News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 5) |BTC Drops Below $100K Amid Market Panic; Chainlink Conference Focuses on TradFi–DeFi Integration; Perp DEX October Volume Hits $1.75 Trillion2Research Report|In-Depth Analysis and Market Cap of Momentum (MMT)3Bitcoin (BTC) Testing Key MA Fractal Support — Will It Repeat the Bounce Back?

MARA Q3 Revenue Up 92% YoY, Net Profit Reaches $123 Million

Bitget·2025/11/05 02:56

Wall Street continues to sell off—how much further will bitcoin fall?

Liquidations across the entire network reached $2 billion, BTC failed to hold the $100,000 mark, hitting a six-month low.

BlockBeats·2025/11/05 02:33

"Black Tuesday" for US Stock Retail Investors: Meme Stocks and Crypto Plunge Amid Earnings Reports and Short-Selling Pressure

Although retail investors still made a net purchase of $560 million that day, it was not enough to prevent the Nasdaq from plunging more than 2%.

BlockBeats·2025/11/05 02:32

Solana ETFs show strength, but SOL price lost its yearly uptrend: Is $120 next?

Cointelegraph·2025/11/05 02:06

Key support in jeopardy, Bitcoin may face a deep correction

Bitpush·2025/11/05 02:05

Wall Street Continues to Sell Off, How Low Will Bitcoin Drop?

BlockBeats·2025/11/04 23:38

That summer, I sniped altcoins on DEX and made 50 million dollars.

Starting from just $40,000, we ultimately sniped more than 200 altcoins across over 10 different blockchains.

深潮·2025/11/04 22:49

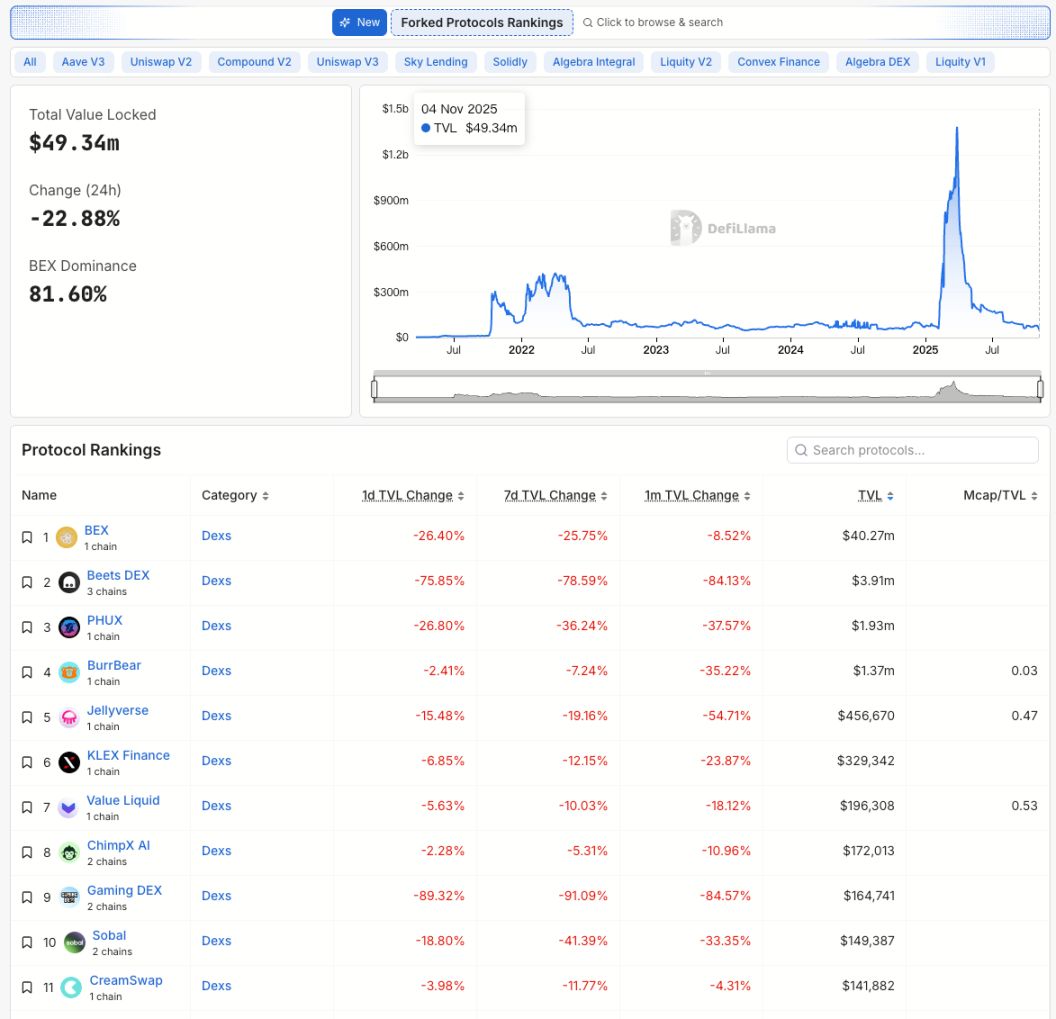

From Balancer to Berachain: When Chains Hit the Pause Button

A single vulnerability exposes the conflict between DeFi security and decentralization.

深潮·2025/11/04 22:48

Berachain: All funds stolen due to the vulnerability have been recovered.

Cointime·2025/11/04 22:48

The Butterfly Effect of the Balancer Hack: Why Did $XUSD Depeg?

Long-standing issues surrounding leverage, oracle construction, and PoR transparency have resurfaced.

深潮·2025/11/04 22:48

Flash

- 03:19Capital Economics: Asian stock market correction reflects bearish sentiment in US stocksAccording to ChainCatcher, citing Golden Ten Data, Thomas Mathews, Head of Asia-Pacific Markets at Capital Economics, stated that the pullback in Asian stock markets appears to be a direct response to yesterday's decline in U.S. tech stocks. In particular, the South Korean stock market has performed strongly recently, so when sentiment shifts, their losses are also greater. Mathews expressed doubt as to whether the sell-off in U.S. tech stocks would intensify and persist, believing that compared to the U.S., valuations in Asia remain low, which may limit the downside risk of a global sell-off.

- 03:11Liquid Capital founder: ETH fundamentals remain strong, continuous buying is recommended at this stageJinse Finance reported that Liquid Capital founder Yi Lihua stated in a post that at the current stage, one should continue to gradually buy in, "as long as the US government remains shut down, it is a huge opportunity." He believes there is no need to worry about the spot performance of ETH, as its fundamentals remain solid, the total scale of stablecoins continues to expand, and the short-term risk in the US stock market is limited. Yi Lihua pointed out that although market sentiment is still under pressure, liquidity and the macro environment are gradually improving, and he remains optimistic about market performance in late November and beyond.

- 03:07Data: The US Hedera spot ETF saw a single-day net inflow of $1.57 million, while the Litecoin spot ETF saw a single-day net inflow of $200,000.ChainCatcher News, according to SoSoValue data, on November 4th Eastern Time, Canary HBAR spot ETF HBR saw a net inflow of 1.57 million USD. As of press time, the total net asset value of the Canary HBAR ETF is 60.42 million USD, and the HBAR net asset ratio (market value as a proportion of HBAR's total market cap) is 0.86%. Canary Litecoin spot ETF LTCC saw a net inflow of 200,000 USD. As of press time, the total net asset value of the Canary Litecoin ETF is 2.43 million USD, and the LTC net asset ratio (market value as a proportion of LTC's total market cap) is 0.04%.