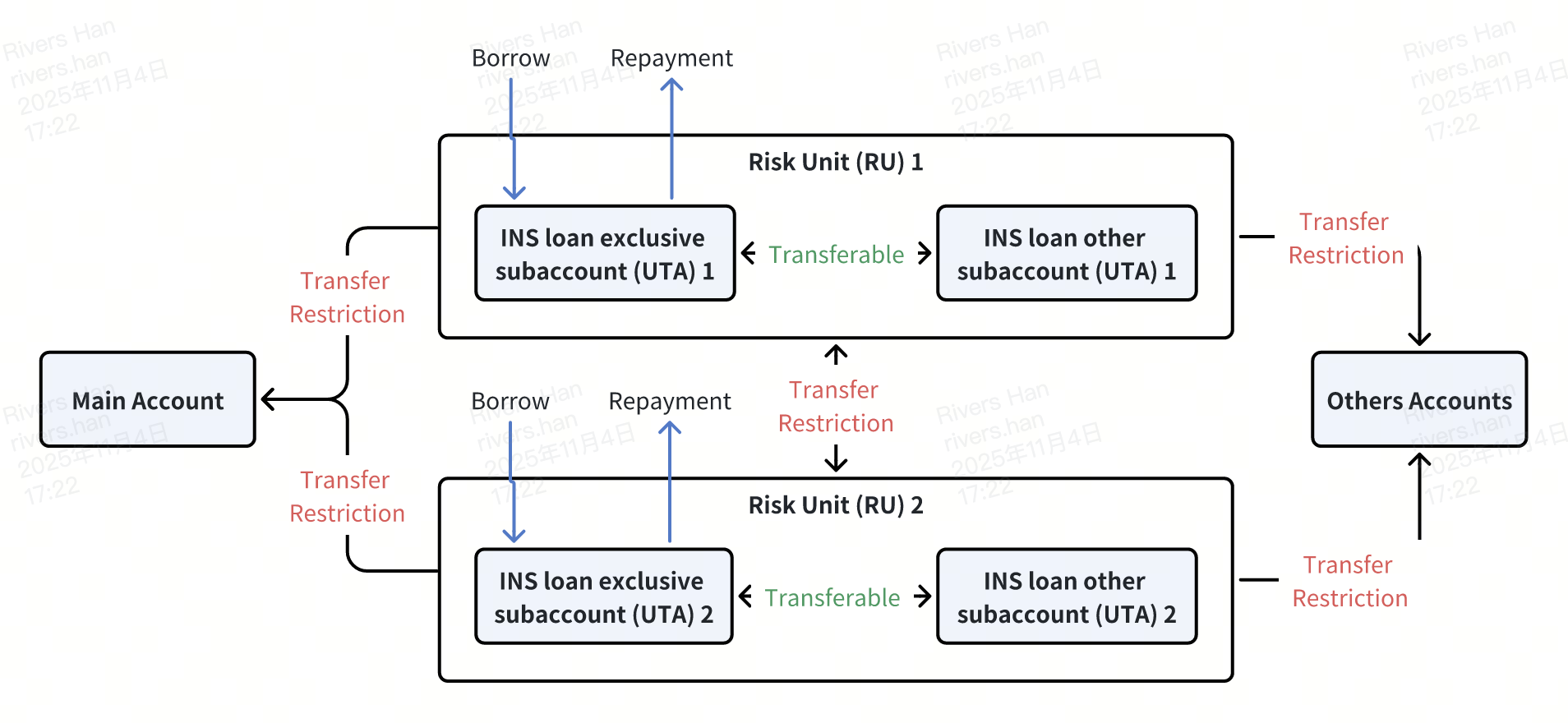

Dedicated unified trading sub-account in the risk unit

|

|

Repayment rules

|

Repayment date:

Repayment scenarios:

|

|

Interest repayment rules

|

|

|

Interest-free program

|

nstitutional Loans offer the opportunity to secure 0% interest through an upon meeting monthly trading volume while otherwise adhering to Bitget Institutional loan interest costing. Please refer to Bitget Institutional Loan Interest-Free Program.

|

Risk Management

|

Risk unit rules

|

|

LTV calculation formula

|

|

LTV trading restrictions

|

|

Liquidation (new process)

When the risk ratio reaches or exceeds 90%, the liquidation and repayment process will be triggered as follows:

1. Cancel open orders: Any open orders of spot, USDT-M and USDC-M perpetual futures, or Coin-M Futures in the UTA will be canceled.

2. No-loss payment: If the transferable assets in your UTA are sufficient for reducing the LTV to approximately 80%, the system will transfer available assets from your UTA for repayment to lower the LTV and end the liquidation.

When there is insufficient asset:

3. Transfer and convert balance for repayment: UTA balance in collateral coins of your institutional loan will be transferred and converted for repayment.

Example: A user has 3 BTC in their account and needs to repay 100,000 USDT for their institutional loan. Assuming the BTC-to-USDT exchange rate is 30,000 USDT (slippage included), the converted amount would be 90,000 USDT. After the repayment, the remaining debt amount would be 10,000 USDT.

4. Repay until 100% IMR: Transfer collateral coins with positive equity in your UTA until the initial margin rate (IMR) reaches 100% or above.

Example: A user needs to repay 100,000 USDT for their institutional loan and has 10,000 USDT in their UTA and 30,000 USDT in unrealized PnL. To reach a 100% IMR, a repayment of 20,000 USDT is required. 20,000 USDT will be transferred from the user's UTA for institutional loan repayment. The user's balance becomes −10,000 USDT, with an unrealized PnL of 30,000 USDT.

5. Repay until100% MMR: Transfer collateral coins with positive equity in your UTA until the maintenance margin rate (MMR) reaches 100% or above.

Example: A user needs to repay 100,000 USDT for their institutional loan and has 10,000 USDT in their UTA and 30,000 USDT in unrealized PnL. To reach a 100% MMR, a repayment of 20,000 USDT is required. 20,000 USDT will be transferred from the user's UTA for institutional loan repayment. The user's balance becomes –10,000 USDT, with an unrealized PnL of 30,000 USDT.

6. Address collateral shortfall: If all of the above steps are completed, but the collateral remains insufficient, trading and withdrawals of all user IDs in the risk unit will be restricted.

7.Liquidation settlement fee:

A settlement fee will be collected by the Loans Insurance Funds. Please monitor your risk level closely to avoid liquidation. Calculation formula:

Liquidation fee = liquidation asset × 2%.

8.Institutional loan liquidation and UTA liquidation

If a unified trading sub-account is already undergoing liquidation, it will be excluded from the liquidation triggered by an institutional loan.

|

Trading mode

|

Permissions

|

Main account (UTA)

|

Institutional loans dedicated sub-account (UTA)

|

Institutional loan sub-account (UTA)

|

|

Spot trading

|

Supported

|

Supported

|

Supported

|

|

Spot margin (UTA)

|

Supported

|

Coming

|

Coming

|

|

Futures trading

|

Supported

|

Not supported

|

Supported

|

|

Spot elite and copy trading

|

Not supported

|

Not supported

|

Not supported

|

|

Futures elite and copy trading

|

Not supported

|

Not supported

|

Not supported

|

|

Spot trading

Spot trading bot

|

Not supported

|

Not supported

|

Not supported

|

|

Futures trading

Futures trading bot

|

Not supported

|

Not supported

|

Not supported

|

|

Convert

|

Not supported

|

Not supported

|

Not supported

|

LTV Calculation Case

The case is as follows, the client's loan amount is 200000U:

| UID | Coin | Coin equity of collateral assets | USD index price | Equity |

| 100001 | USDT | 150,000 | 1 | 150,000 |

| 100001 | USDC | 100,000 | 1 | 100,000 |

| 100001 | BTC | 2 | 60,000 | 120,000 |

| 100002 | USDT | 200,000 | 1 | 200,000 |

| 100002 | BTC | -3 | 60,000 | -180,000 |

| 100003 | USDT | 200,000 | 1 | 200,000 |

| Coin | Coin equity of collateral assets | USD index price | Equity |

| USDT | 550,000 | 1 | 550,000 |

| USDC | 100,000 | 1 | 100,000 |

| BTC | -1 | 60,000 | -60,000 |

| Coin | Collateral value ratio | Maximum collateral value(USDT) |

| USDT | 100% | 1,000,000 |

| USDC | 95% | 1,000,000 |

| BTC | 95% | 1,000,000 |

Step 1: Calculate the unified account collateral assets

Converted assets=550,000 × 100%+100,000 × 95% -60000=585,000 U

Step 2: Calculate LTV

LTV=(remaining unpaid principal + remaining unpaid interest)÷ risk unit asset value (in USDT)=200,000/585,000=34.1%

FAQ

1.How do I apply for an institutional loan?

-

You must be PRO1 or above and have completed institutional identity verification (KYB). If you are an institution or a high-volume trader seeking greater flexibility, we will also assess your request.

-

Contact your relationship manager or send your inquiry to institution@bitget.com, and a dedicated BD will contact you.

2.What are the advantages of Institutional Loans?

-

Supports a wide range of collateral asset types.

-

Improves fund utilization by supporting up to 5x leverage for loan proceeds that are credited directly to the borrower's account, with no over-collateralization requirement.

-

Offers competitive interest rates and flexible borrowing amounts, and borrowers who reach certain trading thresholds may qualify for an interest exemption.

3.Supported trading pairs and collateral assets

-

Supported trading pairs:Ins Loan API

-

Supported collateral assets:Institutional Loan Supporting Collateral Assets

4.How is interest calculated?

5.Do Institutional Loans charge fees?

6.What is the loan-to-value (LTV) ratio?

7.How to bind or unbind subaccounts into Risk Unit?

Share