Bitget: Ranked top 4 in global daily trading volume!

BTC dominance59.09%

Current ETH GAS: 0.1-1 gwei

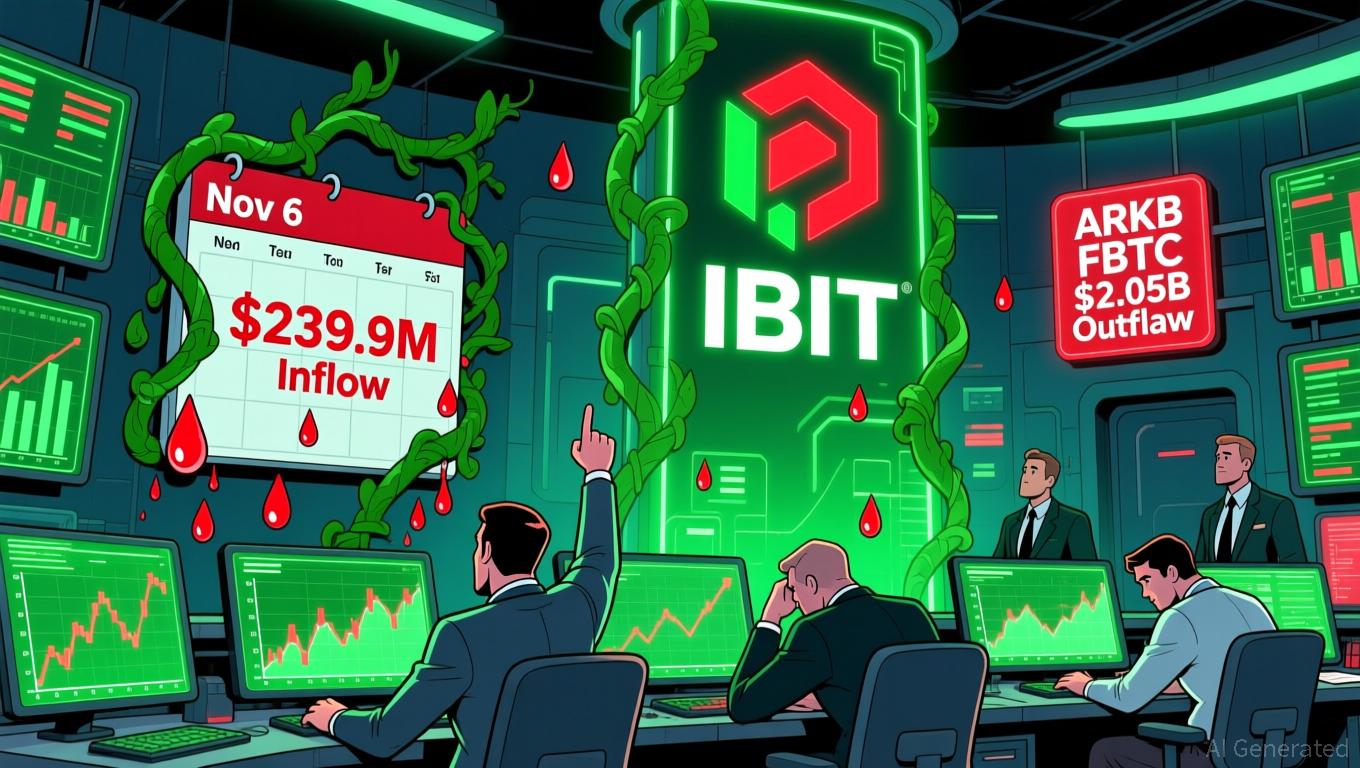

Hot BTC ETF: IBIT

Bitcoin Rainbow Chart : Accumulate

Bitcoin halving: 4th in 2024, 5th in 2028

BTC/USDT$102621.00 (+0.92%)Fear and Greed Index24(Extreme fear)

Altcoin season index:0(Bitcoin season)

Total spot Bitcoin ETF netflow +$239.9M (1D); -$1.8B (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app.Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC dominance59.09%

Current ETH GAS: 0.1-1 gwei

Hot BTC ETF: IBIT

Bitcoin Rainbow Chart : Accumulate

Bitcoin halving: 4th in 2024, 5th in 2028

BTC/USDT$102621.00 (+0.92%)Fear and Greed Index24(Extreme fear)

Altcoin season index:0(Bitcoin season)

Total spot Bitcoin ETF netflow +$239.9M (1D); -$1.8B (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app.Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC dominance59.09%

Current ETH GAS: 0.1-1 gwei

Hot BTC ETF: IBIT

Bitcoin Rainbow Chart : Accumulate

Bitcoin halving: 4th in 2024, 5th in 2028

BTC/USDT$102621.00 (+0.92%)Fear and Greed Index24(Extreme fear)

Altcoin season index:0(Bitcoin season)

Total spot Bitcoin ETF netflow +$239.9M (1D); -$1.8B (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app.Download now

Fidelity Wise Origin Bitcoin Fund

FBTC

Learn more about Fidelity Wise Origin Bitcoin Fund's (FBTC) price performance, volume, premium rate, inflows and outflows, and other key data indicators.

FBTC price today and history

$89.18 +1.23 (+1.4%)

1D

7D

1Y

Open price$89.73

Day's high$89.73

Close price$88.94

Day's low$87.42

YTD % change+5.84%

52-week high$110.25

1-year % change+48.78%

52-week low$58.64

The latest price of FBTC is $89.18 , with a change of +1.4% in the last 24 hours. The 52-week high for FBTC is $110.25 , and the 52-week low is $58.64 .

Today's FBTC premium/discount to NAV

Shares outstanding226.9M FBTC

BTC holdings200.09K BTC

NAV per share$94.11

BTC change (1D)

+621.28 BTC(+0.31%)

Premium/Discount+0.85%

BTC change (7D)

+1.95K BTC(+0.98%)

FBTC volume

Volume (FBTC)4.32M (FBTC)

10-day average volume (FBTC)59.99K (FBTC)

Volume (USD)$384.78M

10-day average volume (USD)$5.35M

FBTC net flow

| Time (UTC) | Net flow (USD) | Net flow (BTC) |

|---|---|---|

2025-11-06 | +$61.6M | +608.06 BTC |

2025-11-05 | +$113.3M | +1.09K BTC |

2025-11-04 | -$356.6M | -3.52K BTC |

2025-11-03 | $0.00 | 0.00 BTC |

2025-10-31 | -$12M | -109.53 BTC |

2025-10-30 | -$46.5M | -429.51 BTC |

2025-10-29 | -$164.4M | -1.49K BTC |

2025-10-28 | +$67M | +593.8 BTC |

2025-10-27 | $0.00 | 0.00 BTC |

2025-10-24 | +$57.9M | +521.78 BTC |

2025-10-23~2024-01-11 | +$12.54B | +204.81K BTC |

Total | +$12.26B | +202.08K BTC |

What is Fidelity Wise Origin Bitcoin Fund (FBTC)

Trading platform

BATS

Asset class

Spot

Assets under management

$21.35B

Expense ratio

0.25%

Issuer

Fidelity

Fund family

Fidelity

Inception date

2024-01-10

ETF homepage

FBTC homepage

Fidelity is committed to innovation, which has helped drive growth during shifting market conditions and consumer preferences. With a firm-wide focus on digital assets, Fidelity is developing a blockchain ecosystem with the goal of becoming a holistic solutions provider.

FAQ

How does the Fidelity Wise Origin Bitcoin Fund compare to traditional Bitcoin ETFs?

Unlike traditional Bitcoin ETFs available to the public on exchanges like Bitget Exchange, the Fidelity Wise Origin Bitcoin Fund is a private, institutional-grade investment product. It offers enhanced security and management by a reputable financial institution but is limited in accessibility and liquidity compared to ETFs.

Can I invest in the Fidelity Wise Origin Bitcoin Fund through Bitget Exchange?

No, you cannot invest in the Fidelity Wise Origin Bitcoin Fund through Bitget Exchange. The fund is a private investment vehicle not traded on public exchanges, catering to institutional and accredited investors through direct investment avenues.

What are the risks associated with investing in the Fidelity Wise Origin Bitcoin Fund?

Investing in the Fidelity Wise Origin Bitcoin Fund comes with risks similar to those associated with directly investing in Bitcoin, including market volatility, regulatory uncertainties, and security risks. The fund's value can fluctuate significantly based on Bitcoin's market price.

How is the Bitcoin stored in the Fidelity Wise Origin Bitcoin Fund?

Fidelity Digital Assets manages the custody of Bitcoin within the fund. They use a combination of cold storage solutions and security measures to ensure the safekeeping and integrity of the cryptocurrency holdings.

Is the Fidelity Wise Origin Bitcoin Fund publicly traded?

No, the Fidelity Wise Origin Bitcoin Fund is not publicly traded. It is a private fund available only to institutional and accredited investors. This means that it isn't listed on public exchanges like Bitget Exchange, which trades more liquid cryptocurrencies.

What fees are associated with the Fidelity Wise Origin Bitcoin Fund?

While the exact fee structure may vary, investors in the Fidelity Wise Origin Bitcoin Fund can expect management fees similar to those in other institutional investment funds. These fees cover the cost of managing and administering the fund, including custody of the Bitcoin.

What are the advantages of investing in the Fidelity Wise Origin Bitcoin Fund?

The fund offers multiple advantages including professional management by Fidelity, secure storage of Bitcoin, elimination of the need for investors to directly handle or store Bitcoin, exposure to Bitcoin price movements, and potential participation in the cryptocurrency market's growth.

Who is eligible to invest in the Fidelity Wise Origin Bitcoin Fund?

The fund is designed for institutional and accredited investors. This typically includes large institutions, family offices, and individuals who meet specific financial criteria and regulations for accredited investor status, such as a high net worth or certain income thresholds.

How does the Fidelity Wise Origin Bitcoin Fund work?

The Fidelity Wise Origin Bitcoin Fund operates by pooling capital from investors to invest in Bitcoin, which is stored and managed by Fidelity Digital Assets. Investors buy shares of the fund, which tracks the value of Bitcoin, providing a simplified way for institutional clients to access Bitcoin's potential benefits.

What is the Fidelity Wise Origin Bitcoin Fund?

The Fidelity Wise Origin Bitcoin Fund is an investment vehicle created by Fidelity to provide institutional and accredited investors with exposure to Bitcoin. The fund allows investors to gain indirect exposure to Bitcoin's price movements without having to own or manage the underlying asset.

Fidelity Wise Origin Bitcoin Fund news

Bitcoin Updates: Investor Optimism Grows as Bitcoin ETFs End Outflow Trend

- U.S. spot Bitcoin ETFs ended a six-day outflow streak with $239.9M net inflows on Nov 6, led by BlackRock's IBIT ($112.4M) and Fidelity's FBTC ($61.6M). - Bitcoin's price rebounded to $103,000 from below $99,000 as improved liquidity and reduced macro volatility drove inflows, though risks persist without sustained buying pressure. - Ethereum ETFs saw smaller $12.5M inflows while Grayscale's ETHE continued outflows, highlighting diverging investor preferences between BTC and ETH. - Solana ETFs emerged as

Bitget-RWA2025-11-07

Bitcoin bulls need 2 things: Positive BTC ETF flows and to reclaim $112,500

CryptoSlate2025-11-07

Bitcoin bulls retreat as spot BTC ETF outflows deepen and macro fears grow

Cointelegraph2025-11-06

Solana News Update: Grayscale Reduces GSOL Fees and Increases Staking Incentives in Response to Bitcoin ETF Withdrawals

- Grayscale waives GSOL management fees and cuts staking fees for 3 months or until $1B AUM, boosting investor returns. - GSOL offers 7.23% gross staking rewards (6.60% net) to compete in crypto ETF market amid Bitcoin fund outflows. - Strategic shift diversifies Grayscale's offerings beyond Bitcoin, leveraging Solana's institutional appeal and low-cost structure. - Unregistered fund structure and staking risks like liquidity constraints remain concerns despite real-time reward transparency.

Bitget-RWA2025-11-06

Bitcoin News Today: Bitcoin ETFs See $8B Outflows While Solana ETFs Draw $70M Over Five Consecutive Days

- U.S. Bitcoin ETFs faced $8.02B outflows over six days, with BlackRock's BIT losing $375.5M amid Bitcoin's $109k-to-$101k volatility. - Solana ETFs gained $70M in five days, including Bitwise BSOL's $195M inflow, as investors shift capital amid crypto market weakness. - Macroeconomic pressures and Fed hawkishness drove redemptions, but Matador locked $100M in Bitcoin for long-term accumulation. - Bitwise predicts $125k-$150k Bitcoin by year-end, though prices risk falling below $100k or $93k if support br

Bitget-RWA2025-11-06

Data: US spot bitcoin ETFs saw a net outflow of $137 million yesterday, marking six consecutive trading days of net outflows.

Chaincatcher2025-11-06

Alternative ETFs

| Symbol/ETF name | Asset class | Volume (USD | Share) | Assets under management | Expense ratio |

|---|---|---|---|---|

IBIT iShares Bitcoin Trust | Spot Active | $2.23B 38.38M IBIT | $80.37B | 0.25% |

BITO ProShares Bitcoin ETF | Futures Active | $352.32M 21.96M BITO | $2.76B | -- |

GBTC Grayscale Bitcoin Trust ETF | Spot Active | $180.86M 2.26M GBTC | $17.76B | 1.5% |

BITB Bitwise Bitcoin ETF | Spot Active | $116.54M 2.1M BITB | $4.13B | 0.2% |

ARKB ARK 21Shares Bitcoin ETF | Spot Active | $79.66M 2.34M ARKB | $4.34B | 0.21% |

BTC Grayscale Bitcoin Mini Trust ETF | Spot Active | $69.53M 1.54M BTC | $4.05B | 0.15% |

Prefer buying cryptocurrencies directly? You can trade all major cryptocurrencies on Bitget

Bitget—The world's leading crypto exchange

Looking to buy or sell cryptocurrencies like Bitcoin? Choose Bitget, the cryptocurrency exchange offering top-tier liquidity, an exceptional user experience, and unmatched security!

Bitget app

Trade anytime, anywhere with the Bitget app. Join over 30 million users trading and connecting on our platform.

Cryptocurrency investments, including buying Bitcoin online via Bitget, are subject to market risk. Bitget provides easy and convenient ways for you to buy Bitcoin, and we strive to fully inform our users about each cryptocurrency we offer on the exchange. However, we are not responsible for the results that may arise from your Bitcoin purchase. This page and any information included are not an endorsement of any particular cryptocurrency. Any price and other information on this page is collected from the public internet and cannot be considered as an offer from Bitget.